The GCC Tajara Monitor series for the financial year 2013 is shortly being released beginning with the KSA analysis. The focus is to provide transparency on developments, trends and the financial and capital dimensions of the trade-finance market-place. CAROLINE MAGINN reviews the findings

The complex trade finance business proposition delivered by banks continues to evolve in an attempt to support corporates’ needs fully in the better handling of supply chain efficiency, tighter liquidity and risk management.

In the background, the still heavily materialised flows of information and paper continue to frustrate corporates abilities to manage liquidity and risks flowing from their buying and selling operations on the back of heavy investments internally in Enterprise Resource Planning systems (ERPs).

Banks seek innovative responses to respond to the perennial issues of the end-to-end automation of information flows at the transaction level on a day-to-day basis.

An increasing number of corporate clients made use of the local-evolving Export Credit Agencies (ECAs). Notably, this was in the year leading up to the Islamic Development Bank’s 50th anniversary. The pioneering pan-regional ECA is the Islamic Corporation for the Insurance of Investment and Export Credit “ICIEC”, which has been helping corporates manage cross-border political and credit risks since 1994.

KSA corporates, across an increasingly diverse range of industry segments, evolved their competitive positions, both domestically and internationally, and grew their collective working capital requirement. This growth was evident across the Eastern, Western and Central regions, and banks responded by releasing more liquidity to corporates market-wide.

This took a broad variety of shapes, including import LC refinance, inventory finance, supplier finance, contractor finance and pre-and post-export finance.

Banks’ liquidity relaxed in the KSA as it confirmed its position as a growth economy attracting fresh, long-term inward investment from Asia as well as some of the more traditional sources geographically.

A continuing fast dynamic was evident in terms of market share gains and losses between banks, as corporate clients continued to talk with their feet and shift trade relationship focus to the banks delivering service excellence and innovation.

CFOs and the trade finance teams of large-to-small-capitalised firms continue to grapple, on a daily basis, with the administration of their work-around solutions to extract the optimum value from available electronic and online banking offerings for trade but are looking for more. This is widely perceived as a “valued enabler” to resolve on a revolving basis their potentially problematic collection flows and to protect their shareholders’ trade and financial capital.

That said, there were strides made by several banks in the KSA trade finance and corporate banking business segment. National Commercial Bank took first position in corporate assets, liabilities, operating income and net income whilst Riyad Bank regained the top of the trade-related contingent liabilities table.

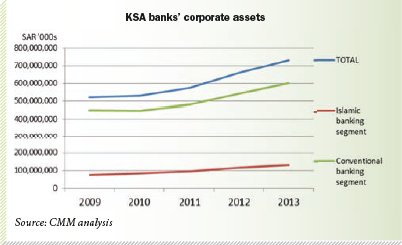

As mentioned, NCB took over at the top of the corporate assets table and in so-doing became the first KSA bank to post more than SAR 100bn in assets for this business segment. The overall market total leapt by 11 per cent to SAR 732bn. Whereas 2012 saw Banque Saudi Fransi lead the way as the first KSA bank to breach the SAR 90bn mark, 2013 saw four banks,(Riyad Bank and Samba joining the aforementioned) in comfortably surpassing this mark.

All 12 banks made gains in this area with the Islamic banking segment narrowly outperforming the conventional, albeit largely at the lower end in terms of outright value. Apart from the top two, positions remained unaltered from the previous year but market share gains were evident both at the top and the foot of the table with the mid-table seeing some erosion.

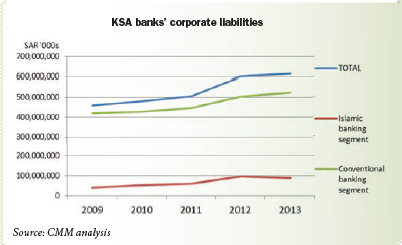

Corporate liabilities continued to grow in 2013 versus 2012, reflecting corporate success in meeting rising domestic demand and establishing international competitiveness. Whilst off the peak of SAR 624bn set in Q3 2013, they settled comfortably higher at year-end, up 2.13 per cent at SAR 613bn. NCB increased its dominance in this area, gaining nearly two percentage points of market share to 21.63 per cent with SAR 132.6bn.

An increasing number of top tier trade banks invested in integrating treasury, cash management and trade solutions. This gathered pace in response to long-standing corporate demand. A growing pool of corporate trade liquidity on corporate commercial success was spread amongst conventional and Islamic banks. Examples included NCB, SABB, Saudi Hollandi Bank and Bank AlJazira.

Although overall positions remained largely unchanged on the year, apart from SABB and Banque Saudi Fransi swapping places in fourth and fifth, there was considerable jostling for market share with five banks seeing double-digit gains and four banks suffering double-digit attrition to outright values on the year.

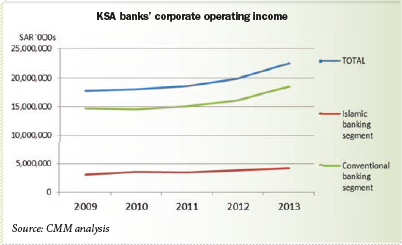

NCB also performed very strongly in terms of corporate operating income, leaping from fifth position in 2012 to lead the way for 2013. Both it and Riyad Bank became the first two KSA banks to surpass the SAR 3bn mark for the year. There are now nine KSA banks whose operating income for this business segment exceeds SAR 1bn.

The overall market total rose, year-on-year, by 13.4 per cent to SAR 22.6bn, with 11 of the 12 banks reporting increases (six of them, including NCB at the top and Arab National Bank, Saudi Hollandi Bank, Alinma Bank, Bank AlBilad and Bank AlJazira lower down the table, with double-digit growth).

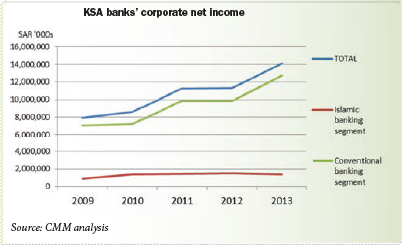

Benefitting from very strong corporate operating income and reduced operating expenses and impairment charges, NCB more than quadrupled its corporate net income, narrowly taking first position in the table with SAR 2.6bn.

The overall market total rose by more than 24 per cent, year-on-year, to in excess of SAR 14bn. Nine of the 12 banks reported increases with some notable relative performances throughout the table. Half of the 12 banks posted comfortably in excess of SAR 1.3bn of net income for the corporate business segment.

At the heart of the corporate working capital proposition, trade finance grew again for a record year in 2013. Corporates and banks evolved their debate on how they could partner more effectively to support the individual corporate bottom line and more generally the KSA’s economic prosperity.

On the competency and skills pool front, banks continued to varying degrees to invest in developing their internal staff training and corporate client training programmes and made some considered trade finance staff appointments to build on local grown skills and experience following the lead shown by corporates and the wider advice in the market.

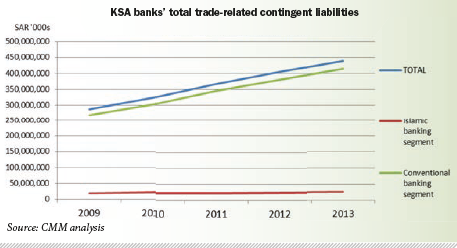

Having surpassed the SAR 400bn mark in 2012, total trade-related contingent liabilities for the KSA banks continued their strong rise in 2013, ending the year at SAR 439.5bn, an annual increase of nearly nine per cent.

This was largely on the back of a 10.5 per cent increase in letters of guarantee which, themselves, accounted for SAR 317bn of the total. Letters of credit continue to hover around the SAR 100bn mark, which was breached in Q1 2013, settling at SAR 99.5 at year end, up 5.8 per cent on the 2012 figure.

Riyad Bank re-established itself as the market leader with a record SAR 85bn in total reported trade-related contingent liabilities, up 19.5 per cent on year-end 2012. Nine of the 12 banks reported increases with seven of those reporting double-digit growth (including some very strong relative performances at the lower end of the table from Saudi Investment Bank, Bank AlJazira and Bank AlBilad, which each saw annual increases of well over 20 per cent). Banque Saudi Fransi also consolidated its fourth placed position with a 17 per cent increase to SAR 66bn, closing the gap on the top three.

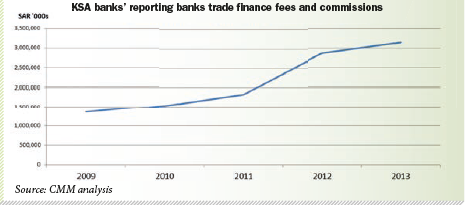

Ten of the 12 KSA banks now report distinct figures for trade finance related fees and commissions with NCB posting figures for 2013 and retrospectively for 2012. The total now exceeds SAR 3bn with six KSA banks reporting comfortably over SAR 250m. SABB still leads the way with SAR 834million with NCB second at SAR 720m. The annual increase was 9.4 per cent with nine of the 10 showing growing revenues.

The provisional figures produced by the Central Department of Statistics and Information, and published by SAMA show that total KSA trade for 2013 was steady, at SAR 2.04trillion, with an eight per cent increase in imports (CIF) to SAR 631bn compensating for a three per cent drop in the value of exports to SAR 1.4trillion.

Chemicals, plastics, re-exports and base metals exports each increased year-on-year but could not make up the shortfall of decreases in value terms in mineral products, foodstuffs, electrics and other exports.

In the full Tajara Monitor reports CMM analyses the relative importance of corporate banking and trends and market-shares of banks’ corporate assets, liabilities, total operating income and net income, and trade contingent liabilities amongst many other corporate banking and trade finance benchmarking statistics across the GCC. The reports refer to supporting data and compares each quarter to its equivalent, where available, in the preceding years and also the past five quarters where appropriate. It also analyses available data on import and export letters of credit both by geography and industry.

The full version of the CMM KSA Tajara Monitor is available via subscription from Cash Management Matters as are those Monitors covering the UAE and other GCC countries.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East