By CAROLINE MAGINN – Trade Partner at Cash Management Matters

caroline.maginn@cashmanagementmatters.com

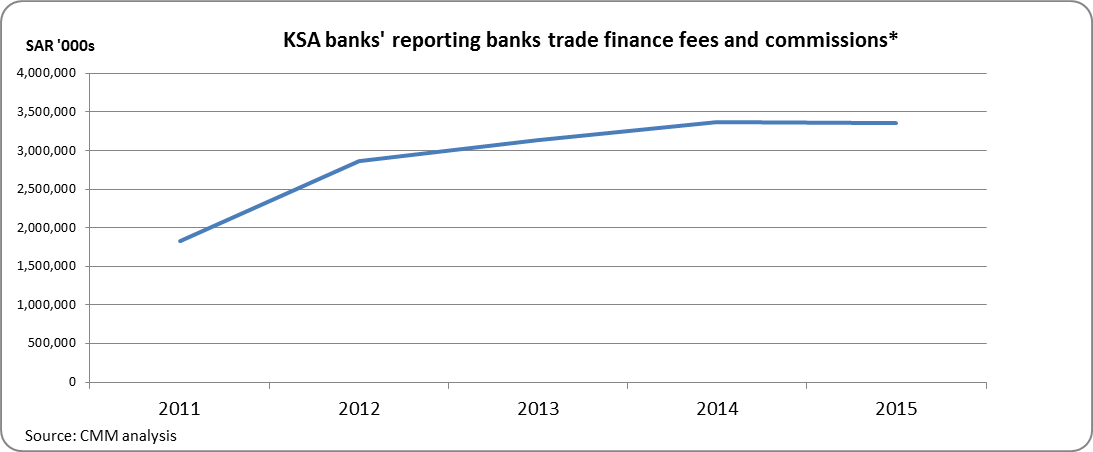

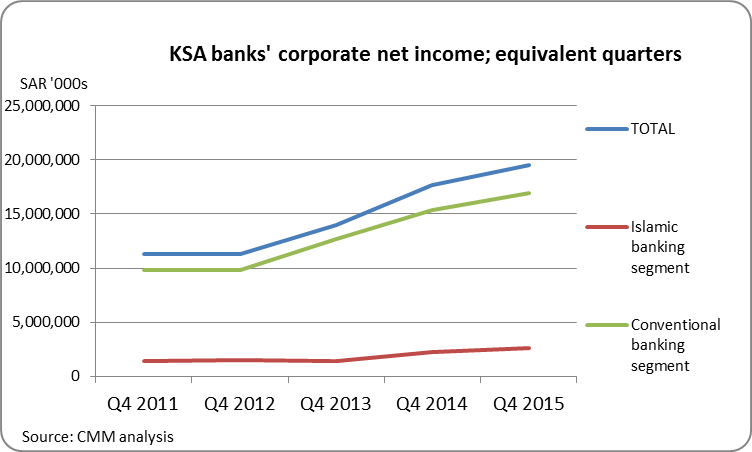

The rising focus on Trade finance has contributed positively to banks’ portfolios, earnings and risk weighting stability. Since the financial crisis KSA Banks have notably enjoyed unparalleled growth and continuous contributions to reserves and current strong levels of capitalisation from trade finance. In blunt terms Trade finance has accounted for SAR 60 billion to the twelve KSA reporting banks between 2011 and 2015. To-date Banks have been stalwart in their prioritisation and support of continuing trade liquidity but that is not to say their resilience has not and is not being tested.

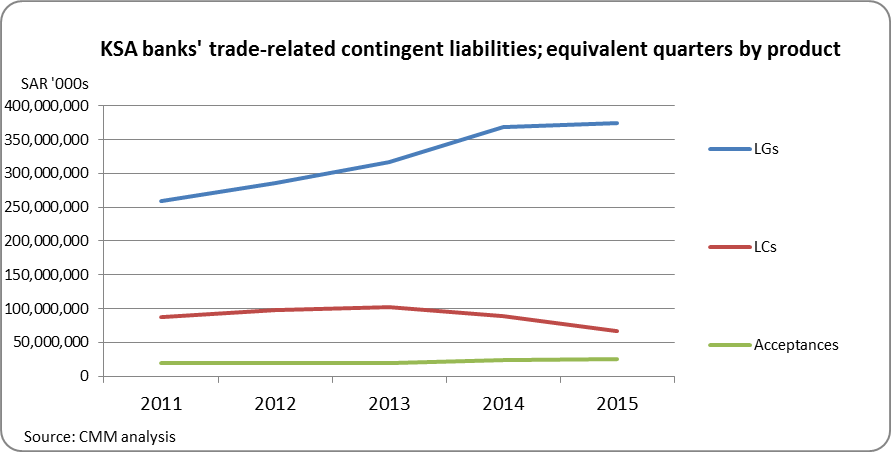

Although, total trade-related contingent liabilities for KSA banks where down marginally, year-on-year by 3% to SAR 466bn from Q4 2014’s SAR 481bn, Letters of guarantee actually proved to be resilient and showed an increase year-on-year, if off the peaks seen during the year.

There were several positive year-on-year trade finance trends among banks in terms of absolute values of their trade portfolios. SABB, SAMBA, Saudi Hollandi Bank, Alinma Bank and Bank AlJazira all reported overall annual increases in Q4 2015.

Five banks report total trade-related contingent liabilities consistently over SAR 50bn and in terms of earnings six banks reported trade finance fees and commissions of over SAR 300 million. This reflects a marked upward shift in the quantum of non interest rate sensitive earnings for KSA Banks.

Current market events present unparalleled conditions for today’s Corporate and Trade Financiers in MENA. That said the increased level of expertise, operational capacity, more adept trade product management tools have positioned them better to tackle the current challenges. All trade finance practitioners in the region understand the importance of continued and well-structured trade liquidity solutions for the private and public sector in these challenging times and beyond.

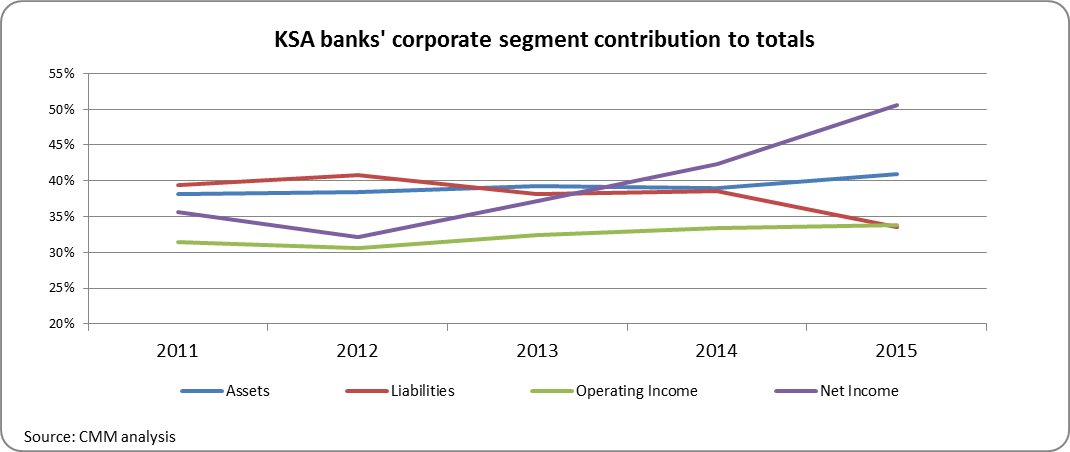

The Corporate Segment is vital to economic, financial and political posterity in the KSA and Trade Finance is a major driver of the segment’s operating turnover, 3flexibility and efficiency. Accordingly, it remains very much at the centre of plate for banks with trade finance as a continuing key driver.

The ongoing high compliance requirement on banks is underpinned most efficiently when institutional and or retail flows are linked with the corporate payment chains and trade finance fintech is deployed well. This can involve the linkage of payments to any related trade transactions. By identifying these linkages, the underlying payment drivers are searchable, referenceable and quantifiable through advances in Trade IT.

Further Trade product intermediated flows are identifiable through bidding, tender, performance payment and collection processes and ostensibly historic cash flow and balance sheet entries. Such exercises can be called for on a systemic or sporadic random basis whether by local or international bodies. This may be one of the become one answer to the rising debate about what the internet of things represents for transaction banking and trade.

It should be no surprise then that ongoing due diligence responsibilities naturally devolve to the Trade Product Management and Operations Units as a consequence of this. Certainly the current market volatility will place additional demands on Trade Finance Product teams to anchor and mitigate their extensions of liquidity accordingly with apposite levels of due diligence.

Banks whilst having maintained upward overall and corporate operating and net income for 2015 and corporate asset levels are bracing themselves for new waves of delinquencies in the fall-out of lower oil prices. Encouragingly already in 2016, KSA banks have continued to take up more prominent lead positions in trade driven project and syndicated financings. This will be a more significant contributor to bank earnings for the medium term at the relevant banks and boost their cross-sell synergies with non interest sensitive fees and commissions businesses.

Downsizing ongoing or recent investments in capacity would be untimely and jeopardise long term client relationships, portfolio risk balancing and future non rate sensitive core earnings.

As KSA export growth has been targeted and supported by the government and multi-laterals in recent years, GCC ECA and multi-lateral agency activity has risen. Their support and co-sponsorship of ongoing trade finance transactions provided by banks will add depth and confidence to primary market liquidity but also command investment and product structuring from banks and the need to boost Client awareness and skills underscoring again the need to maintain investment levels in Trade. It is also imperative to support the competitiveness of KSA and other exporters particularly in light of credit rating volatility.

Additionally, Banks have been leveraging their proprietary appetite through GCC ECA partnerships for short term trade and project finance. Risk sharing with multi-laterals will be increasingly important to KSA Trade Banks in the near term.

Such co-sponsorship programmes for long to short term trade finance assumes or will demand investment in appropriate trade credit programmes and process ownership by the Trade Product Management Champions. The reliable performance of this extra layer of liquidity relies on end to end product process management from policy establishment, approval, renewal and claims and recovery processes and appropriate training and lines of responsibility de-lineation with corporates and FIs.

Hence all is not at all gloomy. The fundamentals of the KSA domestic market-place, role in regional and international markets has changed irreversibly. It is a leading force in several industry segments apart from Minerals and is continuing with diversification whether in food, energy, specialty chemicals, pharmaceuticals, farming, rubber, metals or auto-parts. At CMM we will be continuing to monitor all market developments and contribute to the ongoing debates to create awareness and effective innovation in and regulation for Trade Finance.

It is worth underscoring that GCC markets broadly acted to normalise and stabilise post 2009 capital and trade flows with for example KSA Banks increasing their provision of trade liquidity and playing a significant role locally and internationally as a regulator through their position on the Basel Committee inter alia.

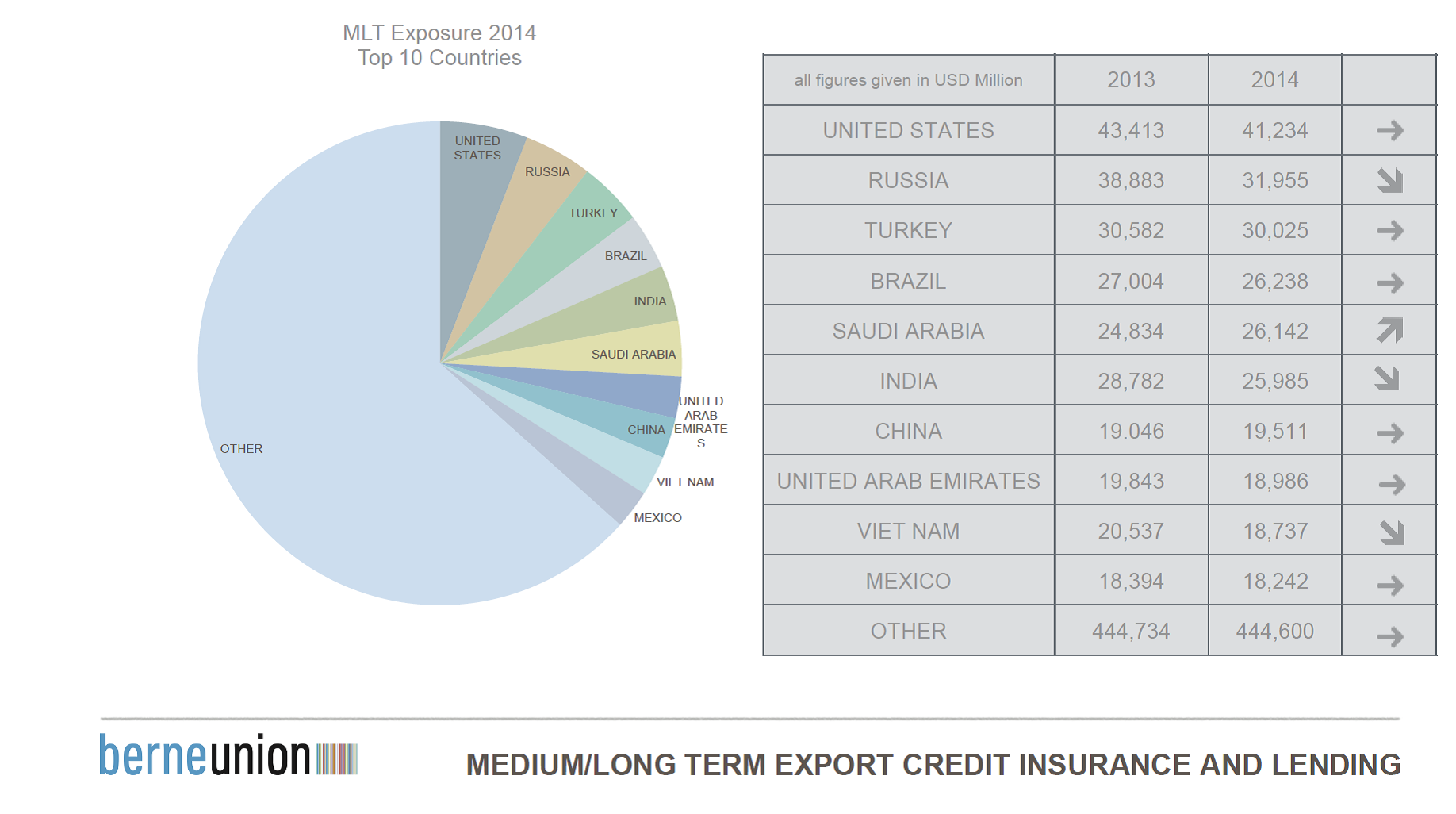

Hindsight of other extreme cycles of events in global and regional affairs has repeatedly suggested that Countries who focussed on trading their way through difficult periods reaped the benefit. Strong mutually beneficial trade value added opportunities should continue to attract local and international multilateral and ECA support to The KSA. Saudi Arabia attracted strong support from Berne Union Members globally in the past for medium term transactions registering as the fifth largest country exposure in 2014. Continued even handedness and reflection of its claims payment track record should stand its exporters and importers in good stead for the future.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East