Trade finance and corporate banking in the KSA closed 2010 on a very positive note and are both poised for further growth in 2011, comments CAROLINE MAGINN, trade partner at CMM

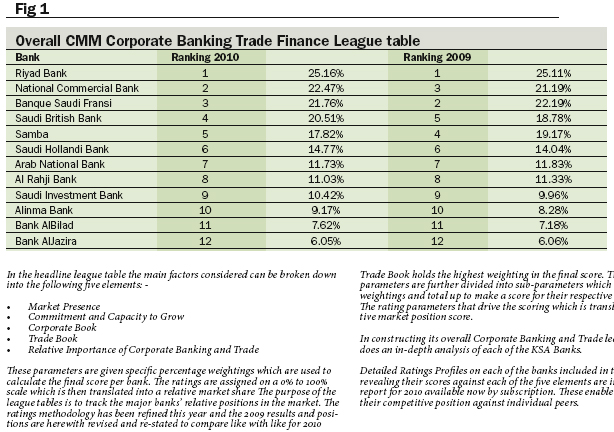

The Tajara Monitor Full Year report revealed that in 2010 Riyad Bank narrowly held on to its lead position but is now challenged by a resurgent national Commercial Bank, whilst at the bottom of the table Alinma Bank firmly establishes itself as a challenger to both Islamic and conventional banks. The primary role of any index or monitor is to provide customers be they corporates, banks or observers with a meaningful market benchmark and, in that respect, the Tajara Monitor facilitates the measurement of banks performance individually and/or collectively in relation to corporate banking and trade finance. It also assesses the sector’s and individual bank performances in providing liquidity for general corporate purposes and for trade finance in detail and in this article we unveil some or the top-level findings from the Monitor which is now available in full to subscribers.

Within the Tajara Monitor, CMM published its headline Corporate Bank Trade Finance League Table below and a wide range of supporting sub league tables which include values and individual bank market-shares against each of the ratings criteria measures.

In the headline league table the main factors considered can be broken down into the following five elements: –

• Market Presence

• Commitment and Capacity to Grow

• Corporate Book

• Trade Book

• Relative Importance of Corporate Banking and Trade

these parameters are given specific percentage weightings which are used to calculate the final score per bank. The ratings are assigned on a 0% to 100% scale which is then translated into a relative market share The purpose of the league tables is to track the major banks’ relative positions in the market. The ratings methodology has been refined this year and the 2009 results and positions are herewith revised and re-stated to compare like with like for 2010 Trade Book holds the highest weighting in the final score.

These broad parameters are further divided into sub-parameters which have their specific weightings and total up to make a score for their respective broad parameter. The rating parameters that drive the scoring which is translated into a relative market position score. In constructing its overall Corporate Banking and Trade league table, CMM does an in-depth analysis of each of the KSA Banks.

Detailed Ratings Profiles on each of the banks included in the league table revealing their scores against each of the five elements are included in the full report for 2010 available now by subscription. These enable banks to monitor their competitive position against individual peers.

Overall CMM Corporate Banking Trade Finance League table Bank Ranking 2010 Ranking 2009 Riyad Bank 1 25.16% 1 25.11% National Commercial Bank 2 22.47% 3 21.19% Banque Saudi Fransi 3 21.76% 2 22.19% Saudi British Bank 4 20.51% 5 18.78% Samba 5 17.82% 4 19.17% Saudi Hollandi Bank 6 14.77% 6 14.04% Arab National Bank 7 11.73% 7 11.83% Al Rahji Bank 8 11.03% 8 11.33% Saudi Investment Bank 9 10.42% 9 9.96% Alinma Bank 10 9.17% 10 8.28% Bank AlBilad 11 7.62% 11 7.18% Bank AlJazira 12 6.05% 12 6.06% There were some interesting changes at the top of the overall league table with Riyad Bank holding on to its lead position reflecting its continued commitment to both corporate banking and trade finance. In respect of the sub-league tables for corporate segment assets, liabilities and net operating income and its overall trade book, Riyad Bank continued to hold the no. 1 position. However, the competition is heating up and Riyad Bank’s lead has narrowed as national Commercial Bank and Saudi British Bank in particular built on their prior year performance to narrow the gap substantially between themselves and the market leader.

At the same time, both Banque Saudi Fransi and samba lost ground compared to the leader. In the middle of the table Saudi Hollandi Bank improved its overall score but Arab national Bank and al rajhi Bank lost ground. at the bottom of the table, Alinma Bank made strong progress whilst Bank alJazira lost ground.

Tajara Monitor Key Findings for 2010

The banking sector in the KSA has attracted positive endorsements from rating agencies and investors across the world due to its stability. Its inherent strength is reflected in the capital adequacy and current credit ratings of KSA banks. The banks’ commitment to corporate banking and the provision of trade liquidity has been stable and continuous in recent times.

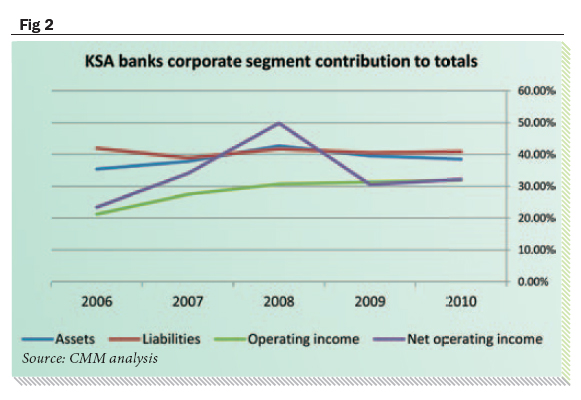

In summary, corporate assets, corporate liabilities, corporate operating income and corporate net operating income have all trended upwards if only slightly since 2009, driven largely by the Islamic banks. In addition, the largely trade finance related contingent items and trade fees have trended more markedly upwards for both conventional and Islamic banks.

Corporate business remains strong and core to KSA banks.

During a difficult time in the markets in broad terms corporate banking remained a prime business segment to banks within Saudi Arabia, whether measured as a percentage of assets, liabilities, operating and net operating income. It is the no.1 business segment to many banks within the KSA ahead of retail, treasury and investment banking and brokerage.

Overall, for 2010, the corporate banking segment accounts for 39 per cent of total assets at SAR 531bn, 41 per cent of total liabilities at SAR 481bn of liabilities and 32 per cent of total operating and net income at SAR 18bn and SAR 9bn respectively.

Having increased substantially between 2006 and 2008, corporate assets have leveled at above SAR 500bn for the past three years.

Corporate liabilities have risen consistently since 2006 from under SAR 300bn to almost SAR 500bn thereby unequivocally showing the rising importance of the corporate segment to both sides of the balance sheet.

The corporate operating income trend has been positive throughout recent turbulent years and risen by more than 50 per cent since 2006. Th s healthy trajectory in revenue generating power provides banks with a medium-term cushion against periodic troughs in relation to credit provisions.

At SAR 9bn in 2010 – and in prior years as much as SAR 13bn – the corporate segment is continually a net contributor to overall bank profitability.

At year-end 2010 net corporate segment operating income continued to show welcome signs of growth seen in previous quarters and was up by 8 per cent on the previous year.

(Detailed charts and sub-league tables on each of corporate assets, liabilities, operating income and net operating income are available in the full Tajara Monitor).

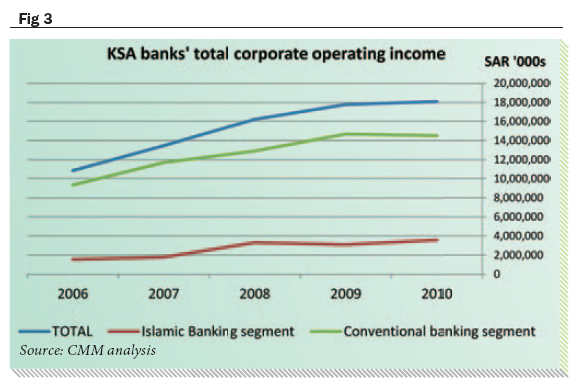

Growth in the corporate banking market for Islamic banks

The Islamic banks’ collective share of corporate banking assets rose from 9 per cent in 2006 to 16 per cent in 2010 at SAR 83bn illustrating their rising systemic importance.

The segment’s level of corporate liabilities continued a strong pace of growth in 2010 to reach SAR 53bn with a total market share of 11 per cent; up from 8 per cent (SAR 23bn) in 2006.

The Islamic banks’ performance in the corporate operating income segment is notable and the Islamic banks in 2010 won a collective market share of 20 per cent with SAR 3.6bn, up from 14 per cent (SAR 1.5bn) in 2006. As at year end 2010 the Islamic banks won a market share of 16 per cent of corporate net operating income, also up from 15 per cent from 2006; reporting just under SAR 1.4bn for 2010.

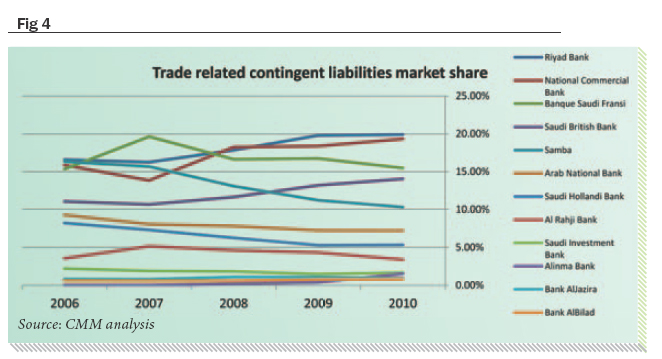

Dynamic competitive landscape in trade finance

With six of the twelve banks recording marketshare gains or losses of 3% or more, the market has been demonstrably fast moving from 2006- 2011

The market-place in 2010 has revealed some interesting winners and losers in terms of market-share in relation to the largely trade finance related contingent items of letters of guarantee, letters of credit and acceptances. These are analyzed in greater detail in terms of absolute values and market-shares, by sub-product, by maturity and counterparty for each bank in the full Tajara Monitor report.

Overall in the market both local and foreign bank attention has been notably increased during the year. JP Morgan committed increased on-the-ground resources to originate corporate banking and trade finance business amongst other activities. Deutsche Bank has formally launched its cash management and trade finance business. Standard Chartered, which globally reported an increase of 28 per cent in trade finance related assets and contingent items, continues to weigh up opportunities for the future in the Kingdom whilst local KSA banks have embarked on a wide and varied range of strategic initiatives to bolster their trade finance. Such activities span re-organisation, training, new product launches, third-party alliances and a broadening of their risk appetite in relation to the more capital-intensive guarantees and long-term transactions, inter alia. Others, such as BNY Mellon, maintain their active engagement in the market.

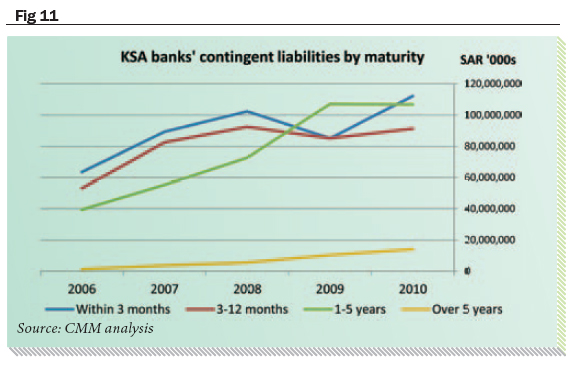

The chart illustrates the overall trends in trade finance. Riyad Bank narrowly held its lead position, first gained in 2009. National Commercial Bank resurrected its position from the 4th place to which it fell in 2007 to gain 2nd position just behind Riyad Bank. Banque Saudi Fransi and samba both lost ground as did Arab national Bank. In the cases of both samba and Arab national Bank, this decline was for the fourth year in a row whilst Saudi British Bank continued to build on a positive trajectory, which is reflected in its no. 1 position in trade fees and in the acceptances sub-league tables which are available in the full Tajara Monitor report. The year was not without some good findings for Banque Saudi Fransi as it held the no.1 position in the 3-12 mon Thend of the contingent liabilities maturity spectrum.

Riyad Bank’s position was particularly strong in relation to the long-term end of the trade related maturity spectrum whilst CNB dominate the short-term end. NCB dominate the letters of credit sub league table whilst Riyad Bank takes the lead in letters of guarantees.

2011 will prove of significant interest and we will see if national Commercial Bank builds further on recent momentum and takes strategic initiative to seize the lead from Riyad Bank, or whether Banque Saudi Fransi will revamp its focus to challenge for the no.1 position it last held in 2007. amongst Islamic Banks, Alinma Bank conveyed an excellent performance driven by an appetite at a senior management level for closing deals to meet client need and a willingness to commit the bank to the more capital intensive long-term deals as well as short-term. It has overtaken both Bank alBilad and Bank alJazira and also Saudi Investment Bank. It will be interesting to follow the results of its unfolding strategy during 2011 to see if it enables it to bolster its operational and IT infrastructure to support a larger-scale business to close on al rajhi Bank (still the largest fully Islamic bank) or if the other Islamic banks will step up their momentum.

Trade finance continues to be an important staple of corporate banking

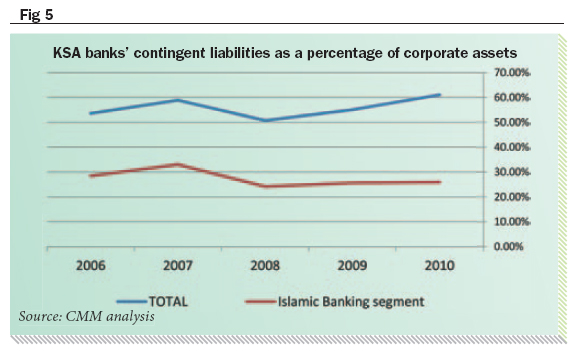

The trade finance market has proved itself yet again as an important staple of corporate banking at consistently above 50 per cent of the total corporate asset level since 2006 and rising to above 60 per cent in 2010.

Fig 5 KSA banks’ contingent liabilities as a percentage of corporate assets

Growth in trade finance market throughout downturn

The nature and level of international trade has again presented opportunities for KSA banks to provide trade related services in an increasingly innovative way and this, in turn, has given them the means to diversify and augment their sources of income. There was a notable recovery in export levels to an estimated SAR 941bn from the SAR 721bn level of 2009 although it has not yet recovered to the 2008 level. Imports have also bounced back to SAR 401bn from SAR 358bn in 2009, which again demonstrates that international imports and exports are a critical component of the KSA economy in good times and in bad. The country continues to be dependent on the external world for food products, heavy machinery, equipment and transportation, which it continues to import throughout the economic cycle, and the rest of the world is dependent, regardless of the price, on the country’s oil-related exports.

Based on leading indicators in the first quarter of this year, CMM forecasts another full year of growth for 2011 in the trade finance market.

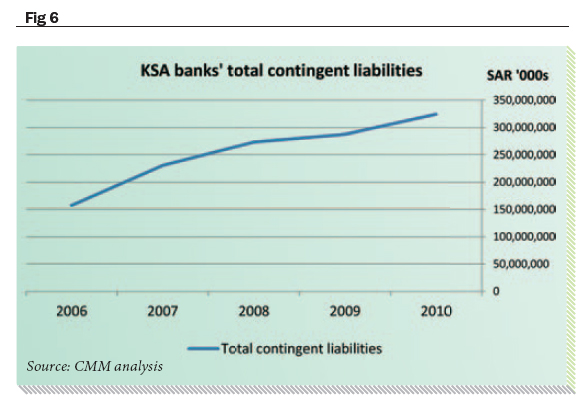

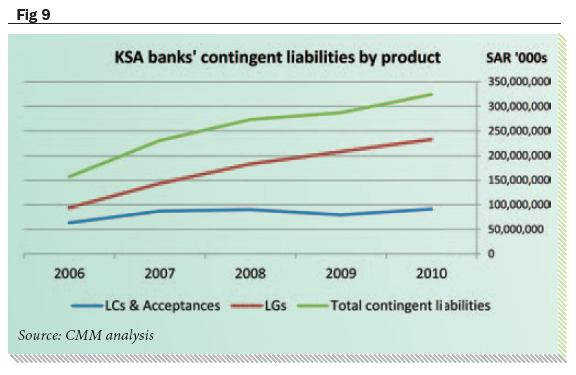

Accordingly, trade finance rallied well during the period showing steady growth since 2006, when it accounted for SAR 157bn in largely trade related contingent liabilities. as at year-end 2010, it reached SAR 324bn up from SAR 288bn in 2009. Even throughout the recent downturn it has continued to show growth whilst other business lines suffered attrition.

The trade finance market has, therefore, proved its resilience to market downturns. This demonstrates that trade is a core need of corporates and that banks continue to have appetite to support trade even during these times of credit tightening.

This growth also signifies the recent preference for secure terms in particular in relation to intra-GCC flows coupled with innovations in banking in the country such as new technology and the introduction of shari’ah compliant products.

Of the total market of SAR 324bn, the top three trade banks account for 55 per cent and the top five banks for almost 80 per cent. Over the past five-year period there have been changes in league table rankings and marked market share winners and losers in trade. This proves that it is a market-place where innovation, commitment and high levels of service can lead clients to switch providers and that there is demand from the market-place and space for an innovative and strong trade finance provider.

None of the Islamic banks currently occupy a top five position in the CMM trade league tables although the conventional banks have been increasingly targeting the Islamic section of the market.

Positive trade finance income trend throughout overall market downturn

Our analysis of the income associated with trade is limited by the fact that the no. 1 and no. 2 banks in trade finance (Riyad Bank and national Commercial Bank) bundle their letter of credit, guarantee and trade finance earnings with other income streams as does al Rajhi Bank, the leading Islamic trade finance bank. This means we cannot track the total overall market earnings from this important business activity. However, we can deduce the overall trend in relation to trade finance by looking at the results of the nine banks that do report trade finance related fees in a segregated manner.

Conservatively excluding the earnings from trade related lending and ancillary foreign exchange and cash management fees related to trade finance flows, CMM’s estimate of the full size of the market for 2010 is well in excess of SARS 3bn.

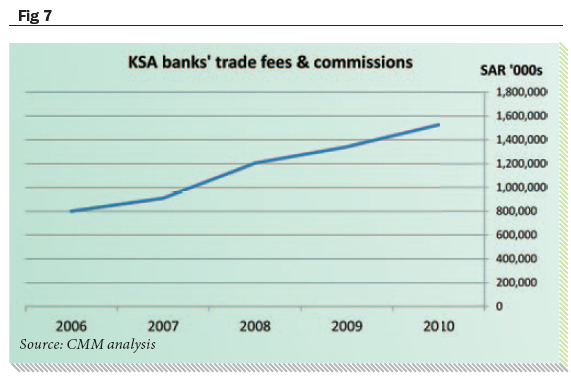

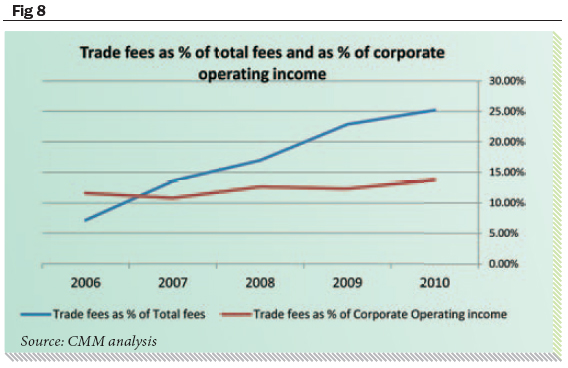

The reported trade fees for the nine reporting banks reached SAR 1.57bn in 2010, up from SAR 0.80bn in 2006. This growth in reported fee income from trade financing continued whilst other business lines suffered. The performance of trade finance in the nine reporting banks included was much better, for example, than their overall fee income and total corporate operating income. Gross fee income from banking services fell to SAR 6.05bn in 2010 from 13.31bn in 2006 compared to trade fees which rose by 96 per cent in the same period. however, it is worth noting that the performance of individual banks varied enormously some improving substantially ahead of others but each of the nine banks saw an upturn benefiting from a rise in the market if not always an improvement in their competitive performance against their peers.

Consequently, the share of trade finance income of total fee income from banking services rose from 14 per cent in 2007 to 25 per cent in 2010 and at the same time from 11 per cent of total corporate segment operating income to 14 per cent. These figures and underlying trends underscore the importance of trade finance income to overall bank profitability.

During this period the three Islamic banks that list trade fee income separately reported an improved contribution from trade finance to overall fees of eight per cent in 2010, up from five per cent in 2009 but still see less of a contribution from trade finance than the conventional banks. Alinma Bank more than quadrupled its trade fees and commissions earnings year-on-year to SAR 23mn to take it ahead of Bank alJazira and Bank alBilad.

Growth in demand for Islamic trade solutions, better service and more innovation in relation to trade finance

Better technology, enhanced customer relationships and the spread of Islamic banking products have enabled Islamic banks and those conventional banks off erring shari’ah compliant services to garner a greater share of the lucrative trade finance market. Banks are looking at the provision of innovative solutions in relation to KSA flows both from on- and off -shore, including activities such as factoring.

The Islamic banks’ market share of trade finance has grown from SAR 7.9bn in 2006 to SAR 21.6bn as at year-end 2010 with a two per cent increase in collective market share to 7 per cent up from 5 per cent. CMM forecasts that this trend will accelerate further in 2011.

Trade Product Contribution

Letters of guarantee are the leading trade product and have been growing in importance in recent years both in terms of value and percentage contribution. Letters of credit, together with acceptances, have settled at a contribution of just under 30 per cent over the past three years and letters of guarantee at 70 per cent.

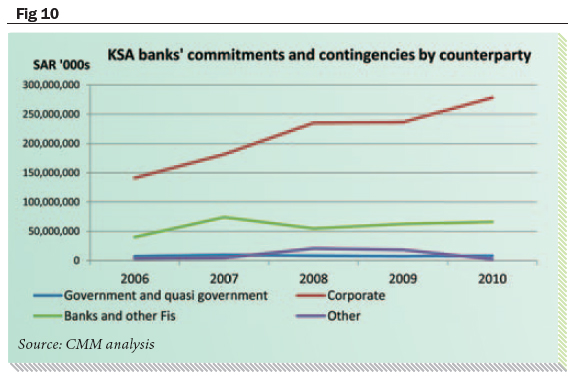

Trade Product Portfolio by Counterparty

If we take our analysis of the banks’ portfolio of contingent liabilities and commitments as a good proxy for their trade business, we can see that corporates are the most intensive users of banks’ trade related capital followed by FIs and then government and quasi-government.

Trade product portfolio by maturity spectrum

From looking at the market’s portfolio of trade instruments by maturity over time we can see there has been a consistent rise in longer tenor transactions in recent times with more volatility and/or liquidity disruption at the shorter end of the spectrum. On a positive note, the total level of capital committed to all aspects of the maturity spectrum have recovered to above their 2008 peak and this is true also of all aspects of the spectrum with the exception of the 3-12 month band.

The upward trends in the corporate segment contribution, together with the dynamic trends in the trade finance market

highlighted above, firmly puts pressure on banks to improve their integrated treasury,trade finance and cash management offerings to rise to the challenge of adequately serving this important and core segment.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East