Tajara Monitor continues in the process of broadening its geographic coverage within the GCC. Here, Caroline Maginn – Cash Management Matters Trade partner looks at some of the Kuwaiti Tajara findings in relation to trade finance. Kuwait is the third biggest trading nation within the GCC

The 2010 report for Kuwait revealed that National Bank of Kuwait maintained its lead position in trade finance, which it recovered in 2009 from Gulf Bank. However, its still very strong leadership position, in relative market-share, was eroded slightly by several other banks in the league table.

Kuwait Finance House made the most progress of all banks featured in 2010. It swapped third for second position with Gulf Bank and gained in market-share terms.

In Kuwait, compared to the other GCC countries analysed, the lead bank has by far the strongest advantage over its competitors and the bulge bracket of the top three banks commands the greater market-share.

In terms of overall corporate banking it is not possible to develop the same analysis for Kuwait on the relative importance of and contribution of the corporate segment to assets, liabilities, operating income and profit as we have done in the KSA and the UAE. This is because the majority of Kuwaiti banks do not yet segregate corporate banking as a distinct business segment and they generally aggregate it with the retail segment in their annual balance sheet reporting.

National Bank of Kuwait and Boubyan Bank have paved the way for other banks to follow in attributing the systemic importance due to corporate banking by making it a discrete business segment for reporting purposes. In this way, market reporting practice could evolve to reflect more accurately the clear management focus and the dedicated resources most banks in practice have allocated to the corporate segment.

The Kuwaiti Tajara coverage includes the 10 major local banks active in trade.

Key trade finance findings for 2010

Overall trade finance closed 2010 on a much more positive note than 2009. The market grew to KD7.8bn up from KD7.2bn in 2009, with the value of trade related instruments growing by eight per cent and more than KD600m over the prior year. This illustrated increased liquidity for trade and capital committed by Kuwaiti banks, which is critical in these volatile times.

CMM remains concerned as do many bankers both within the GCC and overseas about the would-be impact of Basel III provisions for trade, which would reduce the capital alleviation currently afforded by Basel II for trade instruments

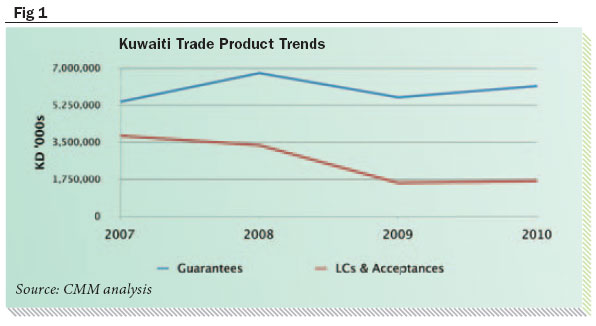

The Kuwaiti market has yet to recover to the 2007 and 2008 peaks of recent years. The value of total trade instruments, as one would expect, matched the trend in trade flows themselves and declined compared with 2007 and 2008 but improved compared with 2009.

During the period, the selected bank intermediation in total trade flows levelled out but continued at more than 30 per cent for the year although trending down on recent years. This suggests trade finance remained a consistent performer during turbulent times and was a core requirement for corporates and the public sector in Kuwait.

This mirrors some of the Tajara findings in the KSA and the UAE. The recovery in 2010 in Kuwait was more marked than that in the UAE but neither have enjoyed the levels of growth seen in trade finance in the KSA.

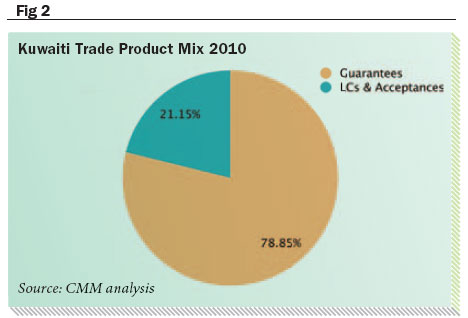

In 2010 letters of guarantee led the recovery. As in other GCC markets, they continued to be the pre-eminent trade instrument accounting as they did for in excess of 70 per cent of total trade-related contingent liabilities. With a total value of KD6.1bn, encouragingly the level of guarantees rose above the levels of both 2009 and 2007.

Letters of credit and acceptances, which are grouped together as several banks aggregate the two products for reporting purposes, rose slightly by just under KD100m year on year to over KD1.6bn in 2010 but remained significantly below the levels of 2008 and 2007.

Contingent liability league table

In the following league table CMM tracks the market share of selected leading banks together with the overall market. The selected banks account for the significant majority of the total market and provide a meaningful insight into the market dynamics. We are regretfully constrained from providing full market transparency as not all banks and, in particular, the international banks, which play a role in trade finance in Kuwait, do not segregate their Kuwaiti trade contingent liabilities.

Dynamic competitive landscape in trade finance

As in the KSA and the UAE, the Kuwaiti market-place since 2007 has revealed some interesting winners and losers in terms of market-share in relation to the largely trade finance-related contingent items of letters of guarantee, letters of credit and acceptances. These are analysed in greater detail in terms of absolute values and market-shares and by sub-product in the sub-league tables, which are in the full Monitor.

Kuwait Finance House continued to build on its positive market-share trajectory in 2010 consistent with its performance over the entire three-year period. At the top of the table, National Bank of Kuwait not surprisingly lost some of the stellar pace achieved in 2009 and 2008 but enjoys a very strong leadership position.

Gulf Bank, Commercial Bank of Kuwait and ABK fared less well year-on-year and during the period as a whole, when they respectively lost ground to banks above and below them in the league table.

At the bottom of the league table, Burgan Bank and Boubyan Bank boasted the strongest improvements year on year and, like Kuwait Finance House, have shown a steady improvement over the entire period each roughly doubling their market-share with Burgan Bank moving impressively from single to double digits in market-share terms.

Above all, the trends in trade finance in Kuwait echo the KSA and UAE markets and underscore the lack of complacency amongst corporates that change their bank provider of trade finance to achieve higher levels of efficiency, speed, responsiveness and credit line flexibility and certainty. This is not unnoticed by foreign banks, which have on the whole been maintaining and/or, in some cases, expanding their significant footprint in the region.

Positive trade finance income trend throughout overall market downturn

The practice of reporting and tracking the trade finance product revenue and profitability as a distinct contributor to both fees and commissions and finance earnings is still evolving amongst Kuwaiti banks as it is elsewhere regionally and globally. CMM tracks and analyses the data where it is available and extrapolates based on best international market practice to estimate a full picture of the market. In this way, CMM hopes to bring transparency to this as well as other aspects of the trade finance business to encourage the development of the market-place.

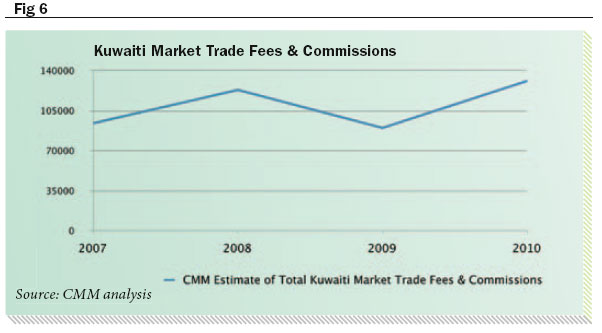

In 2010, CMM’S estimate of the trade finance fees and commissions at KD133m – up from KD90m in 2009 – suggests that they enjoyed a strong recovery and an improved return on risk-adjusted assets associated with trade. That 2010 closed at a record level for the past three years reflects the fact that banks that continued to maintain and/or expand the liquidity they provided for trade were rewarded with higher returns.

The upturn in trade earnings should encourage ongoing commitment to the provision of trade finance, which is critical to the economy as a whole. This applies to banks provision of facilities to both private and public sector trade finance.

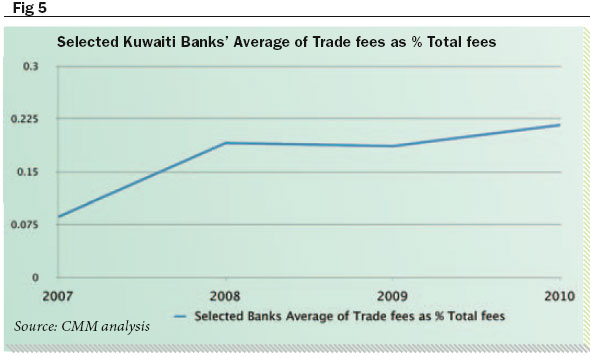

The fees and commissions attributed to trade, where reported, uniformly suggest that they made up a sizeable and growing percentage of total bank fees and commissions. Overall, the contribution of trade fees has grown from single to double digits (in percentage terms from nine per cent to 22 per cent) in a relatively short space of time and this is even more exaggerated for some, making this an increasing core source of earnings for banks. As in other GCC markets, the earnings associated with trade, coupled with its high priority to corporate customers, make it an important area for banks to focus on and attractive to invest in.

The marked upturn of trade contribution to total fees from under 10 per cent to more than 20 per cent plus the increase in absolute value of trade fees from KD94 to KD133m over the three-year period make a compelling part of the argument for banks to invest in, and maintain, the provision of liquidity for trade

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East