The BPO is an electronic trade finance payment assurance and risk mitigation tool created by banks to add value for corporate customers in a world where open account trade is growing, while growth in trade using bank partners and traditional letters of credit has remained stagnant. Here, a global survey reveals its uptake and other banking strategies

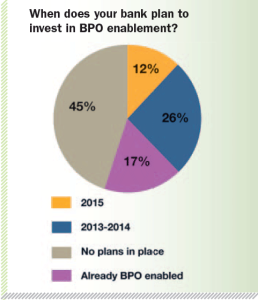

In a 2012 survey by international business consultants Misys – working with Finextra Research to evaluate the state of the global transaction banking sector – 18 per cent of respondents said they were engaged in pilots or planning to offer BPO-based products when ICC URBPO rules became available in 2013.

Looking at the first question below, which asked about products coming online within the next 12 months, Misys said its view was that during 2013 “that figure would be 26 per cent. And given that 26 per cent of respondents say they plan to invest in BPO enablement in 2013-2014, that figure should continue to steadily grow as bank’s offerings come to market”.

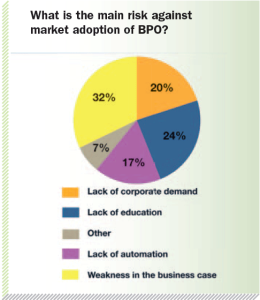

But, it added, “lack of education and lack of automation could continue to keep growth rates of BPO adoption low, with 41 per cent of respondents citing this as a risk to more widespread

adoption in the market.

The largest single factor, with 32 per cent, is weakness in the business case and there is still a debate in the market as to whether the BPO was conceived as a tool to achieve the goals of banks, rather than designed purely with the needs of corporates in mind”.

The online channel

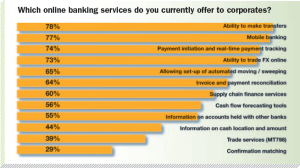

On another front, 80 per cent of respondents said adding new online services was a strategic priority and many stuck to that goal, with 85 per cent saying they had an online portal offering for corporates. The majority still offer only siloed services or fundamental transactional services online though, “with very little in the way of joined-up offerings delivering visibility across trade, payments and cash”.

Only 12 per cent of responding banks claimed to offer all 12 of the services listed in the question “which online banking services do you currently offer to corporates”? The average number of services offered

was seven.

“The big change was the addition of FX to online portals. In 2012, 50 per cent of banks said they offered online FX, and that has now risen to 75 per cent, driven by customer demand for self-service currency and risk management.

“Also, cashflow forecasting online has jumped from 36 per cent to 56 per cent – again a sign that corporates are demanding more and more control over working capital and risk mitigation.

“Trade and supply chain finance services are available more frequently online too – up from 52 per cent to 60 per cent in 2013.”

Mobile ubiquity

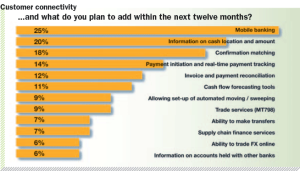

In 2012, Misys predicted that as the transaction banking self-service channels evolved, banks would get better at managing the ongoing development of the mobile channel alongside the more established browser-based or desktop applications.

It said, “Driven by customer input and a desire among banks to be seen as innovative, new functionality that is better suited to the interface and portability of smart devices continues to emerge. Seventy-seven per cent of respondents said they currently offer mobile banking with 25 per cent saying they would add or extend this capability within the next year.

“Beyond mobile channel enhancements, 2013 was expected to see more of a focus on cash management transparency, confirmation matching and real-time payments.”

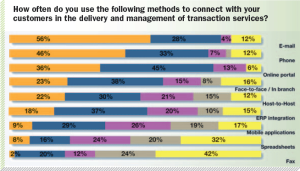

Customer connectivity

E-mail is the most frequent customer engagement channel for transaction banks and their customers, outstripping the more immediate interactions achieved through phone calls or meeting in person. “Interestingly” said Misys, “it is also used more frequently than the online portals.

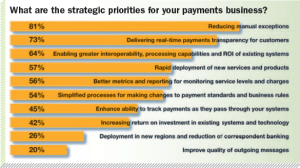

Payments priorities and areas for investment

A successful payments operation is a major driver of customer satisfaction, according to the survey. “If a bank can make sure the correct message is delivered on time without mistakes, and resolve issues quickly if there are errors or lost messages, it can quickly engender feelings of trust and reliability with a customer. But being able to do this well is quite difficult and expensive for banks with multiple, often legacy, systems.

“It is clear that, rather than looking to innovate in their payments business or break into new regions, banks are focusing firstly on improving the quality of their payments operations. Eighty-one per cent of respondents said that reducing manual exceptions was a priority.

“Given the high level of investment over the past decade in reconciliation and exception management systems, this may seem surprising. But even if great progress has been made from the days of paper-based reconciliation, pushing further for incremental improvements in straight-through processing can still yield significant cost savings and improved customer satisfaction.

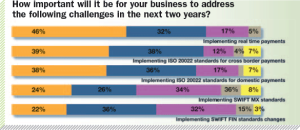

“Although only 57 per cent of respondents said that being able to deploy new services and products rapidly was a strategic priority, they are focused on delivering real-time payments transparency for customers. This was not only the second-highest priority for the payments part of the business (at 73 per cent) but was also ranked the most important challenge that needs to be addressed.”

Looking ahead

Misys said that “taking into account the questions in this survey that specifically asked about priorities and plans for the next 12 months and beyond, as well as the changing responses we’ve had over the past four years of running this annual survey, we anticipate a number of trends:

- the average number of transaction banking products offered online will increase, as banks react to market opportunities and benefit from their planned investment in payment processing efficiency and trade and supply chain finance capabilities. The big trend for new services in 2013 will be cross-border and real-time payments offerings and delivery of greater transparency into transactions, cash movement and location

- soon nearly all transaction banks will offer an appropriate subset of their online channel products and services via mobile

- further development and uptake of banks’ supply chain finance services will be driven by increasing ERP system integration with large corporates, solid online collaboration tools and more standardised online delivery and on-boarding capabilities for SMEs and suppliers

- banks will increasingly look at how they can offer global transaction services across new regions to grow their business by overcoming the operational hurdles with improved global processing and cross-border payments processing

the number of banks capable of offering a BPO service to clients will rise steadily, with a higher proportion being banks operating in Asia. By 2015, well over half of transaction banks active in trade finance will offer BPO services, but expectations of uptake will be realistic and the BPO will only really take off when corporates of all sizes see the true value and the BPO is seen as a facilitator in a more open four-corner model for supply chain finance.

the number of banks capable of offering a BPO service to clients will rise steadily, with a higher proportion being banks operating in Asia. By 2015, well over half of transaction banks active in trade finance will offer BPO services, but expectations of uptake will be realistic and the BPO will only really take off when corporates of all sizes see the true value and the BPO is seen as a facilitator in a more open four-corner model for supply chain finance.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East