Highlights: H1- 2012

- Top line operating income up 5.5% to AED 4.1 Billion

- Net profits up Strong and liquid balance sheet

Highlights: Q2- 2012

- Net profits up 2% to AED 1,046 Million

- Impairment charges lower by 12% to AED 292 Million after strong recoveries

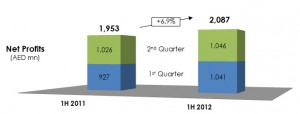

Abu Dhabi- (July 24, 2012)- National Bank of Abu Dhabi (NBAD), the Safest Bank in the Middle East*, reported 6.9% increase in net profits to AED 2,087 million for the first half of 2012 compared with AED 1,953 million earned in the first half of 2011.

Net profits for the second quarter of 2012 at AED 1,046 million were also higher by 2% compared to the second quarter of the previous year at AED 1,026 million.

The annualised return on shareholders’ funds for the first half is 16.9% in line with the targets for the medium-term.

H.E. Nasser Alsowaidi, Chairman of NBAD said, “The Bank had another good quarter and continues to deliver a strong set of financial results. We have also maintained our strong credit ratings in an environment in which well known financial groups across the globe have experienced downgrades to their ratings.”

Mr. Michael Tomalin, Group Chief Executive, commented, “The result for the first half is a reflection of our steady performance so far this year and is in line with our expectations. Loan growth appears more subdued due to some repayments and deposit growth appears lower mainly because of substantial deposit outflows which had been expected and factored into our cash flow positions. The Bank’s liquidity remains strong and we have the capacity to grow rapidly when markets improve. Our international and wealth businesses enjoyed strong growth. The Group has not changed its forecasts for 2012: assuming continuing current market conditions, mid to high single digit growth in earnings for the year with non-performing loans peaking round 3.75% of performing loans by year end or early 2013.”

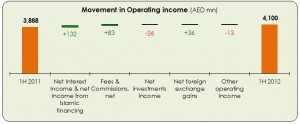

OPERATING INCOME

Operating income crossed the AED 4 billion mark in the first half to reach AED 4,100 million, up 5.5% over the corresponding period of 2011. Operating income of AED 2,071 million for the current quarter was higher than the second quarter of 2011 by 3.2%. Higher net interest income and net income from Islamic financing contracts by 4.6% in the first half of 2012 over 2011 continues to drive the increase in top-line revenues. Though non-interest income was slightly lower sequentially from the 1st quarter of 2012, it remains 7.8% higher in the first half of 2012 than the corresponding period of 2011 led by a strong 12.2% increase in net fees and commissions.

The net interest margin was 2.3% for the first half of 2012, lower than 2.5% for the corresponding first half of 2011 due to an increase in short-dated secured lending and maintaining a more liquid balance sheet. The percentage lent (loans and advances to total assets) at the end of the first half of 2012 was 60% compared with 62% this time last year.

EXPENSES

Operating expenses for the first half were AED 1,350 million, higher by 14% compared with the corresponding period driven primarily by higher staff costs reflecting our continuing investment in talent, learning and development.

The cost to income ratio was 32.9% for the first half of 2012. This is slightly more than the 32.5% recorded for the year 2011 but remains below the Group’s medium-term cap of 35%.

At the end of the first half this year, our domestic network spanned 121 branches and cash offices, over 550 ATMs and 11 business banking centres, while we extended our international presence to 14 countries by opening up our offices in Shanghai (China) and Kuala Lumpur (Malaysia). Our global headcount increased to 5,822 staff as on 30 June 2012.

Our investments in the franchise, network and systems, products and people are in line with our vision to be recognised as the World’s Best Arab Bank.

OPERATING PROFITS

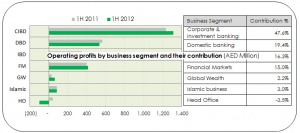

Operating profits grew 1.8% in the first half of 2012 mainly driven by the international and corporate and investment banking businesses, which achieved a growth of 28% and 6% year-on-year, respectively. New products, clients and assets under management (AUMs) coupled with some recovery in capital market activities enabled Global Wealth businesses to almost double its operating profits to AED 61 million from AED 31 million in the previous year. Operating profits in our domestic banking business declined reflecting a tougher market environment. Head Office, which manages the Group’s equity and keeps it liquid, produced a loss this half mainly on the back of lower revenues as a result of the general fall in global interest rates and the run off of earlier positions.

IMPAIRMENT CHARGES

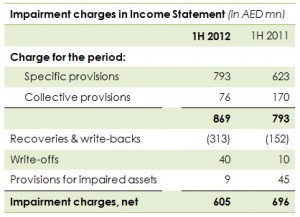

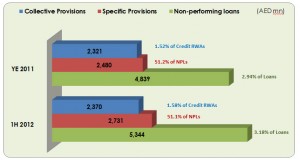

Collective provisions of AED 2,370 million represent 1.58% of the performing credit risk-weighted assets (Central Bank’s 2014 target – 1.5%).Although gross specific provisions were up AED 170 million, net impairment charges were lower by 13.2% to AED 605 million for the first half of 2012 compared to AED 696 million in the corresponding half of 2011 on lower collective provisions and strong recoveries.

Collective provisions of AED 2,370 million represent 1.58% of the performing credit risk-weighted assets (Central Bank’s 2014 target – 1.5%).Although gross specific provisions were up AED 170 million, net impairment charges were lower by 13.2% to AED 605 million for the first half of 2012 compared to AED 696 million in the corresponding half of 2011 on lower collective provisions and strong recoveries.

Non-performing loans increased to AED 5,344 million representing 3.18% of the loan book.

BALANCE SHEET

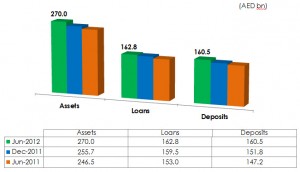

Total Assets were AED 270.0 billion as of 30 June 2012, up 5.6% on 31 December 2011 and up 9.5% on 30 June 2011.

Loans and advances to customers were AED 162.8 billion, up 2.1% on 31 December 2011 and up 6.4% on 30 June 2011.

Customer deposits were AED 160.5 billion, up 5.7% in the first half of 2012 and were higher by 9% as compared to 30 June 2011. During the second quarter, deposits declined by AED 27.2 billion or 14.5%. This was mainly due to a significant portion of short-term government deposits, which were received in the first quarter, being withdrawn in the second quarter. These deposits had been placed across various classes of liquid assets and hence did not impact the liquidity of the Bank. Excluding this inflow-outflow, core deposits grew by a net 5.7% in the year to date.

Capital resources were higher by 5.2% over 31 December 2011 at AED 36.2 billion consisting of shareholders’ funds of AED 24.3 billion, GoAD Tier-I capital notes of AED 4.0 billion and subordinated notes of AED 7.9 billion.

Capital adequacy ratios (Basle-II) remain well above the minimum 12% and 8% (Tier-I) required by the UAE Central Bank, and (prospective) Basle-3, with a capital adequacy ratio of 21% and a Tier-I ratio of 16.3% as at 30 June 2012.

EMIRATISATION

The Bank was honoured by H.H Sheikh Mansour Bin Zayed Al Nahyan, Deputy Prime Minister and Minister of Presidency Affairs for its contribution to Emiratisation goals at an event organised by Emirates Institute for Banking and Financial Studies (EIBFS).

CREDIT RATINGS

NBAD’s long term ratings continue to remain amongst the strongest combined ratings of any financial institution in the MENA region with ratings from Moody’s Aa3, Standard & Poor’s (S&P) A+, Fitch AA-, RAM (Malaysia) AAA and R&I’s (Japan) rating of A+. Both Fitch & S&P reaffirmed our ratings during the second quarter, with S&P increasing our standalone ratings by one notch.

ACCOLADES & RECENT DEVELOPMENTS

During the quarter, the Khalifa Fund and NBAD signed a memorandum of understanding (MoU) to launch an AED 500 million Imtiyaz SME Development Fund aimed at encouraging Emirati entrepreneurship.

The Bank announced plans to launch a real estate fund through its newly incorporated wholly owned subsidiary, NBAD Investment Management (DIFC) Limited.

Several management changes were announced during the quarter allowing for rotation and the promotion of key UAE national senior executives.

NBAD won the Best Payments Infrastructure Project in the Asian Banker Awards 2012. The Bank also became one of the first in the world to introduce a real-time international account to account money transfer service via mobile phones through its innovative Arrow service.

Key Performance Indicators

|

In AED Billion |

30 Jun 2012 |

31 Dec 2011 |

%change |

30 Jun 2011 |

%change |

|

Assets |

270.0 |

255.7 |

5.6% |

246.5 |

9.5% |

|

Customer Loans & Advances |

162.8 |

159.5 |

2.1% |

153.0 |

6.4% |

|

Customer Deposits |

160.5 |

151.8 |

5.7% |

147.2 |

9.0% |

|

Customer deposits + MTBs* |

176.5 |

167.0 |

5.7% |

161.9 |

9.0% |

|

Capital Resources |

36.2 |

34.4 |

5.2% |

33.7 |

7.4% |

* MTBs – medium term borrowings

|

In AED Million |

1H 2012 |

1H 2011 |

%change |

2Q 2012 |

2Q 2011 |

%change |

|

Operating income |

4,100 |

3,888 |

5.5% |

2,071 |

2,007 |

3.2% |

|

Operating expenses |

1,350 |

1,188 |

13.7% |

705 |

622 |

13.4% |

|

Impairment charges, net |

605 |

696 |

(13.2)% |

292 |

331 |

(11.9)% |

|

Net profit |

2,087 |

1,953 |

6.9% |

1,046 |

1,026 |

2.0% |

|

In Percentage |

1H 2012 |

1H 2011 |

|

Return on Shareholders’ Funds (annualised)^ |

16.9% |

17.7% |

|

Cost-Income Ratio |

32.9% |

30.5% |

|

Net Interest Margin (on average assets) |

2.27% |

2.49% |

|

Capital Adequacy (Basel-II) |

21.0% |

20.9% |

|

Tier-I ratio |

16.3% |

15.2% |

^ based on average shareholders’ funds for the period

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

One comment