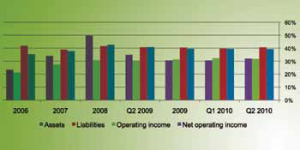

In broad terms, corporate banking remained a prime business segment for banks within Saudi Arabia, whether measured as a percentage of assets, liabilities or operating and net income, writes. CAROLINE MAGINN, Cash Management Matters – CMM trade partner

As global trade continues to recover banks are playing an important role in financing it. They are providing a range of traditional instruments, such as letters of credit, as well as a variety of new and enhanced product offerings. Even for companies trading on open account, banks are becoming increasingly important providers of supporting finance and risk mitigation techniques.

Corporate banking is the No 1 business segment for many banks within the KSA , ahead of retail, treasury and investment banking and brokerage.

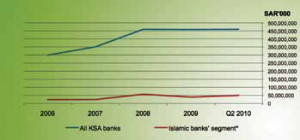

Overall, for Q2 2010, corporate banking accounts for 40 per cent of each of total assets and liabilities and 32 per cent of total operating and net income. Corporate operating income continues to show signs of growth seen in Q1 2010 and is up by five per cent on the same period last year.

Corporate net income continues to be depressed this quarter by impairment charges, which rose to SAR 3.2bn, up from SAR 2.1bn for the first half in 2009.

Under SA MA’s active supervision, banks remain well capitalised to absorb these charges with strong total capital ratios ranging upwards as they do of 13.60 per cent. Where rated by external credit assessment institutions, they continue to enjoy investment grade long and short-term ratings with a stable outlook. Trade continues to be a lead product for banks serving corporates, equating as it does to in excess of 50 per cent of total corporate assets. All in all, banks’ commitment to trade increased, if modestly, in Q2 2010 over Q1 2010, year-end 2009 and Q2 2009.

This demonstrates that trade is a core need of corporates in the market place and that banks continue to have appetite to support trade even during these times of credit tightening.

Corporate net income continues to be depressed this quarter by impairment charges, which rose to SAR 3.2bn, up from SAR 2.1bn for the first half in 2009.

Under SAMA’s active supervision, banks remain well capitalised to absorb these charges with strong total capital ratios ranging upwards as they do of 13.60 per cent. Where rated by external credit assessment institutions, they continue to enjoy investment grade long and short-term ratings with a stable outlook.

Trade continues to be a lead product for banks serving

Corporate assets

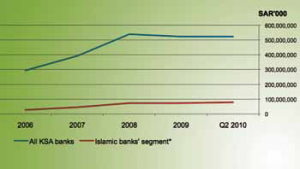

Corporate asset levels held firm at a total of SAR 522bn at the end of the quarter; flat with Q1 2010. Riyad Bank continued to top the league table whilst National Commercial Bank switched places with SAMBA to gain third from fourth position.

During this period the Islamic segment of the market grew from SAR 76bn to just over SAR 79bn demonstrating growth of five per cent. Alinma Bank drove the growth in this segment by more than doubling its corporate asset level to SAR 8bn.

The market in corporate liabilities grew to SAR 460bn showing growth of two per cent over Q1 2010 whilst remaining broadly flat to year-end 2009 and Q2 2009.

Riyad Bank continued to lead the league table although its corporate liabilities level shrank to SAR 88bn.

As with assets, the Islamic segment was driving growth in the overall market and now accounts for SAR 50bn showing double-digit growth of 11 per cent quarter on quarter in an otherwise flat market. Al Rajhi Bank moved up the league table from seventh to fifth position taking over from Arab National Bank. Alinma Bank switched positions with Bank Al Jazira at the bottom end of the table moving up to 11th position.

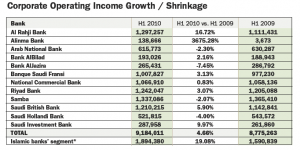

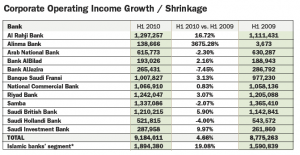

Encouraging signs were evident in the earnings trajectory as overall corporate operating income grew by five per cent over the same period last year to more than SAR 9bn notwithstanding tight market conditions.

The Islamic segment – if still relatively small – outperformed the market showing strong double-digit growth of 19 per cent compared to Q2 2009.

The bulge bracket of KSA banks reporting more than SAR 1bn in first half corporate operating income grew to six banks from five in the preceding year. The same banks dominated the top of the league table although there were some position changes amongst them.

Corporate net operating income

Overall net income was down to SAR 4.6bn at the end of Q2 2010 from SAR 5.3bn in the preceding year reflecting higher provisions for impairments. The top five positions in the league table were held by the same banks: SA MBA, Riyad Bank, Banque Saudi Fransi, Saudi British Bank and Al Rajhi Bank. Of these all four bar Riyad Bank recorded growth year on year.

Six out of the 12 banks reported growth year on year, most notably Saudi Hollandi Bank and Al Rajhi Bank.

The importance of the corporate segment to overall profitability is highest for Saudi Hollandi Bank and for many banks the segment accounts for in excess of 50 per cent of total profitability.

The Islamic segment was buoyed largely by Al Rajhi Bank’s performance

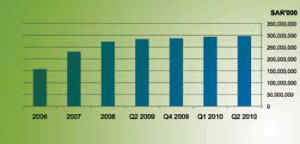

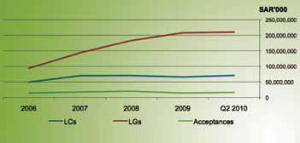

Trade rallied well during the period showing growth, albeit modest, over each of Q1 2010, year-end 2009 and Q2 2009, and now accounts for total contingent liabilities of SAR 297bn. This underscores both the importance of trade related services to corporates and also the KSA banks appetite to support trade related finance.

The top four banks remain unchanged in their lead positions, each accounting for more than SAR 40bn of trade related items. Of these banks all bar The National Commercial Bank recorded growth in capital committed to support trade. Most movement took place in the letter of credit league table, where SA BB, and even more markedly Riyad Bank, grew their market share.

The top three trade banks account for in excess of 50 per cent of the total market whilst the top five banks account for close to 80 per cent thereof. Letters of guarantee continue to be the No. 1 trade instrument accounting as they do for approximately 70% of total trade contingent liabilities.

close to 80 per cent thereof. Letters of guarantee continue to be the No. 1 trade instrument accounting as they do for approximately 70% of total trade contingent liabilities.

Islamic Segment continues to develop substance

The Islamic segment of the market recorded an almost flat position for the quarter at SAR 20bn but up from SAR 19bn at year-end 2009. This continues the momentum in the segment overall which has both grown in terms of size, market share and number of players since 2006 when it had a value of under SAR 8bn and a market share of 5%.

Alinma Bank posted the strongest growth quarter on quarter in Q2 2010 with total trade reaching SAR 3bn and flipped positions with Bank Al Jazira Bank to move off the bottom of the league table. This was a strong performance from the newest entrant in the trade finance arena.

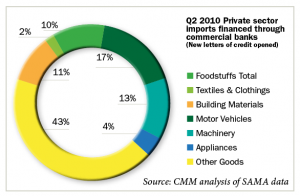

Private sector imports financed through commercial banks (new letters of credit opened)

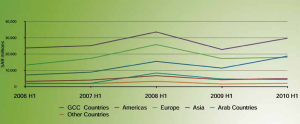

Overall, the level of imports financed was up on the equivalent period in 2009 if not yet recovered to the level in 2008 and is flat with the performance in Q1 2010. Motor vehicles continued to build on their Q1 performance and outperformed the equivalent periods in both 2009 and 2008. Outside of the other goods category motor vehicles, machinery and building materials are the dominant categories.

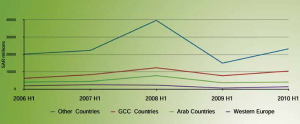

In terms of geography, Asia, the GCC and Europe are the dominant trading partners with the GCC overtaking Europe this quarter emphasising its rising importance in trade finance.

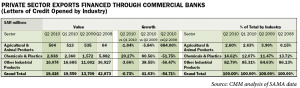

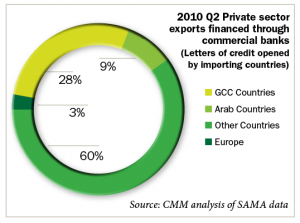

Private Sector Exports Financed through Commercial Banks (Letters of Credit Opened)

Export activity was flat with Q1 this year whilst showing recovery from the equivalent period in 2009 although not yet recovered to the level of 2008.

Outside of the broad other goods category chemicals and plastics is the most significant identifiable sector.

In terms of geography, Asia which is included in other countries continues to dominate the export flows but it is worthy of note that it is the GCC partners who are the second most important and have shown the most positive momentum this quarter. In general terms, they are closest to rebounding to the export peak in 2008.

The full Tajara Q2 2010 report is available by subscription and enquiries should be made to the Editor at editor@cashandtrademagazine.com

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East