Committed trade financiers in the GCC were rewarded by their customers in 2012. But what will they be doing for their clients in 2013 to return that loyalty? CAROLINE MAGINN looks at the answer to that question

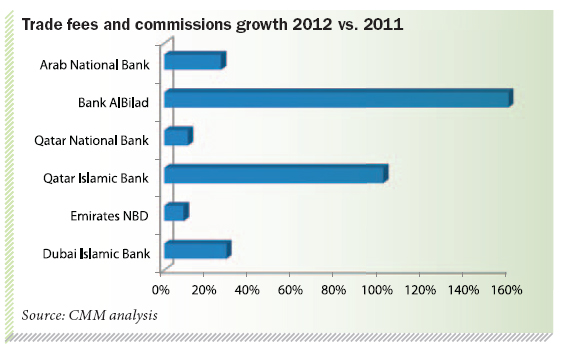

Many banks, around the region, reflected growth in their trade finance business in 2012. For example, Arab National Bank and Bank Bilad in the KSA, Emirates NBD and Dubai Islamic Bank, in the UAE, Qatar National Bank and Qatar Islamic Bank, , to name a few, reported trade finance revenue growth and in some cases in double digits, significantly above 20 per cent.

However, and unsurprisingly in light of the current dynamic and rising interest in trade finance, some banks, even those historically strong in trade finance, lost ground last year, whilst others made substantial gains.

Trade finance is instinctively espoused by seasoned bankers in the region as one of the core banking activities contributing to wealth distribution and economic prosperity. It is simply central to corporate needs. We suggest the 2012 results coupled with the budgeted level of government infrastructure spending, export diversification and promotion, and support for SMEs as well as the outlook for oil and gas, augurs well in the short-to-medium-term for banks in the region prioritising trade finance.

Qatar National Bank (QNB) was the first of the region’s trade finance heavyweights to file its detailed annual report in January earlier this year. The 2012 annual results revealed a double-digit growth in trade related contingent liabilities and trade revenues and suggest further food for thought and action in 2013 for banks in Qatar and more generally around the region.

For this reason we chose to make it the focus in this article, which highlights the launch of a new series of ad hoc Tajara Monitor Spotlights, which is an extension to the Tajara Monitor trade finance research CMM has been sponsoring since 2007 to bring greater transparency and efficiency to this area of corporate banking in the region.

By scrutinising, independently, individual bank and corporate trade related activities, we hope to bring further insights to the scale, continuity, means and methods of the provision of trade finance in the region.

QNB, which took the top spot in the CMM Corporate Banking and Trade Finance League Table in last year’s Qatar Tajara Monitor, revealed a broad spectrum of indicators of its trade finance business for the full year. These suggest growth across the trade portfolio as it deepened its support for, and commitment to, work with importers and exporters.

The bank, having lost its crown to the by-many-measures smaller Doha Bank in the same table in the 2011 Qatar Tajara Monitor continues to show re-invigorated support to trade finance at the heart of its corporate banking proposition:

- its total contingent liability book, a significant portion of which was trade-related, grew by 18 per cent year-on-year and closed at QAR 59bn as at 31 December 2012, up by more than QAR 9bn on 2011

- growth in letters of guarantee was 11 per cent year-on-year and, at almost QAR 2bn, registered above the overall market growth rate. This is the third consecutive year of growth in the bank’s capital committed to support this important instrument used by both importers and exporters

- in terms of letters of credit, its portfolio value dropped in absolute and relative market-share terms

- the bank grew its appetite for the higher risk, more capital intensive, 1-5 year part of its overall contingent liabilities book, showing its willingness to support corporates medium-to-longer-term transactions. The trajectory for the overall market need at this end of the maturity spectrum and longer is very much on the rise and the bank’s intentions in this regard will be a determining factor of its future value added to clients and trade finance business market position. Given its superior risk rating and ready access to incremental capital, this is a natural area for trade finance product and competitive differentiation for QNB

- growth in loans and advances to the sectors with substantive trade finance and broader supply chain finance needs was strongest in the industrial (+90 per cent) and government agency sectors, followed by commercial and government sectors (both +20 per cent)

- the value of bills discounted rose almost four-fold from QAR 122m to QAR 582m. Whilst this at first glance appears small in the overall scheme of its lending book at two per cent of total, it has proved a vital offering for the commercial and services sectors that include a sizeable number of SMEs for which it registered substantially higher value and/or usage preference than overdraft.

- hence for QNB and the other banks increasingly targeting the SME sector as one with significant growth potential this is a significant indicator of the bank’s success last year

The bank’s commitment to support importers and exporters did not go unrewarded and was evident across the different analyses of the bank’s income streams as follows below:

- the domestic corporate segment total operating income, which includes a large contribution from trade finance, grew from QAR 6.9bn to QAR 7.9bn and yielded corporate operating segment profit of QAR 6.2bn up from QAR 5.4bn in the prior year

- the international banking segment total operating income, which includes a large element of trade finance, grew from QAR 1.8 to QAR 2.3bn and yielded operating profit of QAR 1.7bn up from QAR 1.4bn

- the purely fees and commissions contribution from trade finance to the bank’s income was included in each of the sub-categories of loans and advances (QAR 595m), off-balance sheet items (QAR 184m); and bank services (QAR 426m). These in turn collectively accounted for 84 per cent of total bank fees and commissions’ income

- the domestic corporate business segment yielded net interest income of almost QAR 7bn fees and commissions income of almost QAR 1bn

- the international banking segment yielded net interest income of almost QAR 2bn and fees and commissions income of QAR 0.2bn

- whilst continued prudent provisions were made for the corporate segment, these also dropped in 2012, reflecting the perceived health of the underlying credit quality of the bank’s corporate book.

Although it is impossible, externally, to size the absolute contribution from trade finance to each of the foregoing it is reasonably considered to be sizeable.

Hence, domestic corporate banking alone confirmed itself as the biggest contributor by far to QNB’s profitability, accounting as it did for approximately 75 per cent of its total operating profit. The corporate segment, when considered both domestically and internationally, thus ranks well ahead of retail, consumer, and asset and wealth management business lines.

Whilst in some other GCC economies retail and high net worth individual business segments have won deserved and sometimes undeserved priority over the corporate segment, the structure of the Qatari economy dictates and justifies continued high prioritisation from QNB and other banks regarding the corporate segment.

Notwithstanding the facts that the corporate segment is:

- comparatively demanding when it comes to the range of product offerings and service delivery excellence; and

- sometimes lumpy from a credit point of view if concentrations and exposures are not carefully managed and mitigated

- sometimes perceived as uneven in terms of profit contribution if not considered over the life cycles beyond the curve of individual annual report filings through the country’s economic cycles both good and bad.

It is untenable for banks with core economic importance aspirations in the country not to serve corporates and serve them well with regard to trade finance and other essential banking requirements.

The predominance of trade finance at the core of both large and small corporate client requirements, which are themselves the centre of plate client segments for the bank, make trade finance a continuing high priority area for QNB.

Given that these trade finance needs in Qatar and elsewhere within QNB’s broadening geographic business reach are increasingly complex, they both demand and reward investment for QNB and their competitor banks.

This is a fact not unnoticed by top tier foreign banks but QNB, like other local banks, is evolving its management depth and reporting structures to rise to this competitive challenge. This is reflected in its introduction of matrix reporting structures, balanced scorecard reporting and added sophistication of its research, marketing and strategic planning, people talent building, training and review activities.

These steps are a key to ensure management oversight and insight when it comes to investing shareholder funds in a more complex business model with which QNB is demonstrably tackling. For example, the bank’s training budget grew to QAR 25m from QAR 17m which is an important step in facilitating the building of the talent inventory and supporting succession planning to address emerging challenges.

QNB is making concrete steps towards realising its regional expansion. Last year it realised a long-term acquisition of a major bank in Egypt through its acquisition of Societe Generale’s stake in National Societe Generale Bank-Egypt. Additionally, the bank has expanded its foot-print in Iraq and Libya.

With the rising management complexity of its franchise, the bank recognises that it requires more than ever robust internal people, processes and systems infrastructure to both manage and inform risk and liquidity management whilst building its business origination capacity.

Additionally, QNB can and is applying selectively the best practices of other international banks but around its own unique track record of success and innovation and, very importantly, long-haul relationship commitment. This means it will invest in unpopular initiatives without market acclaim and spend time on getting the balance of relationship and solution details right.

For example:-

n Relationship Commitment

When faced with clients in difficulty, it has embraced a positive approach to re-structuring to see clients through downturns, eg, in 2012 it re-negotiated QAR 107million of corporate loans and QAR 22m of SME loans and advances

n Global Transaction Banking

n It took a brave lead in the market by signing up to the ICC Banking Commission & SWIFT Bank Payment Obligation “BPO” initiative which, according to some banks, works more to the benefit of corporates than the banks.

n It has had considerable success in domestic and trade financing on the back of its significantly expanded bill discounting product although some banks considered it insufficiently glamorous to warrant allocation of management resource.

n It worked through the IT operations and investment and short-term loss of balance earnings costs of rolling out its core banking Bank Fusion project. This was to facilitate better ease of cash management and optimum pooling of dispersed cash flows for corporates across domestic and cross-border accounts.

n Structured Trade Finance Facilities

It has historically taken the lead in Qatar underwriting some initially perceived to be uncommercial infrastructure transactions that are now in vogue amongst other banks and promises to do the same in the new countries now in its foot-print.

Hence QNB has shown it has and can continue to act with foresight and it will borrow from the tradition of the old school merchant banks as well as later breeds of banking model, which have not always had the same longevity in banking short-to-long-term trade and capital flows regardless of political unrest.

As to the year ahead, it will be interesting to see what unfolds for QNB and other banks in the region in relation to trade finance. Some of the questions begged by banks’ success or loss in trade finance in 2012 together with the systemic importance of trade finance are suggested by us below.

Which banks will join other major GCC and international banks in sponsoring initiatives to evidence their commitment to transparency and excellence in trade finance – for example, through the following and hopefully further initiatives?

- by grand-fathering the BPO offering to benefit importers and exporters on a meaningful scale in relation to import and export transactions

- adding their weight to that of the other major international banks building up the scarce empirical data on trade finance risk characteristics feeding into Basel III and other regulatory initiatives by sponsoring the ICC Banking Commission’s Trade Register

- joining multi-bank trade finance forums in the region to foster best practice and shared learning from experience in trade finance

- continuous improvement in trade finance training of the new emerging school of next generation local trade financiers in the region internationally certified and practitioner qualified

- delivering client solutions and forums to resolve the costly inefficiencies still inherent in trade flows and endemic to complex multi-party trade transactions

- utilising proprietary risk appetite and working with the region’s export credit agencies to address the multiple risks facing corporates and provide liquidity, risk mitigation and certainty of cashflow.

All of the key banks active in trade finance in the region (including QNB) will be measured by Cash&Trade publisher CMM in detail on an independent common carrier basis with other banks in the region on an on-going basis in their individual country Tajara Monitors. The resulting highlights will be published as they were in previous years (when, incidentally, QNB did not, contrary to market expectation, always top the Qatar Tajara Monitor league table and CMM openly voiced the lack of corporate client tolerance for complacency from its bankers).

CMM will be evolving this Spotlight series to provide insights to trade finance on an on-going basis and welcomes participation, suggestions and comments in this regards from corporates, banks, export credit agencies and market-infrastructure providers to this effect. n

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

One comment