Managing Director

Global Sector Head – Resources and Energy Group Payments and Cash Management

At present, resource and energy companies have a major opportunity to enhance their process efficiency and transparency, as well as boosting their financial liquidity. The decline in crude oil prices of some 70% has had a major effect on their liquidity positions. As a result, while liquidity management was once almost a peripheral consideration for the sector, it is now becoming a primary focus as companies appreciate the opportunity and need. Furthermore, as Lance Kawaguchi, Managing Director, Global Head of Resources and Energy Group – Payments & Cash Management at HSBC explains, the expertise needed to mobilise any hidden/trapped liquidity and automate its investment is also readily available.

The oil and gas sector is currently experiencing unprecedented conditions. While the sharp decline in oil prices may not be so exceptional, the accompanying supply metric certainly is. During previous oil price weakness, producers significantly reduced supply: in 2008 OPEC cut production by some 4.2 million barrels per day, in 1997-9 by 1.7 million barrels per day. By contrast, although crude oil prices are now hitting seven year lows , major producers are actually increasing supply. The net result is that prices are expected to remain depressed for an extended period.

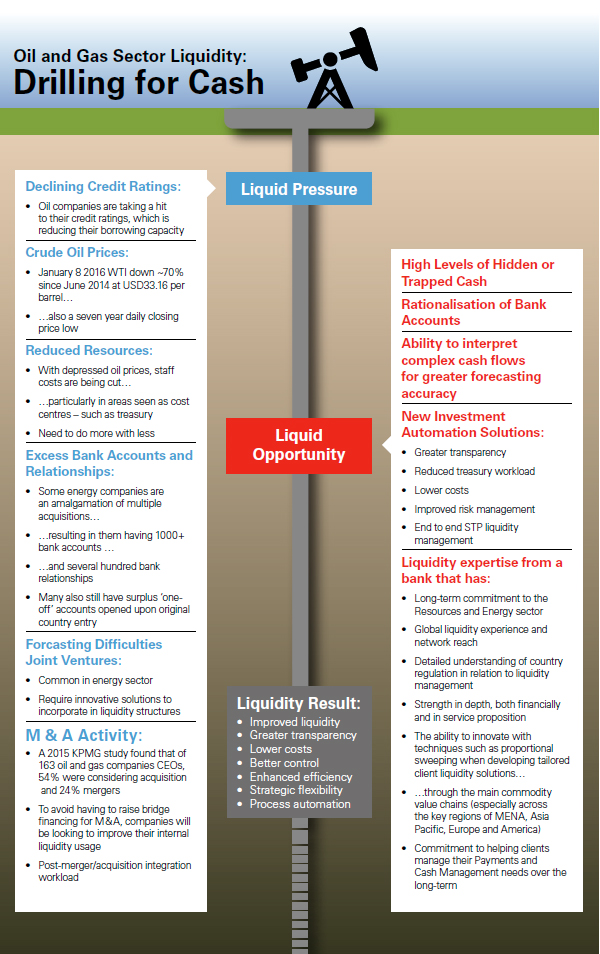

Liquidity pressure

This unusual price/supply dynamic has inevitably shocked the oil and gas sector, with activity, liquidity and profitability contracting sharply – perhaps unsurprising given that Wood Mackenzie claims that few energy companies can break even (i.e. hold net debt flat) with an oil price of less than USD60 per barrel . This scenario has inevitably had a knock on impact on many oil and gas companies’ liquidity.

For a variety of reasons, oil and gas companies are finding that dealing with their current liquidity situation is not straightforward. Other industry sectors that were immediately hit by the financial crisis have already accumulated appreciable experience of liquidity optimisation. By contrast, oil and gas companies were less affected in 2008-9. Even though crude prices fell then from around USD118 per barrel in late August 2008 to below USD40 by year end, OPEC production cuts re-balanced the market. The resulting rebound saw prices recover to USD70 by June 2009, before going on to top USD100 in March 2011 .

Therefore, oil and gas sector liquidity levels were not too severely affected and until quite recently have remained sufficient. However, the current protracted decline in crude prices has had a far more deleterious effect on oil and gas sector liquidity, so that there is now a need to implement best liquidity practices. Given recent innovations in investment automation, this best practice now extends beyond just liquidity aggregation to encompass a complete end to end automated liquidity management chain, from liquidity sourcing to investment.

External sources of liquidity are also becoming less readily accessible as the decline in the oil price has hit oil and gas company credit ratings. Moody’s Investors Service Liquidity Stress Index (LSI) jumped to 6.8% at the end of December 2015, its highest level since February 2010, but at the same time the LSI for oil and gas climbed to 19.6% . Moody’s also downgraded four exploration and production (E & P) companies to its weakest liquidity category in December, as well as placing a further 29 E & P companies on downgrade review .

Reduced ratings are expected to affect the sector’s ability to tap capital markets. This potential impact makes it important to implement best practices sooner rather than later to maximise utilisation of existing internal liquidity sources. This is particularly germane given that energy companies are already having to operate in a lower surplus cash environment, in conjunction with increased competitive pressure and declining revenue streams.

The current environment has also affected M&A activity in the energy sector. While M&A deal volume was down in 2015, a recent KPMG survey anticipates that 2016 volumes may be at an all time high. The survey of 163 energy company CEOs found that 24% were considering merging and 54% were considering an acquisition. This activity will need to be funded somehow and – particularly in the context of declining sector credit ratings – this makes optimal liquidity management even more of an imperative. There is also the consideration that it will place an additional integration burden on already stretched treasury resources. As some companies in the energy sector already have more than a thousand bank accounts and several hundred bank relationships, this burden could be considerable.

Liquidity opportunity

Fortunately, the positive flip side to this apparently negative state of affairs is that many oil and gas companies are likely to be sitting on substantial untapped internal liquidity. The previous lack of pressure to optimise liquidity compared with other industry sectors makes it more likely that there will still be underutilised pockets of cash spread across the organisation. Even on an individual country basis there may be cash that can be centralised to add value, but extrapolate that to a regional or global level with cross border liquidity schemes and the opportunity becomes even greater. A further advantage is that the steps required to improve control of corporate liquidity also confer other benefits as well, such as improved transparency and control, bank account rationalisation, lower costs, streamlined processes and automation.

Automation is especially relevant in liquidity management at present, because it is now possible to automate the entire cash and liquidity management process, including investment of any surplus, from end to end. While automation of liquidity aggregation has been available for some time, it has not previously extended much into the actual implementation of investment policy, which has largely remained a manual treasury process.

Treasuries are now able to define a mandate, which can be varied according to market conditions, that defines a set of investment parameters based on risk appetite and corporate investment policy. Any resulting orders are then automatically executed in accordance with this mandate across multiple investment options and registered in the corporate portfolio, where they are visible though a single interface. This helps to ensure that the reporting of all investment trades, holdings and income is fully compliant and aligned with corporate investment and governance mandates, as well as supporting a streamlined audit process.

This final piece in the automation jigsaw means that liquidity management can become a completely automated business process. In doing so, it also becomes more transparent, with improved risk management and lower costs. Furthermore, skilled treasury personnel can spend less (or no) time manually executing investment transactions and more time determining what the optimal investment strategy should be.

However, before this final automated investment step can take place, the necessary liquidity must be identified and mobilised. There are several key stages in achieving this. Visibility is one: web-based systems that provide global visibility of cash balances and real-time balance sheet management will improve the identification and correction of cash flow leakage. Instituting end-to-end processes for collections, payables and investments will increase cash flow speed and make it easier to net surpluses/deficits across regions. This can then be exploited within a global cash structure that includes all operating countries and includes target balancing and appropriate notional pooling.

Boosting operational efficiency and productivity by reducing manual intervention and fragmented processing will also assist liquidity improvement by facilitating straight-through processing. This in turn reduces costs and settlement risk, while expediting processing cycles. Rationalising bank relationships and extending the scope of shared service centres will also help streamline financial processes.

Financial supply chains can often prove a valuable source of additional liquidity. Accelerating the purchase-to-pay and order-to-cash cycles allows for both working capital and cost savings. For instance, automating receivables processing through electronic invoice presentment and payment can be used to expedite collections and reduce days sales outstanding. Supply chain financing can also add value through punctual (or even early) supplier payments, while simultaneously enabling an extension of days payable outstanding.

On the technology front, electronic bank account management (eBAM) can be used to minimise the significant administrative overhead of managing numerous bank accounts around the globe. At the same time, eBAM enables treasuries to improve controls, while also standardising and simplifying processes across all corporate entities.

External assistance is available to ease the introduction of these improvements. Major banks have dedicated liquidity management teams with extensive experience of liquidity optimisation acquired through working with corporations in other sectors before and since 2008. This experience and associated expertise is equally applicable to the energy sector.

Where the bank concerned has a long term commitment to oil and gas, these bank liquidity teams can provide commensurate long term benefits. By taking a consultative relationship-based approach, they are able to arrive at a solution specifically tailored for each client. In practical terms, this starts with a detailed review of a client’s existing bank accounts and liquidity process, which is then used to develop a proposed project plan.

An important consideration here is that while the process is collaborative, many of the resulting steps do not require significant client resources. For instance, a robust liquidity project methodology will attempt to minimise the client workload. A related benefit for treasuries with limited/reduced resources is bank understanding of local regulation and what is or is not feasible in specific jurisdictions. This is valuable in relation to techniques such as physical and notional pooling, especially in regions such as Asia.

This expertise is also valuable in certain sector-specific areas. For example, joint ventures with local governments are commonplace in the energy sector, but these can be problematic from a liquidity management perspective. Nevertheless, a suitable bank will be able to offer a solution that includes automated proportional sweeping for joint ventures. This allows for funds to be swept to more than one master account and to/from partners of a joint venture entity, as well as for collections to be distributed between different department accounts.

A liquidity bank should also be able deliver a high degree of automation and visibility in a consistent manner across all the client’s accounts, including those held with local banks, which facilitates credit risk management by allowing balances to be swept on an intraday basis if needed. This degree of standardisation should also apply to the liquidity bank’s client service delivery across multiple jurisdictions.

Conclusion: liquidity result

While the current environment clearly throws up appreciable liquidity management challenges for the oil and gas sector, it also presents similarly appreciable and accessible opportunities. Given that many oil and gas companies have not previously been under much pressure to maximise the use of their internal liquidity, there is a reasonable chance that many of them will find scope to do so. Balances around the globe – including those in Asia and the Middle East, which have historically been seen as challenging in liquidity management terms – that may previously have been overlooked can be mobilised and put to worthwhile use. This is especially pertinent in an industry where inherent forecasting difficulties make maintaining a substantial buffer of immediately available liquidity essential.

Liquidity improvements can be achieved without stretching corporate treasury resources. A successful liquidity strategy will also appreciably reduce treasury workload post-implementation through increased automation, so that the focus switches to review and planning rather than manual intervention. Improved transparency and data also mean that investment policies and counterparty risk can be more efficiently managed. This is now perfectly achievable given the new tools available for investment automation that complete the end to end liquidity management chain.

However, implementing a liquidity strategy that actually delivers on the potential opportunities outlined above depends heavily upon making the right choice of liquidity bank. Any serious contenders obviously need to be invested in the energy sector and fully understand its nuances. In addition they need to be able to deploy this understanding in the context of the highest quality liquidity management expertise and a consistent global network service proposition. Finally, and perhaps most importantly, they must deliver all this on a truly consultative basis, so the resulting liquidity solution fits the client, not the reverse.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East