CAROLINE MAGINN looks at a triumphant year for UAE banks

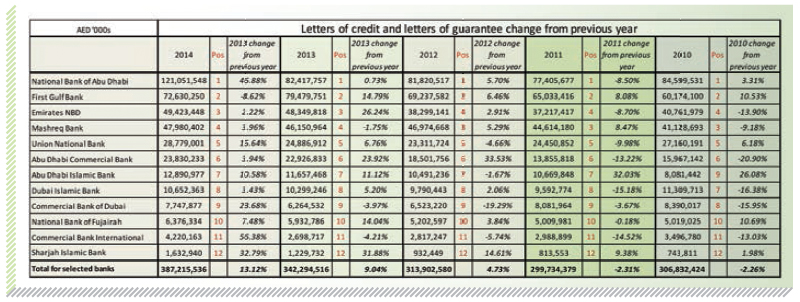

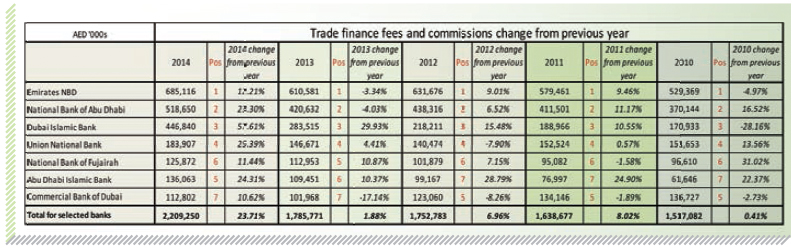

Trade finance and corporate banking enjoyed a robust year in the UAE in 2014 with our 12 selected banks reporting overall record figures in trade-related contingent liabilities, corporate assets, liabilities, operating income and profit. This was reflected also in trade finance fees and commissions where the seven banks who report this category separately comfortably breached the AED 2bn mark.

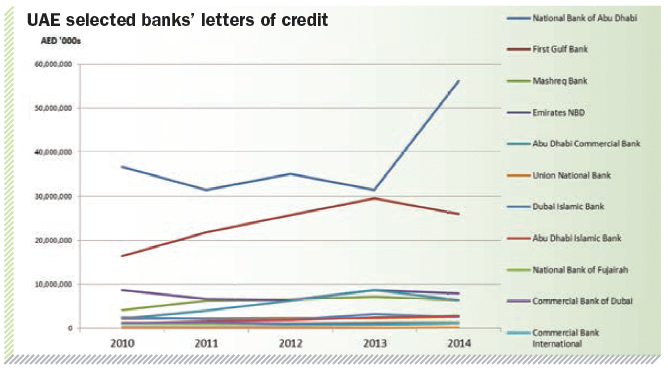

National Bank of Abu Dhabi increased its lead, in terms of total letters of credit and guarantees, from First Gulf Bank, with more than AED 120bn; a rise of 47 per cent on 2013. This gives it 31 per cent of the total for the selected banks and a lead of nearly AED 50bn on its nearest rival.

The leap forward is thanks to substantial gains in both LCs and LGs. In LCs alone, NBAD reported more than AED 56bn which gives it 49 per cent of the total and more than double the AED 26bn of First Gulf Bank, which remains clear in second place. It would appear that this performance has come at a cost to several of its competitors as six of the 12 banks suffered attrition in letters of credit on the year.

The overall total, however, was up over 18.5 per cent to AED 115bn. This is in contrast to the KSA, where, we reported in the KSA Tajara Monitor, there has been a decline in LC issuance by comparison to letters of guarantee over the course of 2014.

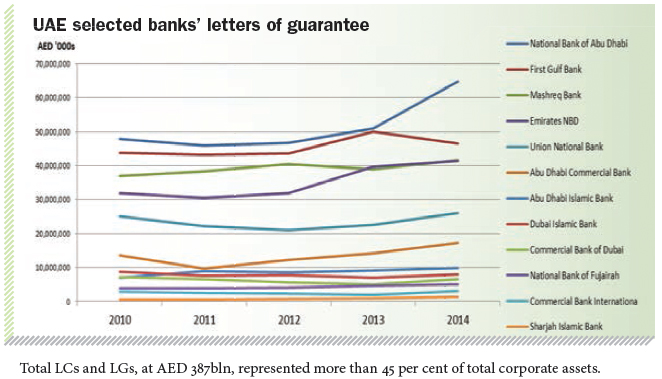

In terms of LGs, NBAD again leads the way with AED 65bn, a rise of nearly 28 per cent from the year-end 2013. It is notable that 11 of the 12 selected banks posted robust gains on the year with only First Gulf Bank reporting attrition after its own strong performance.

Total LCs and LGs, at AED 387bln, represented more than 45 per cent of total corporate assets.

Of the banks that report trade finance related fees and commissions as a distinct category, Emirates NBD heads the table with AED 685m. NBAD remains in second position on AED 519m, up by AED 98m versus 2013. Dubai Islamic Bank, in third position, had a very strong year with a 58 per cent rise to AED 447m. All of the reporting banks posted gains with the overall figure up by 24 per cent to AED 2.2bn. Trade finance related fees and commissions account for 14 per cent of corporate operating income.

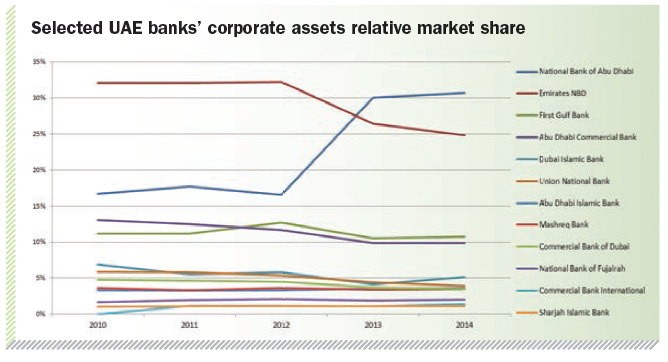

Corporate assets rose by 10.62 per cent to AED 852bn, at year-end 2014, and now are responsible for more than 48 per cent of the selected banks’ total assets. NBAD and Emirates NBD dominate this category and together they account for more than 55 per cent of that total. The corporate segment is most important to National Bank of Fujairah, where it contributes 68 per cent of the bank’s total.

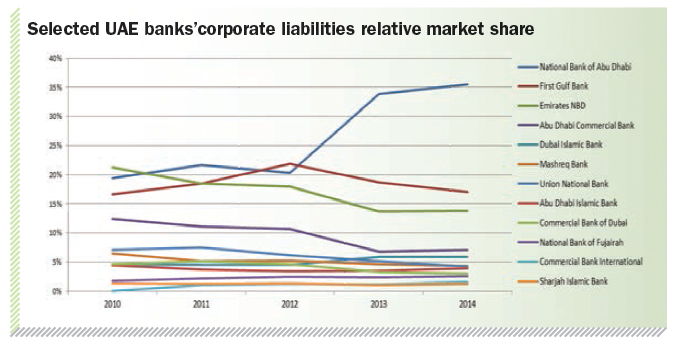

Corporate liabilities rose 11.5 per cent over 2014, to AED 721bn. As with corporate assets, 11 of the 12 banks posted robust increases with particularly strong relative increases reported at the lower end of the table. NBAD, First Gulf Bank and Emirates NBD dominate this category with a joint 56 per cent share of the total.

The same three banks top the corporate operating income table. Abu Dhabi Commercial Bank, in fourth place, posted just short of AED 2bn. All of the selected banks reported in excess of AED 1bn for this category apart from three and, overall, there was a rise of nine per cent to AED 24bn.

Corporate segment profit soared in 2014 to AED 12bn with Commercial Bank of Dubai gaining more positive momentum to show a 71 per cent increase to AED 792m. Dubai Islamic Bank continued its momentum to breach the AED 1bn mark. NBAD, First Gulf Bank and Abu Dhabi Commercial Bank complete the top three places.

The full CMM UAE Tajara Monitor is available by subscription from Cash&Trade magazine.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East