The Turkish economy has now re-aligned itself more closely to the regional markets in the GCC and MENA countries. MUSHTAK PARKER reports in detail on the new outlook

MUSHTAK PARKER reports in detail on the new outlook

Whichever party wins the Turkish general election in June this year, one thing remains certain. Turkey’s participation banking sector will continue its steady progress and, in the process, further consolidate the sector as the third major component in the Turkish financial system after the depository (conventional commercial deposit-taking) banks and the development and investment banks.

Participation banking is the Turkish euphemism for interest-free profit-and-loss-sharing banking – in other words Islamic banking. Its importance is underlined by the fact that it has f lourished since its establishment in 1983 by a special decree introduced by the military regime of President Kenan evren, and more recently it has undergone a successful transformation that has seen it become part of the mainstream banking industry following its licensing, regulation and supervision under the same provisions of the general 2007 Turkish Banking act (amended).

Perhaps equally importantly, Turkish participation banking has been unassumingly innovating cash management and trade finance products that in many respects are unique in global finance, let alone Islamic finance. These include cash management and savings products backed by physical gold; the world’s first Islamic exchange traded funds (ETFS), including one which is gold-based; the use of sukuk al-Ijarah to raise funds from the international markets, especially in the Gulf Cooperation Council (GCC) region to finance crossborder trade and expansion of Turkish corporates and for balance sheet purposes; and the proactive use of syndicated Commodity Murabaha loans from the international markets.

While the ruling AK (Justice Party) of Prime Minister recep Tayyip Erdogan seems to be com-fortably ahead in the polls, a fundamental realignment of Turkish politics is highly unlikely given the disarray of the opposition parties and their outmoded leadership and manifestos, and the fact that in general the erdogan government has successfully managed the Turkish economy over the past decade. during that time the Turkish economy grew from being the 26th largest in the world in 2002 to the 16th largest this year. Erdogan’s policies have also seen the Turkish economy re-aligning more closely to the regional markets in the GCC and Mena countries through a shift in foreign outlook, which is now based on the concepts of “a dynamic equilibrium” and “strategic depth”.

These concepts balance the policy masterminded by its urbane architect, foreign minister ahmet davutoglu, between its international obligations as in its membership of NATO; its european Union membership ambitions, which have over the past few years been resisted by a near Islamophobic opposition from France, Germany, The netherlands, austria, Finland, Greece and Cyprus; and its newfound rapprochement with the Mena countries, especially the GCC, Syria, Iraq and Iran, and with neighbouring powers such as russia.

In some respects the global financial crisis, EU policy towards Turkish membership ambitions and the pro-democracy protests sweeping the MENA region have all contributed to the policy shift. Its impact in Turkish trade demographics (and indirectly to the further development of the participation banking sector) could not be starker.

Before the crisis in 2008, according to Fatih Bulaç, head of the International Financial Institutions department, Türkiye

Finans Participation Bank, total Turkish exports reached Us$132bn, of which the largest share were to the industrialised markets especially eU countries such as Germany, austria and the UK. after the crisis, total Turkish exports slumped by 22.6 per cent to Us$102.1bn in 2009, of which exports to the EU-27 countries fell sharply by 25.8 per cent to Us$47bn.

In contrast, Turkish exports to Mena countries, especially to the GCC region, and other african nations have witnessed dramatic increases of up to 20 per cent. This shift in the Turkish trade profile has opened new and consolidated established synergies with the Mena region. Three of the four Turkish participation banks have got majority GCC ownership interests – Turkiye Finans is largely owned by national Commercial Bank of Saudi Arabia; Kuveyt Turk Participation Bank (KTPB) is majority owned by Kuwait Finance House, one of the largest Islamic banks in the world; and Albaraka Turk Participation Bank (ATPB) is a subsidiary of the Bahrain-based Albaraka Banking Group.

The fourth, asya Particpation Bank (APB), also has close ties with the GCC and has set up a joint venture with the Islamic Corporation for the development of the Private sector (ICD), the private sector funding arm of the Islamic development Bank Group (IDB), called Tamweel africa, which invests in financial institutions, leasing entities and extends lines of credit to finance trade in subsaharan africa.

Equally significantly, even Turkish conventional banks are now targeting the GCC as a regional hub. several are setting up offices in the dubai International Financial Centre (DIFC). “We also plan to promote our Dubai subsidiary,” explains Ufuk Uyan, CEO of Kuveyt Turk Participation Bank, “because there are a lot of trade flows going through dubai nowadays. The dutch authorities are creating big problems for Turkish conventional banks. They don’t want them to extend credits and are putting various restrictions on their business activities. several of the Turkish banks have decided to move to dubai dIFC. europe-wise it is not easy for Turkish banks, although Turkey has long-standing trade ties with europe.”

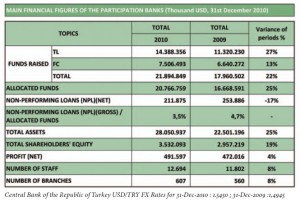

While Turkish bankers agree that 2011 will be a volatile year for the Turkish banking sector as a whole because of the elections and regional developments, Ufuk Uyan remains adamant that 2010 was a perfect year for Kuveyt Turk in particular and in general for the participation banks in Turkey. “The growth of the participation banking sector was double that of the conventional sector. KTPB has now become one of the Top 10 banks in Turkey and in 2010 our balance sheet growth was about 50 per cent compared with 2009. By the end of this year we plan to have 180 local branches. We also have a branch in Bahrain since 2002; in Germany; a representative office in Kazakhstan; and a full subsidiary in dubai at the dIFC. We also have plans to go to northern Iraq and open a branch in erbil; and some other locations in the region, which have not been finalised as yet,” he explained. This confidence is further underlined by the latest data for the four participation banks for the year ending 31 december 2010 released in april 2011 by the Participation Banks association of Turkey (TKKB).

According to Osman Akyuz, secretary general of TKKB and the former general manager of ATPB, total assets of participation banks in FY2010 increased by 25 per cent on 2009 reaching Us$28.1bn; deposits increased by 22 per cent to reach Us$21.9bn, of which 66 per cent was in Turkish lira and 34 per cent in foreign currencies; financing allocated by the participation banks grew by 25 per cent to reach Us$20.8bn; total shareholders’ equity increased by 19 per cent to Us$3.5bn; net income increased by four per cent to reach Us$491.6m; and the number of branches and number of staff of participation banks totalled 607 and 12,694 respectively growing at a year-onyear rate of eight per cent.

Similarly, the market share of participation banks assets is 4.31 per cent; of participation deposits is 5.4 per cent; and of participation financing six per cent. The financing-to-deposit ratio of participation banks in 2010 was 96 per cent compared with 83 per cent for the conventional banking sector in Turkey. In terms of non-performing loans, participation banks also fared better. The nPL for participation banks in 2010 was TL341 million or 0.34 per cent compared with TL379 million or 0.47 per cent in 2009.

The current market share of participation banks of the total banking market in Turkey is a mere six per cent, although Ufuk Uyan is confident that a target of between 10 per cent to 12 per cent market share is achievable over the next few years. However, from a global perspective where Islamic banking has a 38 per cent market share in Saudi Arabia, a 40 per cent market share in Brunei, and a 22 per cent market share in Malaysia, the participation banking sector has still a long way to go to reach the above market penetration.

However, this points to huge opportunities in Turkey underpinned by massive latent demand for products such as trade finance, syndicated loans, Sukuk, Tawarruq (Islamic cash management) and investment funds. Not surprisingly, there are two new applications with the Turkish banking authorities from GCC promoters for licences to launch participation banks in Turkey.

KTPB in recent months has pioneered an exchange- traded fund (ETF) backed by physical gold; gold-based current and term accounts; the purchase of gold coins through ATMs; and has launched the first cooperate Sukuk in Turkey (a US$100m Sukuk Al-Ijara). The bank is also planning a second US$500m Sukuk later this year. Turkiye Finans pioneered the first Participation ETF in the world; it has launched several mutual funds; and a spate of gold-backed current and savings accounts. Albaraka Turk Participation Bank is also finalising its debut Sukuk issuance; has pioneered products such as the Barakat Card aimed at the small and rural farming community; and a franchise and business card.

The backbone of Turkish participation financing is commodity Murabaha, especially to smalland- medium-enterprises (SMEs). Turkey has one of the largest international trade volumes among the IDB Member Countries, totalling US$334bn in 2008 alone. Given the short-term nature of participation deposits, there is a mismatch with medium-and-longer-term financing liabilities. As such Turkish participation banks are forced to raise Islamic financing through lines of credit provided by entities such as the IDB, the ICD and the Dubai-based Islamic Trade Finance Corporation (ITFC), the dedicated trade finance entity of the IDS B Group, and through the international syndicated Murabaha market.

As part of its Member Country Partnership Strategy (MCPS), a new initiative launched by the IDB in 2010 to identify, target, allocate, implement and evaluate its financing more efficiently in member countries, the IDB published a pilot MCPS report on Turkey for 2010-2013 recently. The report emphasised that lines of trade financing extended by ITFC through domestic banks has proved to be an efficient way to do business with SMEs, and that ITFC is looking to expand this business to include Turkish conventional banks.

“The disbursement level and the developmental impact under the line of financing operations,” explained the report, “are higher compared to the direct operations. Other multilateral financial institutions active in Turkey follow a similar approach where they reach the SMEs through the local banks via line of trade financing operations or through confirming Letters of Credit.

ITFC has been collaborating with public and private conventional banks for establishing new lines beside the well established co-operation with Turk Eximbank and the four participation banks, which have already utilised several facilities and are interested in renewing the lines.”

However, one potential impediment is the line of trade financing documentation of the ITFC, which is not acceptable to some of the conventional and participation banks because some of the articles are not in line with local laws and regulations. The IDB is already working with the Turkish government to streamline the legal documentation and to develop a simpler legal framework for a 2-Step Murabaha Agreement that would be acceptable to the Turkish banks.

On the other hand, Turkish banks are probably the most active in the international Murabaha syndication market. The latest to access the market is Asya Bank, which raised US$300m through a Murabaha syndicated loan in March 2011. This was the largest single such facility extended to a Turkish bank, and Asya Bank’s third foray into this market in the last two years. In 2010, Asya Bank closed another US$255m Murabaha syndicated facility, which was subscribed by 26 international banks.

Asya Bank’s general manager, Abdullah اCelik, was spot on when he emphasised that the latest facility is a sign of the trust international markets have in the Turkish economy and his bank. Indeed, because of the huge appetite from the market, the Murabaha facility was upsized from the original US$150m to US$300m. The facility actually comprised two tranches: US$171m and EURO 94.5m.

Once again, a record 26 international financial institutions participated in the syndication, including Standard Chartered Bank in the UK, ABC Islamic Bank in Bahrain, Noor Islamic Bank in Dubai, National Bank of Abu Dhabi, as well as 22 others from the United States, Europe, Turkey, Pakistan and other Middle East and North Africa countries. The pricing for the 1-Year Murabaha facility is LIBOR (London Interbank Offered Rate) and EURIBOR (Euro Interbank Offered Rate) plus 1.5 per cent.

Going forward, more recently exciting new avenues are emerging for Turkish banks to raise participation funds from the international markets. This is in the Sukuk market. Hitherto, the lack of Sukuk legislation has meant that Turkish banks have been forced to venture offshore to raise medium-to-long-term funds to finance some of their activities, instead of deposits, which are largely short-term.

KTFP started with the first corporate Sukuk – a US$100m issuance – and, according to Ufuk Uyan of KTPB, the bank plans to go to the market later this year to raise US$500m through a Sukuk issuance, but on a longer tenor, maybe through a 5-year issuance, thus underlining KTPB’s confidence ina healthy market appetite for Turkish risk and Islamic investments there. KTPB uses the funds raised for balance sheet purposes to finance trade and projects.

But to sabri Ulus, vice president, Türkiye Finans Participation Bank, an “emerging Islamic finance market, like Turkey, may just be what the global sukuk industry needs to sustain growth. Turkish sukuk originations could appeal to yieldhungry investors in the GCC, asia and europe because Turkish investments tend to pay relatively attractive spreads in comparison to Gulf and european spreads”.

In fact, market sentiment has been boosted by developments in sukuk legislation in Turkey. almost unnoticed, the Turkish national assembly in ankara passed the Finance Bill 2011 this February. It includes tax neutrality measures for sukuk al- Ijara (leasing certificates) thus paving the way for a spate of corporate sukuk issuances in the country.

Murat Haholu, head of the Surveillance Group, corporate finance department, Capital Markets Board of Turkey, confirmed that the tax neutrality measures for the sukuk al-Ijara were published in the Official Gazette in February 2011, which he emphasised is an important development in the participation banking sector in the country. “There is a major problem for Participation Banks in terms of long-term borrowing requirements. The conventional banks can borrow through bond issues on a 3-years or 5-years basis and the taxation side was cleared a long time ago. The same is needed for the Participation Banks and there is only one way this can be done which is the sukuk route. recently, the government covered the tax neutrality issues for sukuk al-Ijara, but for other sukuk products there is a need for legislation development,” maintained Uyan.

He agrees that the amendments to the law in terms of tax neutrality for sukuk al-Ijara “will enable Turkish corporates to issue sukuk. Corporates need financing and a good way could be to raise funds through project and other sukuk. The change in the law is a good step forward. But the market should be in a position to absorb any corporate sukuk issuances. There are many companies with a lot of good assets. The new law would allow Turkish participations banks to borrow for longer tenors instead of the current short-term 3-years. In this way sukuk origination can help finance the growth of the Turkish economy especially investment in industry”.

Not surprisingly, the market is expecting Turkey to develop into a sizeable sukuk origination destination over the next few years. as such, Turkish participation banks are increasingly exploring the possibilities of raising funds through a sukuk issuance, albeit dependent on the quality and volume of available Ijara assets that can be securitised. despite the huge improvements in the Turkish banking sector over the last decade or so through improvements in prudential regulations and supervision, the IdB contends that more needs to be done to enhance the banking sector’s efficiency and that there is a significant financing gap to cover financing of foreign trade. The financing bottlenecks include the limited availability of longterm finance, sub-optimal allocation of resources as reflected in the high share of FDI (foreign direct investment) in non-exporting activities and limited mergers, acquisitions, and restructuring of sMes. These bottlenecks are due to the lack of depth of the financial system and the inadequacy of the country’s financial infrastructure.

Turkey is one of the major beneficiaries of IDB financing to date, and has received financing totalling Us$4.6bn, of which trade financing accounts for Us$3.5bn. This figure represents a staggering 10 per cent of total gross trade financing approved by the IDB.

Following the establishment of ITFC two years ago, the annual approval level for trade financing in favour of Turkish companies and banks rose from Us$50m to Us$200m.

IDB/ITFC trade financing disbursement in Turkey until a few years ago was limited to Letters of Credit, but more recently the two entities started to implement “documentary collection” as an alternative method of disbursement. The limitation on the source of supply by allowing only imported goods is also being overcome, albeit most of the trade finance clients of ITFC in Turkey procure their goods from domestic sources instead of imports. as such, ITFC has started to provide financing for purchasing from free trade zones within Turkey, and lines of financing that can be used for pre-export purposes.

According to the MCPs report on Turkey, the ITFC is keen to scale up its trade finance operation to Us$250m over the next two years. The corporation will continue to build on the ongoing operations, mainly intervening by providing lines of trade financing through local banks.

In this respect, ITFC’s co-operation with the Turk exim Bank and the four participation banksis set to increase. If the legal issues related to trade financing documentation are resolved, ITFC envisages pursuing and developing business opportunities with intermediary banks, including Ziraat Bankasi, Vakifbank and halkbank, where an sMe financing scheme would be developed in conjunction with the Treasury and KOsGeB, the Turkish trade promotion agency.

Another encouraging development of IDB perception of Turkish market risk is that ITFC is prepared to extend lines of financing to secondtier companies on a secured basis and the top-tier companies on an unsecured basis. The corporation also plans to lead Murabaha syndications for mobilising resources for large Turkish entities.

Another possible intervention from ITFC would be in the structured commodity trade finance area, where it would consider structuring export/import financing transactions in favour of co-operatives and companies in the agricultural and food sectors.

Another IDB entity targeting business in Turkey is the Islamic Corporation for the Insurance of export Credit and Investment (ICIEC). The total amount of business insured by ICIEC for Turkish exports, according to the report, has reached Us$674m, while business insured for Turkish imports amounted to Us$201m.

The main services that ICIEC provides are medium- term export credit insurance, investment insurance and insurance of Letters of Credit in favour of banks and reinsurance for Turk exim Bank in addition to short-term credit insurance for non-clients of Turk exim Bank. These services are channeled through ICIEC’s local agents in Turkey, aktif Bank and PGlobal advisory services; through Turk exim Bank; Turkish banks in general; and major international and local brokers in Turkey.

ICIEC sees good potential for the Insurance of Letters of Credit to be confirmed by Turkish Banks, a product that enables Turkish Banks to enhance their confirmation capacities on banks from importing countries and to extend their confirmation business to more countries.

In terms of cash management, Turkish participation banks are pioneering gold-backed products. KTPB, for instance, is very active in gold accounts. “any client who wishes to invest in gold come to our branch and deposit Turkish liras or Us dollars and convert them into dollar-equivalent grams of gold. The client can thus at anytime redeem the deposit either in the form of physical gold or in dollars equivalent to the price of gold at the time. This is for the current account. For the term account, we swap the gold into dollars and invest the dollars and the return is distributed to gold account holders in the same format,” explained KTPB’s Ufuk Uyan.

Gold investments are culturally acceptable in Turkey. Before and during the years of the financial crisis many Turks preferred to keep their gold at home under the mattress. KTPB’s gold-based accounts are also fully shariah-compliant, and the product has even been exported for offering in the Malaysian and the GCC markets, especially Kuwait and Bahrain. KTPB is a member of the Istanbul Gold exchange, “so we keep the physical gold at the exchange. We are one of the top three banks active in the exchange”.

Indeed, to attract institutional gold investors, KTPB also launched the GoldPlus exchange traded fund (ETF), which is listed on the Istanbul stock exchange and has been traded since august 2010. “although the size is small we expect it to increase. The pension funds and the insurance companies have to keep some of their investments in the form of gold, so that they can invest directly without losing on the buy-and-sell exchanges differences,” added Uyan.

At the same time, KTPB is probably the only bank in the world where you can draw gold coins through its ATMs. These coins are certified by the Istanbul Gold exchange and the refineries. “This is unique for any bank. If you go to one of our ATMs and want to buy gold coins you can just pay through your debit card or cash and you will get the gold coin/s,” said Uyan.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East