As at Q3 2010, Riyadh Bank’s corporate liabilities rose over Q2 2010 to reach SAR90bn, whilst over the same period corporate assets also rose to SAR90bn and trade related contingencies held fi rm at SAR56bn. In recent years, the bank achieved market shares of approximately 20 per cent in each category and continued to occupy the No1 position in the CMM Corporate and Trade League Table published in the Tajara Monitor.

Corporate is Riyad Bank’s No 1 business segment, as it is for many other banks in the KSA. Th is is true whether measured by assets, liabilities, operating income or net income.

In trade, its closest rivals – NCB and Banque Saudi Fransi – both narrowed Riyad Bank’s lead in Q3 2010. National Commercial Bank and Banque Saudi Fransi continued to build trade related contingent liabilities items this quarter as did several other banks whilst Riyad held fi rm. Full details are available in the Tajara Monitor Q3 2010 report, which is available to subscribers.

Riyad Bank has long focused on the provision of key services to corporates, including at its heart, trade facilities for importers and exporters. It has a strong tradition of facilitating both inward and outward Saudi capital and trade fl ows and has developed its branch network within the KSA and abroad in London, Singapore and houston to support both KSA clients and those overseas doing business with the Kingdom.

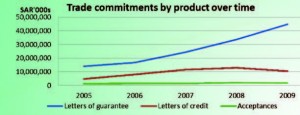

Like other banks active in trade, and, as market leader, Riyad Bank has increased capital committed to trade throughout the crisis. This has underpinned trade liquidity, which is of systemic importance to the Saudi economy, dependant as it is for essential items imports such as food, automotive and electrical goods, whole, of course, the world depends on Saudi oil and related exports. Of growing importance in recent years has been Riyad Bank’s apparent support of medium-to-long-term infrastructure projects. Th is is refl ected in a rise of capital committed to support the full range of counterparties who facilitate these fl ows.

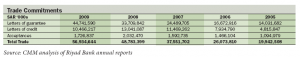

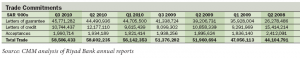

The bank has been supporting a steady and substantial rise in approved trade transactions, most notably for corporates, from just over SAR16bn in 2005 to above SAR47bn in 2009.

Apart from the size of, and growth in, its corporate trade business we have noticed a steady and substantial level of approvals for bank/ FI counterparties at well above SAR10bn over the past three years.

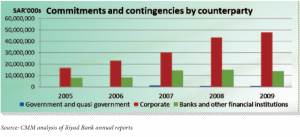

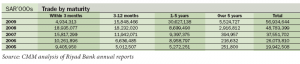

Interestingly, the maturity profi le of trade contingencies has shift ed over time and the bank has shown fl exibility and appetite to support longer tenor transactions.

This, together with commitment from several other banks in the market, has been crucial for importers to benefi t from extended payment terms during the recent downturn and support the bonding required and capital expenditure imports to back infrastructure projects, which by their very nature involve longer tenor transactions.

There has been a marked rise in its portfolio of LC transactions at the longer end of the maturity spectrum. For example, in the 3-12 month maturity range they were up signifi cantly by 99 per cent in 2009 over 2008 and also in the 1-5 year maturity band. Th is may be due to Saudi Importers moving to longer deferred payment terms from sight and under three-month payment tenors.

There has also been a marked rise in longer tenor LG transactions in their portfolio, which is very focused overall on LGs as is the market generally. On average, LGs account for 69 per cent of the total trade portfolio over the past fi ve years. Their rise is particularly notable in the 1-5 year transaction range for which the total has risen from SAR8bn in 2008 to SAR29bn in 2009.

Riyad Bank’s increased commitment to trade has been rewarded by a rise in trade income over the period. Riyad Bank’s income from trade and corporate finance and advisory fee income has risen sharply both in terms of absolute value and its importance to total bank fee income.

Trade related income has apparently proved markedly less volatile and shown strong annuity quality compared with other income streams.

If we consider Riyad Bank’s activity over the past three years and look in detail at the performance in Q1, Q2 and Q3 2010, we see that the bank has been overall increasing or maintaining its sizeable commitment to trade.

We will look with interest at the KSA banks’ full-year trade performance in the Tajara Monitor for 2010, which will be available to subscribers in early 2011. We will see if Riyad Bank, which has just reported an increase year on year of 18 per cent in total operating income for the nine months ended September 2010, is the first bank in the KSA to report annually in excess of SAR1bn for trade and related earnings.

There is no doubt that corporates are not complacent about their choice of banking partner to meet their important trade needs and that the competition for trade within the KSA shows no signs of abating.

CMM will continue to monitor developments in trade within the KSA, including the performance of existing players and new entrants in its Tajara Monitor publication.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East