In contrast to some other MENA economies, Saudi Arabia continues to have a positive balance of trade and growth momentum. CAROLINE MAGINN reports on what has been another record year

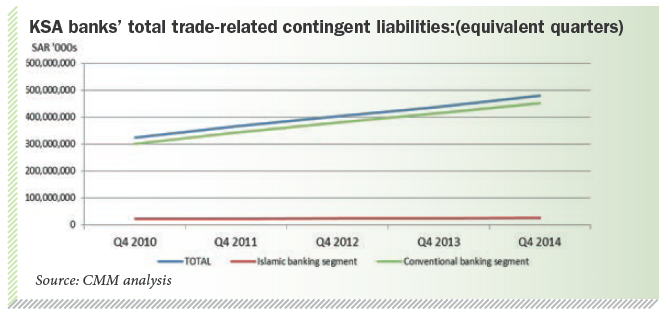

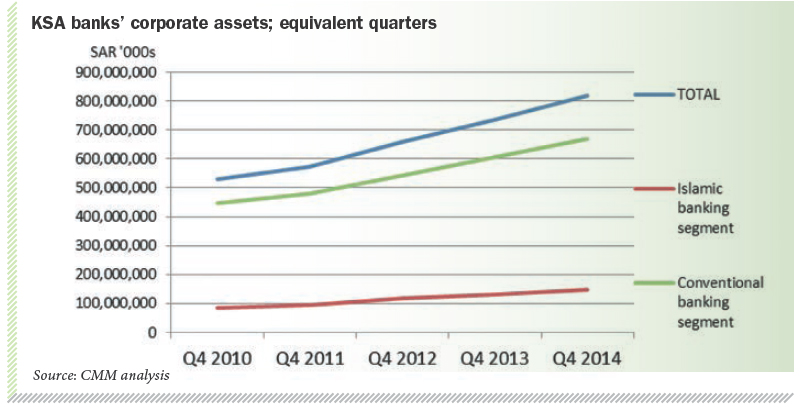

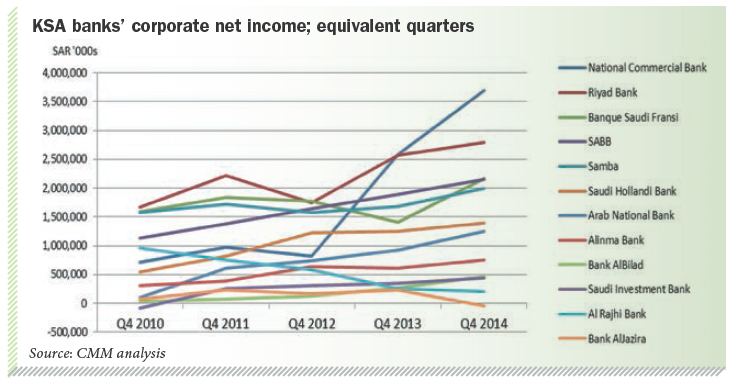

Trade finance and corporate banking in the KSA had another record year in 2014 with total trade-related contingent liabilities and corporate assets, liabilities, operating income and net income all registering new highs. It remains to be seen what effect the fall in the price of oil will have on these measures as it filters through and we will look with interest at the Q1 2015 figures as they are reported in the coming months.

Certainly the advances made in diversification, reflected in other industrial segments over the recent decade, the ongoing trade liquidity to these and infrastructure investments underway are critical systemic buffers for the long-term. The KSA continues to have a positive balance of trade and economic growth momentum in contrast to several other economies.

Total trade-related contingent liabilities for KSA banks ended 2014 on a continuing positive note driven by letters of guarantee, which, at SAR 369bn, rose on the year by 16.5 per cent and 4.2 per cent on the previous quarter. By contrast, letters of credit continued their downward trend from the Q1 2014 peak of SAR 100.5bn, and settled back to SAR 84.6bn in Q4 2014, off nearly 15 per cent from 2013.

At end of year 2014, Riyad Bank reinforced its position at the head of the KSA banks’ total trade-related contingent liabilities table with SAR 96.5bn; a year-on-year increase of SAR 11bn, up nearly 13 per cent on the previous year. This represents 20.05 per cent of the market and, with nearly a 3.5 per cent lead over its nearest rival, SABB, demonstrates market share dominance in this measure not seen since Q3 2008, when National Commercial Bank (currently third) led the table. Riyad Bank has more than doubled its provision of trade-related contingent liabilities since then (from SAR 47.8bn) against an overall market rise of 65 per cent.

All 12 banks posted gains on the year with the overall market up 9.5 per cent on 2013 at SAR 481bn. The Islamic market segment outperformed the conventional, up 14.31 per cent, albeit with all four banks at the lower end of the table.

Seven of the 12 banks showed double digit annual growth with Alinma Bank up 34 per cent after falling back in 2013.

Riyad Bank’s strong overall performance was underpinned by its letters of guarantee portfolio, which, at SAR 81.5bn, represents 22.08 per cent of the overall market of SAR 369bn, and a full SAR 20bn ahead of its nearest rival SABB, coming out at a 25 per cent annual increase on 2013.

All 12 banks reported record end-of-year figures in this category with the overall market up 16.53 per cent on the year. Nine of the 12 posted annual gains well into double-digits with notable increases made by Banque Saudi Fransi, in third place with SAR 58bn (+24 per cent), Saudi Hollandi Bank (7th, SAR 23bn + 19 per cent), Saudi Investment Bank (8th, SAR 23bn +19 per cent), Alinma Bank (10th, SAR 4.4bn +69 per cent) and, at the bottom of the table but narrowing the gap on those immediately above them, Bank AlBilad (12th, SAR 3.5bn, +24 per cent).

Corporate assets continued to rise throughout 2014 ending the year up 11 per cent at SAR 817bn. Eleven of the 12 showed growth in this measure (eight reporting double-digit increases). They were led by National Commercial Bank whose SAR 122bn represented 15 per cent of the market with Banque Saudi Fransi (SAR 106bn) and Samba (SAR 102bn) in second and third places respectively.

The contribution of the corporate segment to total assets remains solid at 39 per cent with Banque Saudi Fransi, Saudi Hollandi Bank and Alinma Bank each reporting a corporate contribution of more than 50 per cent.

Corporate liabilities made their largest ever outright annual increase in 2014, jumping by SAR 98.5bn to SAR 713bn +16 per cent on year end 2013. Eleven of the twelve banks showed increases in this regard with only Bank AlJazira posting a decline. National Commercial Bank again leads the way with a 23 per cent market share of SAR 164bn, recording a 22 per cent rise on the year. Riyad Bank (SAR 106.5bn) remained in second place followed by SABB, Samba and Banque Saudi Fransi. Arab National Bank, in sixth, on SAR 66bn, outperformed the market with a 29 per cent increase and lower down the table Saudi Investment Bank more than doubled its 2013 figure with SAR 12bn (although still far from their pre-segmental restructuring total of 2010). The 2014 year-end overall figure is more remarkable considering that seven of the 12 scored even higher in Q3 2014.

The contribution of the corporate segment to total liabilities is most notable at Riyad Bank, where they represent 59 per cent of their overall liabilities. The contribution is well over 40 per cent for eight of the twelve banks.

Corporate operating income again proved extremely robust and ended 2014 up 9.5 per cent at SAR 24.6bn. Again eleven banks posted increases with only Al Rajhi Bank showing attrition.

Seven banks posted in excess of SAR 2bn for the year. Arab National Bank and Saudi Hollandi Bank joined the SAR 2bn plus club comprising SABB, Banque Saudi Fransi and Samba with National Commercial Bank and Riyad Bank continuing to lead the way, both reporting corporate operating income of more than SAR 3.5bn.

Corporate net income enjoyed another record breaking year, up 23 per cent on 2013, at SAR 17bn. Four banks, National Commercial Bank, Riyad Bank, Banque Saudi Fransi and SABB, posted more than SAR 2bn for 2014, with Samba in fifth place on SAR 1.99bn.

National Commercial Bank was the clear leader with more than 21 per cent market share and a five per cent lead on its nearest rivals. Gains of more than 20 per cent on the year were commonplace throughout the table and seven banks posted in excess of SAR 1bn.

The corporate segment accounts for more than 50 per cent of total net profit for 6 of the twelve banks.

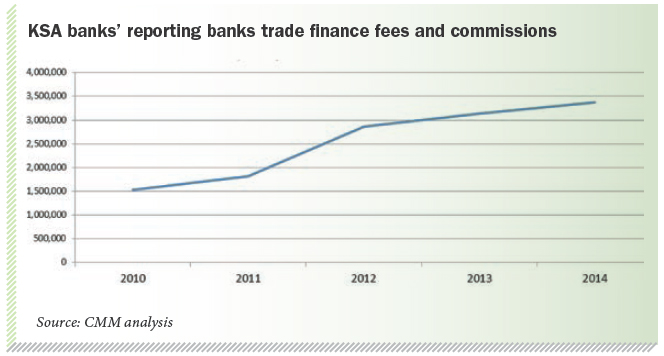

Underpinning the segment’s overall performance was the improved corporate purchase and sales activity in domestic and international trade. In a further reflection of this, trade finance fees and commissions continued their positive momentum in 2014 with a 7.5 per cent increase on the year to SAR 3.4bn.

SABB heads the table with just under SAR 900mln and a 26 per cent market share, 5.4 per cent ahead of its nearest rival National Commercial Bank; (Riyad Bank and Al Rajhi Bank do not differentiate trade finance fees and commissions in their current reporting).

All banks that do report separately posted increases on 2013 with the exception of NCB. Notable relative performances were seen by Saudi Hollandi Bank with a 32 per cent increase to just under SAR 350mln and further down the table by Alinma Bank (up 102 per cent to SAR 49mln). These two banks, together with Arab National Bank, Bank AlBilad and Bank AlJazira, have more than doubled their trade fees and commissions since 2010 with Saudi Investment Bank (+98 per cent) almost joining them as well.

The corporate segment is of primary importance in terms of each of assets, liabilities, operating income and net income for five banks: Banque Saudi Fransi, Riyad Bank, Samba, SABB and Saudi Hollandi Bank. Of the totals for the four discrete major business segments corporate banking contributes more than 40 per cent of total for assets, liabilities and net income.

The corporate segment has again demonstrated its resilience in terms of its primary importance regarding each of the key measures and the segment is continuing to demand more finely tuned granular trade finance offerings to support flexible finance, servicing and risk coverage needs for continued expansion of its operating capability, and competitive terms to buyers and suppliers both internationally and at home.

This is driving trade finance, innovation and evolution of risk appetite among the banks serving clients well to offer more flexible maturity spectrums for trade-related facilities and an enriched range of traditional and open-account products.

Facilities include those offered on a bi-lateral as well as a syndicated basis and more diverse risk-sharing tailored as appropriate for emerging industry and geographic flows.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East