Trade finance income has risen in the UAE thanks to a resurgence of exports and imports. CAROLINE MAGINN, trade partner at CMM, looks at what has been a most impressive performance from the banking sector

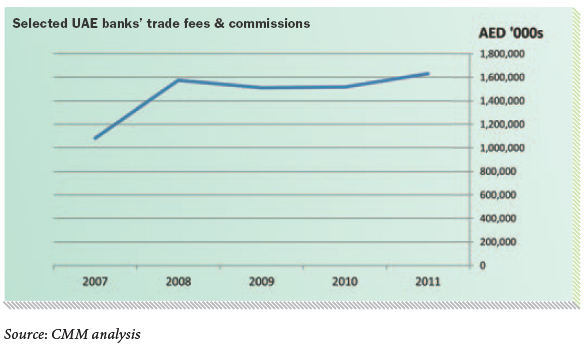

With a majority of reporting banks posting figures far in excess of AED 100 million, trade fees and commissions rose by an average of seven per cent, in 2011 in the UAE. Several banks engaged in the crucial sector of trade finance were rewarded for their continued efforts and innovations, by showing double-digit increases on the previous year. The sector’s contribution is even more impressive, as illustrated in the latest UAE Tajara Monitor, published by Cash Management Matters (CMM), when set against an overall decrease, of some five per cent year-on-year, in total bank fees and commissions.

As part of its aim to create transparency in the corporate banking and trade finance market-place and to improve the UAE’S statistical capacity, CMM publishes the UAE Tajara Monitor. This full-year report for 2011 may be updated each quarter during 2012 as interim reports are published by the banks, the Central Bank of the UAE and the UAE National Bureau of Statistics. Currently, CMM analyses the trade finance and corporate banking performance of 12 major locally incorporated banks, which are licensed entities with the Central Bank of the UAE.

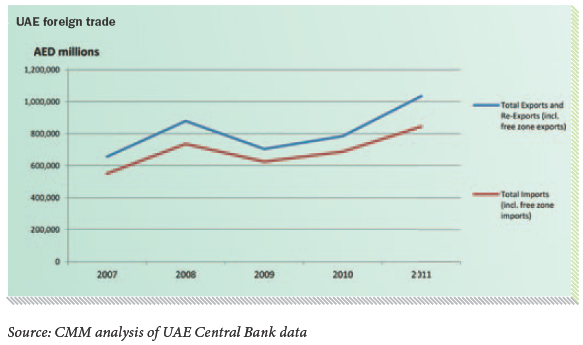

Against continued global market uncertainty, UAE foreign trade grew substantially, in 2011, with imports, non-oil exports and re-exports each registering double-digit growth. Total exports, including re-exports, closed the year up 32% at over AED 1 trillion, and nearly 18% above their recent peak of 2008. Imports increased by 23% in 2011 from the previous year, and, at AED 844bn, represent a 15% increase over their 2008 peak.

Whilst banks were cautious against the backdrop of uncertainties, the on-going re-structuring of Government Related Entities and credit provisions, they grew their lending to trade related economic activities by five per cent to AED 446 billion in 2011. This underscores the confidence in, and stability of, the fundamentals when it comes to corporate banking and trade finance and reflects a welcome upturn in lending against trade-related economic activities which rose by five per cent year-on-year.

Against this backdrop of trade growth, lending to trade related sectors grew. The Construction sector, at AED 116 billion accounting for 26 per cent, was the lead sector followed by Trade at AED 105 billion, accounting for 24 per cent, Government at AED 102 billion, accounting for 23 per cent and Manufacturing at AED 45 billion, accounting for 10 per cent.

Mining and Quarrying followed by Electricity, Gas and Water and then Trade showed the biggest increases reflecting the increased infrastructure investment set to continue in 2012 and a general recovery in Trade.

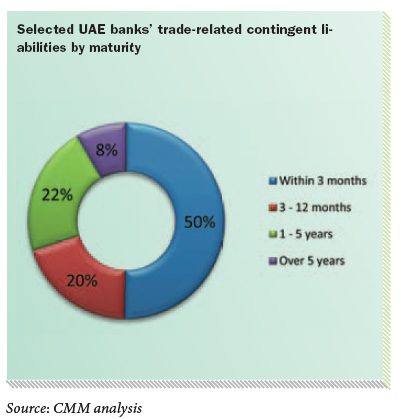

Additionally, trade finance continues to be dominated by the shorter tenors, with transactions within 12 months making up 70% of the total portfolio; justifying its preferential treatment for capital allocation and credit approval purposes.

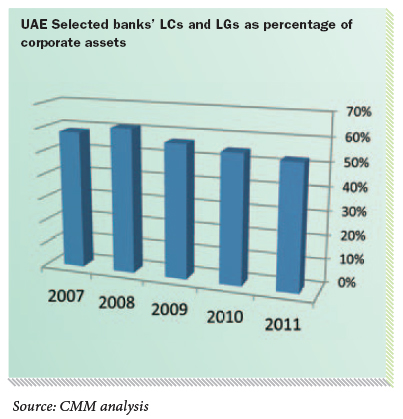

During this period the level of bank intermediation in trade remained broadly constant at above 25% when measured purely on the basis of letters of credit and guarantees. This is significantly higher when trade related finance, cash management and trade finance are taken in to account. Against this backdrop, trade finance levels were broadly maintained despite market turmoil and continued its strong positive trajectory at above AED 460bn since 2008. It is not anticipated that demand will decrease in the near term. The challenge will be for the banks to retain their confidence in, and commitment to, the provision of the needed levels of trade liquidity, service excellence and product innovation.

The growth in 2011 was almost entirely at the shorter end of the spectrum. In the within 3 months band the market grew from AED 93bn in 2010 to AED 106bn in 2011, whilst in the 3-12 months band it grew from AED 37bn to AED 42bn.

At the longer end of the maturity range there was shrinkage in the 1-5 years range in 2011 whilst in the above 5 year range there was a marginal increase. These parts of the tenor spectrum are vital for medium term capex imports and infrastructure projects and can be expected to grow further in the medium term.

Trade finance continues to be a lead product and the largely trade-related contingent liabilities equated consistently above 50 per cent of corporate assets in 2011 for the banks tracked.

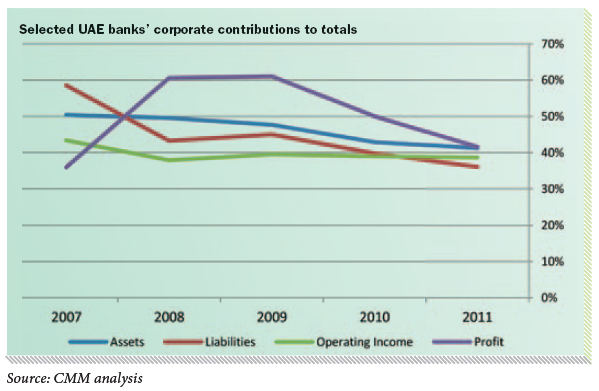

Similarly, the corporate banking segment underlined its continued systemic importance accounting for, in the region of, 40 per cent of total assets, liabilities, operating income and net profit.

During continued global market uncertainty corporate banking remained a prime business segment to banks within the UAE; when measured as a percentage of assets, liabilities, operating and net operating income. It is the number one business segment for nine out of the twelve leading banks on which we focus in The UAE Tajara Monitor ahead of retail, treasury and investment banking and brokerage.

The overall stable trends in the corporate segment contribution, together with trade finance discussed in more detail elsewhere in the report, continue to place pressure on banks to maximize and improve their integrated treasury, cash management and trade finance offerings. A growing number of banks are putting Global Transaction Banking Services or Working Capital Units in place to address different aspects of the corporate supply chain finance requirement.

The UAE Tajara report includes the headline CMM Corporate Banking and Trade Finance League Table, based on the individual banks’ performances over a range of relevant sub-sectors.

National Bank of Abu Dhabi continues to top the overall table, as it has done since 2008, but the competition is making inroads into its lead. Indeed, from top to bottom, there has been movement in terms of market share, as would be expected in such an important and competitive banking sector.

As the market-share dynamics in 2011 demonstrated, UAE corporates are not complacent when it comes to switching provider

It is very important that banks continue to engage actively in their support of corporate banking and trade finance in the Emirates and that they do so in a transparent manner.

Without the roles played by locally incorporated and foreign banks in UAE trade finance, which are facilitated by the ICC, there would be a real risk of disruption in the supply and exchange of goods and the associated financial cycle.

The UAE economy has, for a long time, been underpinned by export promotion and, according to His Excellency Obaid Al Tayer, the Minister of State for Financial Affairs, trade finance is the next most important item on the economic agenda after the Comprehensive Financial Policy for Stability.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East