20th May, 2013

- 2013 Invesco Middle East Asset Management Study

- ‘South-South’ trade in action – local investment opportunities drive Indian, Russian and Chinese capital into UAE

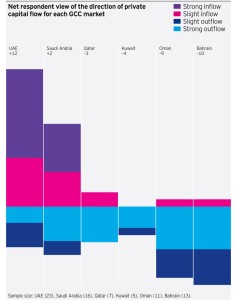

The United Arab Emirates (UAE) is the key beneficiary of private capital flow into the Gulf Cooperation Council (GCC) region, according to the fourth annual Invesco Middle East Asset Management Study1, with capital from emerging markets, most notably from India, Russia and China, overtaking those from developed markets (see heat map below). Invesco opened its Dubai office in 2005, and has been working with GCC clients for decades, offering financial institutions and investment professionals access to global investment expertise.

The in-depth study, which looks at the evolving asset management industry in the GCC, shows that participants2 estimate that just under half (43%) of private capital flow entering the UAE is from emerging markets

including 15% from India, 10% from Russia, and 7% from China. Just 13% of private capital is flowing in from across all developed markets including UK, Continental Europe and North America. Furthermore, just over a third (35%) of capital into the UAE is actually coming from the wider MENA region and 9% from the other GCC countries.

While capital is flowing into the UAE, overall capital in remaining GCC markets including Bahrain, Oman, Kuwait and Qatar appears to be exiting home markets, making the UAE the key focus for capital flowing into the region [see Figure 1].

Global heat map showing participant estimates of private capital flowing into the UAE from international markets

This inflow trend is supported by national statistics that highlight a 9% net increase in UAE bank deposits during 2012, and a 17% annualized growth rate in UAE property prices over the same period, both indicators of increasing capital flow. [See Figure 2]

Before the financial crisis, the UAE saw leveraged capital (such as properties bought with mortgages) coming in from developed markets, but the picture painted by respondents in 2013 suggests non-leveraged capital (such as properties bought with cash) is now flowing in from regional and emerging markets.

Key drivers of private capital flow into the UAE

There are two main drivers of capital flow into the UAE: the first, according to a third (33%) of participants, is its relative political stability compared to the MENA region [see Figure 3]. This is a consequence of continued regional instability – not just in Syria but also in Egypt and other parts of North Africa as well as select GCC countries – influencing decisions on where to invest capital.

The second driver for 29% of participants is the local investment opportunity. This is the overriding reason for Indian, Russian and Chinese markets investing in the region – an example of ‘South-South’ trade in action.

Nick Tolchard, Head of Invesco Middle East commented: “Our 2013 study provides a strong indication of a structural shift in the UAE’s fortunes. It seems to be showing signs of developing a leading position as a regional hub between Europe and Asia. As an investment centre, the UAE has been proactive in attempting to build relationships and encourage investment from emerging markets so these inflows could also be indicative of UAE policy rather than simply emerging markets seizing the opportunity. This re-balancing has been important to the UAE recovery, as developed markets continue to focus on the economic situation closer to home.”

Nick Tolchard concluded: “Despite positive momentum on capital flow, the UAE’s economic climate is ever evolving and a number of Dubai’s economic challenges remain in the spotlight, certainly around debt restructuring as 2014 approaches. Whether or not the recovery continues into this year and beyond is near on impossible to predict, but what is clear from the study is that the UAE has been successful in attracting international capital.”

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East