The hope that global growth will be driven by emerging economies suggests that the lack of adequate (and affordable) levels of trade financing is something that requires urgent commercial and political attention. ALEXANDER MALAKET, president of OPUS Advisory Services International Inc. and author of Financing Trade and International Supply Chains, looks at the issues.

While the biggest mandate for treasury post-2008 has been to deliver strategic value for the organisation as a whole, the need to establish controls and mitigate risk across the enterprise is also paramount.

The global financial crisis helped to shine light on and firmly establish logical, commercial and political linkages between the conduct of international trade (the creation of economic value) and the financing that supports and enables that activity.

Not only is this connection far more appreciated today, but its critical role is acknowledged in the context of bilateral trade between one importer and one exporter, as well as in the context of the complex, global ecosystems of trading relationships called supply chains.

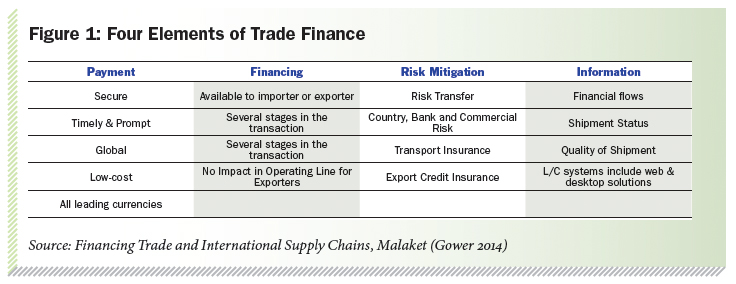

Trade financing here is defined, very broadly, to include four elements that may be found

(with varying degrees of emphasis) in most transactions:

Certain transactions (or trading parties) will give more priority to financing; others might be more about the flexible and effective risk mitigation options available to trading partners or supply chains.

In the nascent propositions related to supply chain finance (SCF), the risk mitigation option was, for a time, ignored relative to the financing dimension,. However, the rapid growth of SCF and its increasing use in developing and emerging markets has motivated solution providers to bring the risk mitigation dimension back into play.

While business leaders, entrepreneurs and policymakers now clearly appreciate the critical enabling role of trade financing (both traditional solutions such as documentary credits, and evolving solutions in SCF), there is another linkage that has historically been best understood by international institutions and multilateral development banks: that is gaining visibility.

It is the linkage between trade financing, the conduct of trade and the positive impacts on international development and poverty reduction. The search for a global path to recovery through economic value-creation in the post-crisis environment – one being healthy and robust trade activity – has placed greater focus on trade as an engine of development, and thus, trade financing as a strategically important enabler of trade and of development activity.

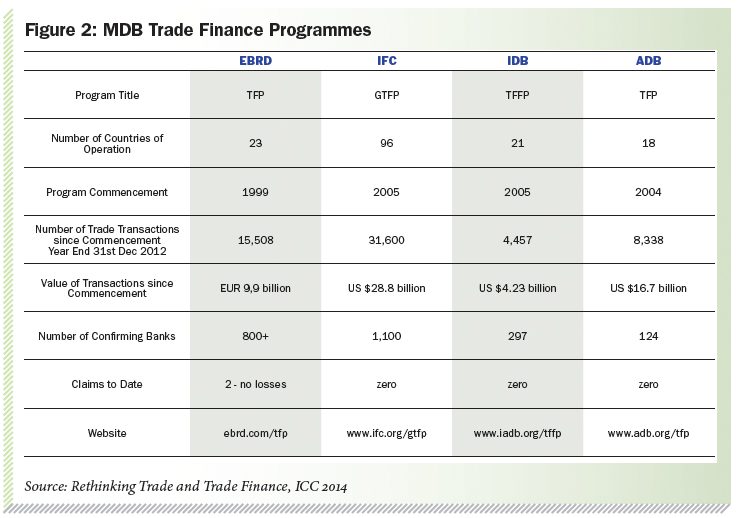

The major Multilateral Development Banks (MDBs), including the Islamic Development Bank through the International Islamic Trade Finance Corporation (IITFC – “Advancing Trade, Improving Lives”), have all developed and deployed highly impactful trade finance and trade finance facilitation programmes with various features and solutions, and have thus been engaged (since 1999 in the case of the European Bank for Reconstruction and Development) in the provision of trade financing in frontier, developing and emerging markets.

The post-crisis environment, coupled with a renewed focus on the multilateral trading system and the importance of re-energising global development efforts and poverty reduction targets have all combined to create a context where the financing-trade-development linkage can truly be better appreciated, where policies enabling access to adequate levels of trade financing in developing markets can be convincingly advocated for, and where concrete, real-economy results can be achieved through international commerce.

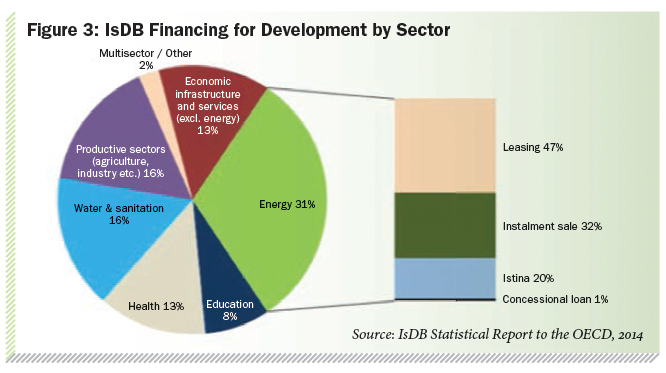

The rapid growth and rise of Islamic finance, including Sharia’h-compliant trade finance has widely been seen as a positive development, attracting the interest (and investment) of non-Islamic banks and institutions in Europe, the Americas and elsewhere. As with other multilaterals, the Islamic Development Bank has placed significant focus on financing for development – including enabling access to trade financing as a development tool, with a significant portion of positively affected sectors linked to trade activity in numerous MENA markets.

It is suggested by market observers and practitioners that challenges in accessing trade financing are particularly acute for developing and emerging markets, and at the client level, for small and medium-sized enterprises. This is particularly troubling given that SMEs are often the economic backbone of markets around the world, be they OECD economies or frontier regions, and the hope that global growth will be driven by emerging economies suggests that the lack of adequate (and affordable) levels of trade financing is an issue that requires urgent commercial and political attention.

The Asian Development Bank has been working on quantifying the gap in trade financing that is available globally versus what the market would require, if all demand were met. The latest estimate (published in ADB Brief No. 25, December 2014), suggests that there is a financing gap in the range of $1.9 trillion annually, of which about $1 trillion exists in Asia.

There is a material challenge for existing providers in even attempting to address or respond to this gap, from constrained balance sheet capacity to compliance and regulatory pressures that (at minimum) discourage engagement in higher-risk markets and with high-risk clients, to the oft-repeated issues in dealing with SMEs that often do not have the technical skills to develop bankable financing proposals. Additionally, in some parts of the world, including parts of the MENA region, ongoing issues with financial management and reporting practices complicate matters.

As the challenges are recognised and addressed, through a variety of initiatives ranging from education to advocacy, it is clear that a long-term, sustainable solution to addressing the trade finance gap, and to assuring adequate levels of trade-related financing resources in support of international development, requires new propositions.

Supply chain finance, an area so nascent that the market is in the process still of creating common nomenclature and terminology, is a promising option. Although the MENA region is particularly loyal to traditional tools of trade finance, such as the long-established documentary credit, the global trend is clearly toward trade on “open account” terms, and thus squarely in the realm of SCF providers.

Certain SCF structures allow small suppliers (typically based in developing and emerging markets) to access affordable and adequate levels of financing on the basis of the credit standing and borrowing capacity of large global buyers. Such programmes (referred to in at least one instance in the United States as a “Supplier Wellness Programme”) enable the buyer’s bank to work with the buyer to identify strategically important suppliers, qualify them through appropriate due diligence, and invite their participation in an SCF programme, where they are offered the option to seek early payment for approved invoices, either in “bulk” as a portfolio of receivables, or on an individual basis.

Programmes such as these, perhaps coupled with emerging technologies and settlement/financing platforms, combine well to enable businesses in developing and emerging markets to engage with global supply chains, thus leveraging the capability to create economic value (growth and poverty reduction) through trade: all underpinned by access to adequate levels of affordable trade finance and supply chain finance.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East