Qatari banks show renewed focus on corporate banking and trade finance, says CAROLINE MAGINN, trade partner at CMM

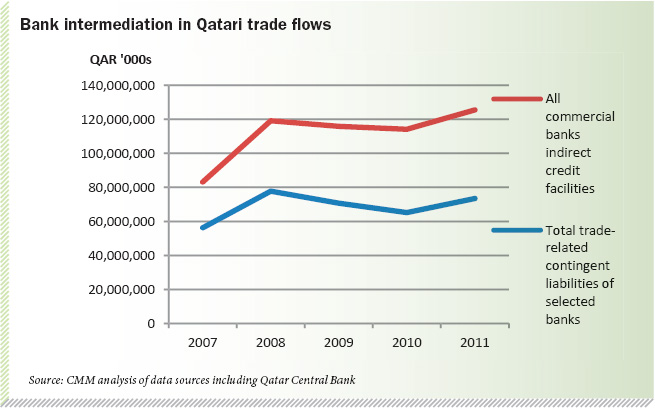

Banks active in corporate banking and trade finance have continued to both contribute to and benefit from Qatar’s growth and prosperity. This is particularly evidenced by their increased provision of trade finance from QAR 114bn at year-end, 2010 to more than QAR 125bn in 2011 and an average growth rate of 12 per cent in trade finance related income in 2011 over 2010.

During the same period corporate banking segment operating income and operating profit grew by 28 per cent and 23 per cent respectively for those banks engaged in corporate segment reporting, which is still evolving in Qatar.

Having closed their Islamic windows in 2011 in response to the Qatar Central Bank’s directive, 2012 sees the first year when conventional banks seek to make up new ground to cover the loss of QAR 1.3bn of Islamic banking profit. Unsurprisingly, this means that the more enlightened banks in Qatar are taking a fresh look at corporate banking and trade finance.

This article highlights some of the key findings of the Qatar 2012 Tajara Monitor, which goes directly to the point of the strong business case for corporate banking and trade finance in Qatar.

This publication follows the precedents set by CMM in the KSA, the UAE and Kuwait and includes added depth and breadth of coverage. The aim of the Tajara series is to bring greater transparency to trade finance in the GCC and to improve on its statistical capacity relating to trade finance.

In summary, corporate banking and trade finance has been a business and product segment that many Qatari banks have been arguably too relaxed about for many years. They have regarded it as bread and butter business with limited scope for innovation and/or justification for new investment. However, this is now changing. Several banks have continued to improve their capabilities on these fronts, even if only on a piecemeal basis in the case of some.

The majority of Qatari banks increased their focus on providing facilities to the SME sector whilst several also expanded capacity for the contracting and public service entities sectors and project finance. Additionally, some banks have launched, or upgraded, their e-banking services for trade and/or improved supply chain finance on the back of extended bills discounted and credit guarantee products.

It is only in recent years that banks in Qatar have started to identify corporate banking as a whole as a discrete business segment in their financial reporting. As of 2010, only three of the eight traditional and Islamic local banks, registered with the Qatar Central Bank and covered in the Monitor, report on the corporate business as a distinct segment.

In 2011, five of the eight banks, albeit in some cases partially, started to report on the corporate segment. This gives much needed transparency as well as demonstrating the recognised importance of the segment. Other banks continue to group retail together with “corporate” as one segment.

QNB took a brave lead amongst GCC banks as a whole by joining the community of 40 banks globally that have adopted, or are in the process of adopting, the SWIFT Trade Services Utility (TSU) Rules supporting the Bank Payment Obligation (BPO). They are expected to adopt the ICC’s Uniform Rules for the BPO on their scheduled publication in Q2 2013. This signals a forward-looking view to trade finance but which still provides both scope for improvement and innovation in Qatar and the financial incentive for banks to invest in improving their trade finance offerings.

It is worth noting that local banks in Qatar are joined by a strong group of foreign banks with a direct or indirect foot-print in trade finance. HSBC Middle East, Standard and Chartered Bank and BNP Paribas have all been active among others in banking the Qatari trade flows. They have for some time identified Qatar as a growing and lucrative market of strategic significance within the MENA region and they provide coverage both from on-and off-shore. According to CMM estimates, the foreign banks have increased their aggregate market-share by more than five per cent over the past five years to around 40 per cent of the total market in 2011.

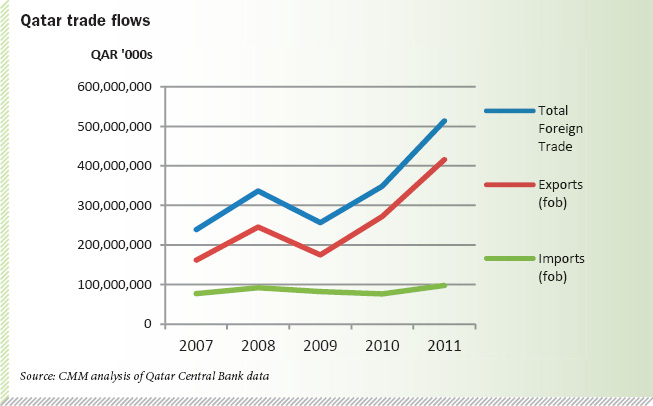

Qatar Central Bank reports exports, in 2011, increased to more than QARs 416bn. Whilst naturally boosted by a rise in fuel prices, total exports also benefitted from an increase in the “non-hydrocarbon” goods flows. This reflects Qatar’s successful diversification strategy. Imports were also reported increased at QAR 98bn.

The level of bank intermediation required in total trade flows has been constantly well above 30 per cent in recent years. It is not anticipated that demand will decrease The precedent set by the banks is a favourable indicator of their good intent in this regard as they have collectively increased the level of trade liquidity at above QAR 125bn over the past three years.

However, there will be additional burdens on, and opportunities for, providers of trade finance in future as the estimates of trade flow growth will create demand for a rise in the level of facilities required from banks. This may be at a time when the Basle III requirements may drive up the capital required to support these increased levels of trade finance.

As in other GCC countries, guarantees continued to be the major trade instrument in Qatar and the one with the strongest growth. It is relevant to note that the letter of credit offering in Qatar is still skewed toward imports as evidenced by the ratio of import-to-export letters of credit. The trends and values of each sub-product are analysed in more detail in the full Monitor.

Bid and performance guarantees, and the related project finance needs, are set to continue to rise given the very significant infrastructure spend, including that on roads, completion of the port, airport and metro for which the budget allocation has been estimated at around $100bn.

It is worthy of note that the key growth relates to inside Qatar instruments. This indicates that a strong on-shore credit, operational and customer service infrastructure is essential for any bank with aspirations for a full trade finance market contribution.

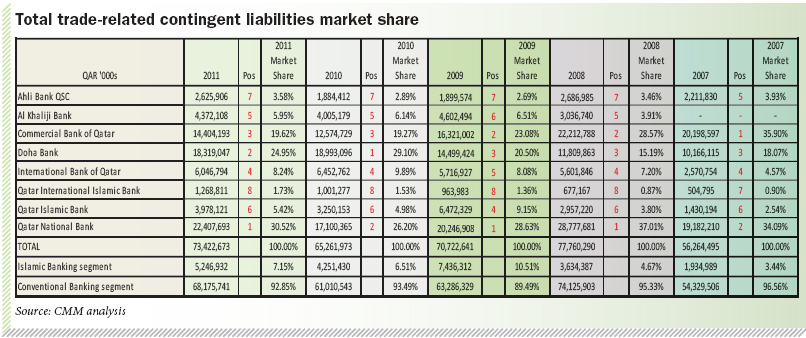

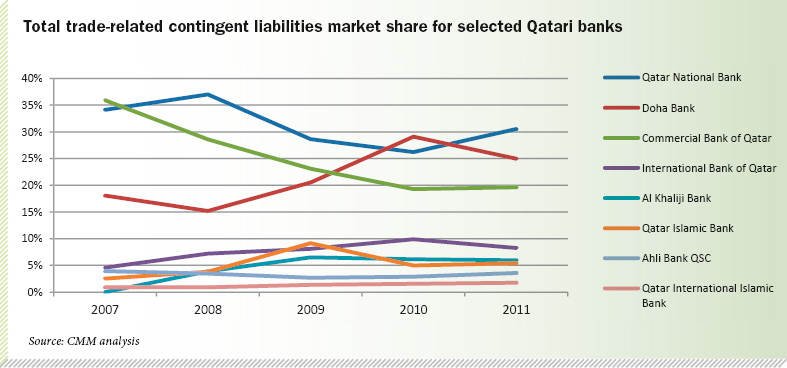

In 2011, QNB recovered what many would consider to be its natural crown in trade finance from the smaller Doha Bank. Doha Bank still maintains a strong position in second place, ahead of the larger Commercial Bank of Qatar in total trade related contingent liabilities; although, unlike its closest peers, its business shrank in absolute value terms in 2011. Ahli Bank showed the strongest growth of all banks in the table year-on-year with an impressive growth of +39 per cent. Both purely Islamic banks unsurprisingly showed substantial year-on-year growth.

In Qatar, as in other GCC countries, corporates have not been complacent in their choice of bank partner to facilitate their trade business. This is reflected in the market share changes in recent years with some marked winners and losers amongst banks as referred to below.

The detailed analysis of individual bank’s trade product and corporate segment performance is analysed in the full Monitor. The report details the figures by bank and product in terms of value, market-share and growth in as well as dimensioning the trade flows by geography and industry and a variety of other leading and lagging indicators of the corporate bank and trade product segments.

Qatari banks providing a range of trade finance products have not gone financially unrewarded. Unlike with some other business lines, there has been a positive trajectory in trade finance income. The contribution of trade-related fees and commissions towards total fees and commissions is in some cases as high as 44 per cent.

Doha Bank continues to head the trade fees and commissions table with trade commissions of more than QAR 170m in 2011, up from QAR 162m in 2010. In second position, Qatar National Bank saw a much stronger increase last year whilst Commercial Bank of Qatar had a further year of decline. Otherwise other banks in the table also saw improvements in their trade related income. This is analysed in more detail in the full Monitor with reference to the largely trade related indirect facility fees and commissions.

It is very important that banks continue to engage actively in their support of innovative trade finance in Qatar. It is hoped that they will build on the lead shown by QNB in signing up to the BPO initiative and start supporting their clients in the new generation of trade instruments.

It is additionally hoped that Qatar’s banks will subscribe to the ICC Banking Commission’s Trade Finance Register to enable the commission to make the case to the Basle Committee for prudent requirements of capital provisioning for trade. The latter is very important for the cost of doing trade in Qatar. If the level of bank capital required to support trade finance increases, so, too, will the charges banks need to levy on their corporates.

Trade finance market participants in Qatar would welcome the Central Bank’s endorsement of the URBPO when they are published by the ICC Banking Commission, which is scheduled for Q2 2013.

For their part, CMM and Cash&Trade magazine will continue in their roles in awareness raising and advisory with banks and corporates. We believe that with the right support from their banks, Qatari corporates can tangibly reduce the cost of goods purchased and increase the profit on goods sold, thereby enhancing the economy as a whole. n

The scope of the GCC Tajara Monitors is presently limited to the indigenous banks that by and large make their annual and interim reports with details of their letters of credit guarantees and acceptance levels freely available. This is due to the fact that foreign banks, although active in trade finance across the GCC, do not publically disclose their country specific financial positions and on-and-off balance sheet reporting for trade finance or corporate banking as a whole. If the foreign banks would disclose details of the trade finance portfolios at an aggregate trade product level at a GCC country level they could be compared in the Monitors on a level playing field with the national banks without compromising client confidentiality.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East