Top bankers from across the region came together at iGTB’s second annual client advisory event in Dubai, to discuss transaction banking throughout the Middle East and to address issues arising from the low oil price, drop in confidence, increased competition and heightened need for technological innovation

Top bankers from across the region came together at iGTB’s second annual client advisory event in Dubai, to discuss transaction banking throughout the Middle East and to address issues arising from the low oil price, drop in confidence, increased competition and heightened need for technological innovation

Following a highly unusual year for the Middle East, characterised by prolonged low oil prices, February saw industry players return for iGTB’s second annual event in Dubai, to share their experiences and discuss the obstacles faced. Senior bankers from Jordan, Kuwait, Qatar, the UAE and as far as Kenya came together to engage with each other – as well as technology experts, corporate executives and specialist media – in frank dialogue about regional and global bank challenges and developments.

Attendees were more cautious in their regional outlook than at iGTB’s previous client advisory event in the region – understandably so given the further slump in oil prices and other market trends – but seized the opportunity for open debate with peers for intra- and inter-regional knowledge-sharing.

The overwhelming consensus was that the region was sorely lacking in such communal discussion and co-ordination, with the most recent collective project being SWIFT. In addition to encouraging conversation between banks, the event included an engaging client’s-eye view of treasury concerns and triumphs.

State of the Nations

The day started with Tim Fox, Head of Research & Chief Economist, Global Markets & Treasury, Emirates NBD, sharing his detailed view of the economic and financial outlook for the region. Clearly, the ongoing global picture is complex, with oil prices an ongoing threat for deflationary pressures. While in previous periods low oil prices would have been considered clearly positive for global growth, the persistence of low yet volatile prices is more ambiguous – especially for the Middle East.

Fox sees the current oil prices as being driven more by supply than demand – but also posited that sentiment had a heavy hand. As such, prices will continue to be highly volatile throughout the year, ranging across a wide spread from USD$20 to USD$60. Nonetheless, Fox believes that in the longer term the OPEC approach of increasing production will work and fundamentals will reassert, with high-cost producers forced to cut back – resulting in lowered supply driving up prices. Yet spare capacity in the oil market is tight and, if demand continues to increase in response to low prices, the snapback could be sharper than anticipated.

So what does this mean for economies in this region? Oil prices’ biggest effect on growth is affected through changes in both oil production and government spending and the consequential shifts in sentiment. While increased oil production in the region is contributing positively to growth, reduced government revenues have meant reduced spending.

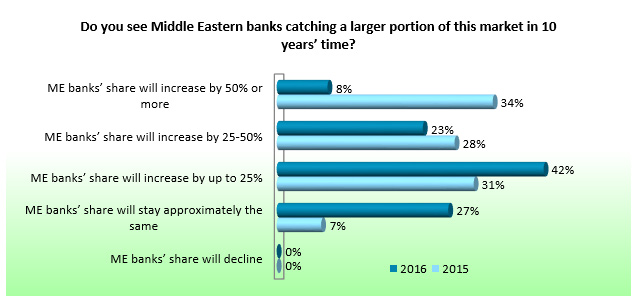

Of course, since the event, Dubai has experienced the first contraction of its non-oil private sector economy since 2009 – a strong indicator of its overall economic condition. It is not surprising then that attendees were a little less upbeat than last year about Middle East banks’ chances of winning a larger share of total global transaction banking revenues, predicted to rise to half-a-trillion US dollars by 2021, although nearly three quarters of those asked (73%) still believe that Middle East banks are set to capture a larger share of this market (down from 93% last year). In 2015, 62% of attendees thought that ME banks would increase their share of transaction banking revenues by 25% or more over the next decade – this year just half as many continue to feel as confident, but 42% still expect the region’s share to increase by up to a quarter (up from 31% last year).

Fig.1. 2016 sees a huge downswing in confidence

Opinions on a potential “Brexit” and its impact on business in the Middle East were evenly balanced – 29% of those questioned thought a Brexit would have a positive effect, 38% a negative one, and 33% believed it would not have much of an impact either way – potentially displaying uncertainty as much as ambiguity about the implications for trade.

Fig.2 Middle East far from immune to developments in other regions

The Digital Drop

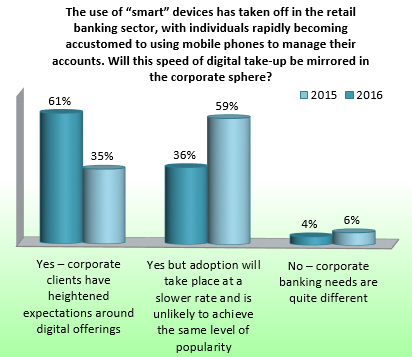

Throughout the day, electronic voting took place on key issues facing the banks and their customers. For example, a substantial 61% of attendees reported that their corporate clients have heightened expectations around digital offerings.

When asked whether the speed of digital take-up in the corporate sphere would mirror that in the retail banking sector, where customers are now accustomed to managing their accounts on their mobile phones, the proportion of those thinking that the corporate sector would follow suit was considerably higher than last year’s 35%. A further 36% thought adoption would take place, just at a slower rate than in the retail sphere, and that smart devices would not achieve the same level of popularity – down from 59% in last year’s survey. The proportion of those who considered corporate banking needs were entirely different from those of the retail sector had dwindled to a mere 3% (down from 6% last year).

Fig. 3 2016 sees soaring confidence in the relevance of digital offerings.

The big shift in attitude over the past 12 months and the changed perception of whether customers are eager and ready for these developments has significant implications. Clearly, the Middle East is now conceptually ready, if not quite technologically prepared, for digitisation and all it has to offer treasury and financial services. That being said, on other fronts, not all customers are comfortable with aspects of technological developments. Indeed, the C-Suite is often still nervous around cybersecurity issues and some are still unfamiliar with online banking and digital interfaces.

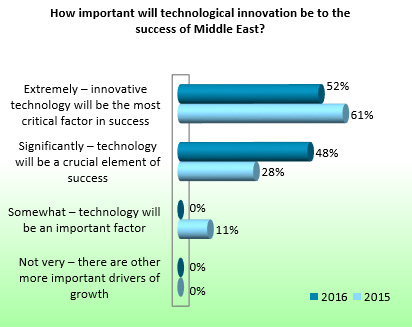

This mixture of client demands is a challenge for banks, as are their own digitisation projects. Nonetheless, banks are quick to recognise the importance of such implementation, with every single respondent agreeing that technological innovation would be either critical or crucial to success.

Fig. 4 Technological innovation has become more important than ever before

The Customer Has His Say

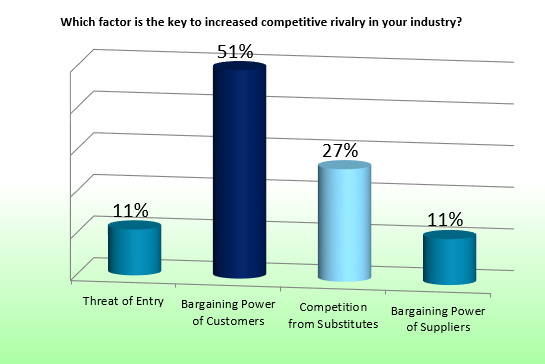

In fact, attendees identified the bargaining power of customers as the key driver of competition amongst them, far and above other factors. CFO of MNC National Paints, Gabriel Osho, shared his company’s journey with their bank, from being a small family business to the largest of their industry in the region. In parallel with this trajectory is the evolution of the company’s treasury and financial operations, from manually-processed cheques to online banking and more sophisticated solutions – a progression that Osho credits with facilitating a leap in organic growth from 18% to 24% between 2002-2014.

Fig. 5 Competition fuelled by the bargaining power of customers

The group has been with their bank since 1979, but after overhauling their treasury system – with the help of their bank and iGTB systems – new features have increased efficiency and reduced headache-inducing labour points. Gabriel called for banks to educate the SMEs and family-run businesses in the area, as he said many were nervous and uninformed about their options, especially when it came to technology and security, for example around online facilities. As Osho noted, “Customers want a bank that will provide liquidity, help us grow, and be present in all our markets”.

What’s next for the Middle East?

Bankers also discussed key industry themes in roundtables, from digital, liquidity, payments and cash management to supply chain and trade. This encapsulated the spirit of the event as a space in which to openly communicate with colleagues and peers, without the restrictions of competition. Fostering such industry discussions is a main objective of iGTB’s client advisory events – and one that bankers in this region are clearly crying out for more of. In addition to the roundtables, attendees discussed recent projects or crises and how they had dealt with them

Digital challenges for the region include finding the right vendor, encroachment by private non-bank players, and updating human resources around digital implementation. Simplification for corporates was a key trend and visibility of funds continues to be a key concern for corporate treasurers; no corporates are ‘local’ any longer, but rather regional and global, and they seek solutions to match. Challenges here include providing an integrated view across multi-banked and multi-regional corporates’ positions. A lack of information around payment data and reconciliation is also problematic, as it is a key requirement for customers. Direct debit not being standardised was also raised as a stumbling point, and African attendees in particular highlighted the lack of standardised formats and client anxiety over security issues.

The consensus from the roundtables was that supply chain solutions had yet to truly take off in the Middle East, as there was a lack of big anchor clients (like in the USA for example) and there weren’t the same potential revenue volumes in the region. Banks are somewhat apprehensive about getting into supply chain finance, particularly as end-to-end automation is required, which the region has yet to achieve. But in a separate presentation, Anand Pande, Product Council Head, Supply Chain and Trade Finance, iGTB, took the audience through an exploration of how supply chain financing is converging with the cash management business and will be an increasingly large portion of trade finance revenue in coming years. With today’s new trade flow patterns and the importance of SMEs, as well as growth of the global factoring industry, this is an area banks in the Middle East can no longer afford to overlook.

To support such efforts, Andrew England, director and head of strategy at iGTB, took attendees through exacting tactics for extracting higher performance from transaction banking. England walked the audience through the nuances of the paradigm shift with regards to regulatory and balance sheet requirements, as well as the customer’s environment, and explained what the direct and unintended consequences of these changes were likely to be – and how banks could manage them.

In all, the day’s takeaways were that – despite some macroeconomic pressures on the region – there continues to be significant scope for growth and development in this sector. Customers are savvy and expect more sophistication and more advisory from their banks, but banks are increasingly in a position to supply these offerings with the right tools and technology to hand.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East