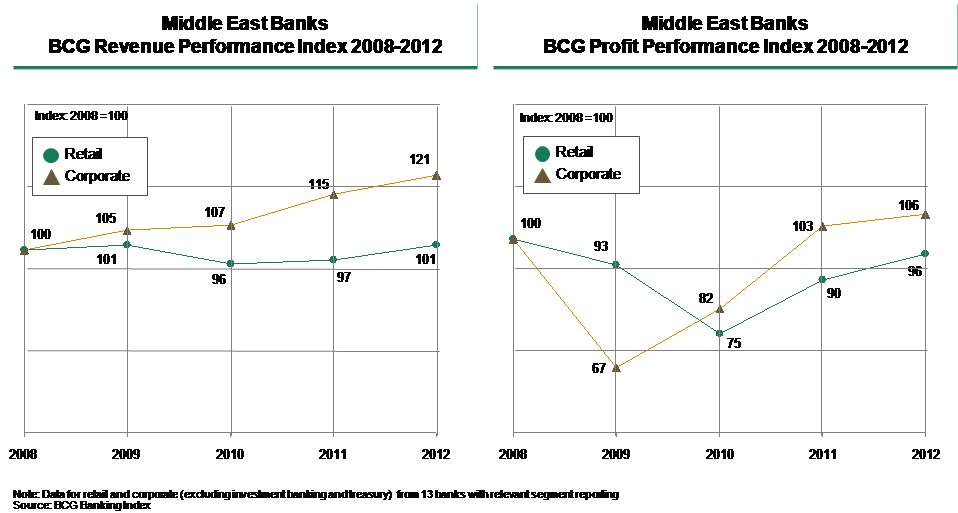

GCC banks’ corporate banking divisions at their highest levels since 2008 by revenues and profits, however there is high divergence in performance across banks with no common solution for further improvements.

Dubai, UAE 27 June 2013 – According to a recent study published by The Boston Consulting Group (BCG), GCC banks’ corporate banking divisions are at peak levels in terms of revenues and net profits and have even crossed the pre-crisis levels seen in 2008. This impressive performance is even more apparent when compared to the same banks’ retail banking divisions, where revenues and net profits have barely touched 2008 levels.

In its Corporate Banking Benchmarking Report, BCG highlights a ‘multi-speed world’ for the corporate banking divisions of banks across the globe and highlights positive growth for GCC markets in this context.

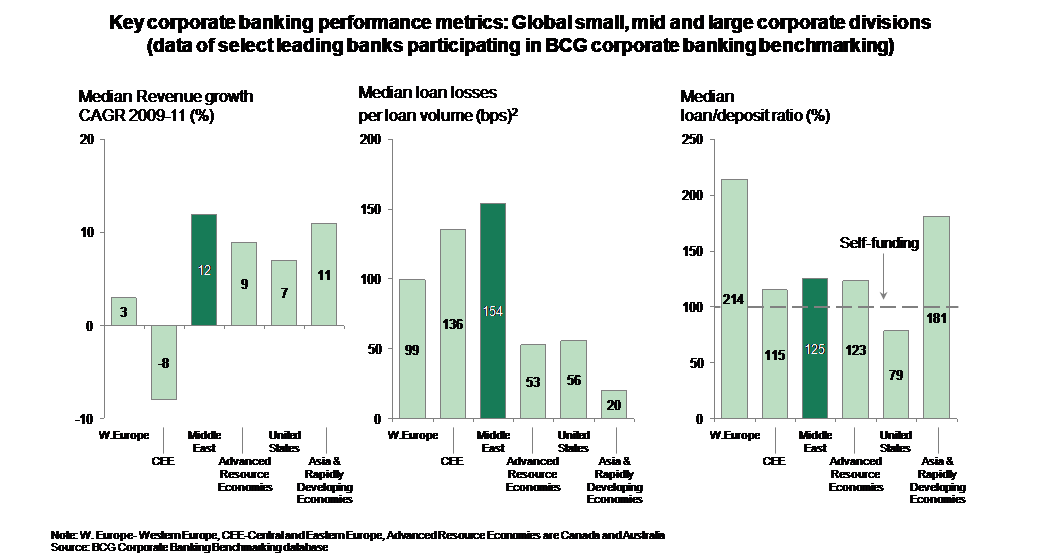

When the performance of a set of leading GCC banks who participated in BCG’s corporate banking benchmarking is examined, then the GCC markets’ comeback is further evident compared to those in other geographies. At 12 percent, this set of GCC corporate banks have witnessed some of the highest growth rates between 2009 and 2011 among all geographies surveyed.

Globally, while banks in Europe are still reeling under pressure in the aftermath of the financial crisis with limited growth or declines in revenues, corporate banking divisions of banks in the GCC, USA, Asia, Rapidly Developing Economies (RDEs) and ‘Advanced Resource Economies’ (Canada and Australia) are showing improved performance with high single-digit and even double-digit growth.

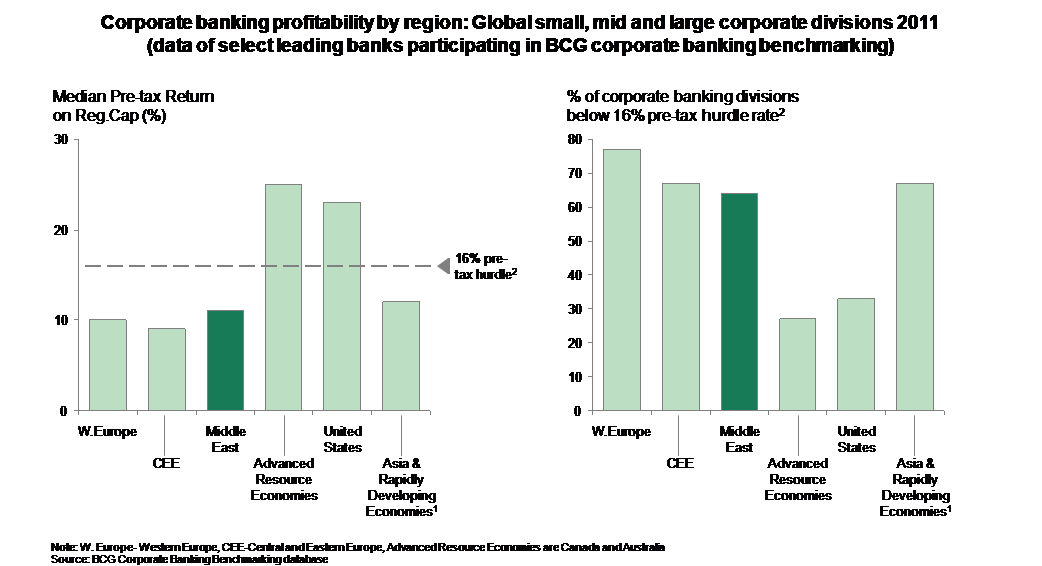

Interestingly, GCC corporate banks appear to be lagging behind when compared on the basis of other key matric like return on regulatory capital. Close to two-thirds of GCC corporate banking divisions are not returning the generally expected 16 percent cost of equity hurdle.

“While banks have been able to increase their revenues and even profits by extending more credit and keeping loan losses in check, they have been limited in their options of diversifying their source of revenues away from standard credit offerings. This has led to no real improvement in the return on regulatory capital in spite of increasing revenues,” said Mr. Markus Massi, Partner and Managing Director, BCG’s regional leader in Wholesale Banking and Capital Markets and author of the study.

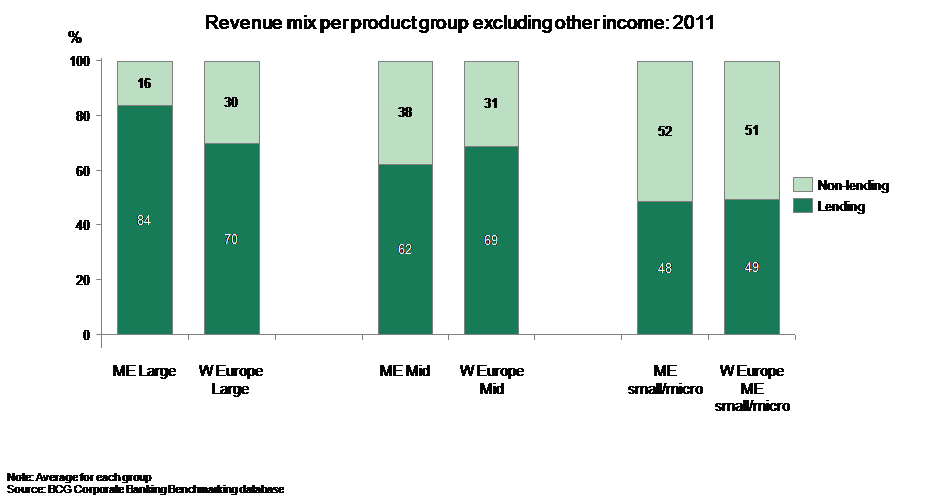

The findings become even clearer when taking a disaggregated view of banks’ performance. Corporate banking segments (whether micro/small, mid or large) within the corporate banks in the region which have smaller percentages of revenues from credit and have performed well on most of the levers of BCG’s blue-chip corporate bank[1] framework have shown higher return on regulatory capital. In contrast, business segments with high or very high percentages of their revenues coming from lending products and are also performing badly on many or all of these levers are far below the ideal hurdle rate of 16 percent return on equity (ROE).

The report highlights that corporate banks will need to adopt a segment-specific approach to setting target returns in order to create incentives aligned with equity investors’ interests, as all segments cannot be measured against one single target ROE hurdle rate.

“GCC banks tend to have wider variation in performance as compared to their counterparts in developed markets across almost all key matrices. This clearly shows the developing nature of the market and the development stage of individual banks, as we see top performing banks able to pull performance levers in a more superior manner,” added Mr. Mohammed Turra, Principal in BCG’s Dubai office and co-author of this report.

The study further highlights three ‘super-critical’ characteristics of top players in the region.

Value driven revenue mix

“All top quartile performing business divisions within these corporate banks in the region and elsewhere have one thing in common – lower credit mix in their revenues,” shared Mr. Massi. “Most of the divisions which were able to cross the return on equity hurdle rate had less than 55 percent of their revenues coming from lending products. This was the case with many of the mid and small corporate banking divisions in the region, which were on par with banks from developed markets in terms of revenue mix.”

From the large corporate segment, only a few banks were able to take their non-credit business beyond 15 percent of revenues, while in developed markets the average non-credit income of large corporate units is almost double that at 30 percent. This large dependence of GCC banks on credit income has weighed heavily in terms of capital requirements for the banks and pulled down their return on regulatory capital.

Risk Adjusted Credit Income

Top performing corporate banking divisions are almost always in their segment’s top quartile on risk-adjusted credit income. This can be attributed to better interest income per Risk Weighted Asset (RWA), indicating repricing that these banks have been able to achieve in the aftermath of the crisis and success in avoiding extreme loan losses, if not necessarily avoiding loan losses altogether.

Liquidity and Capital Management

The common aspect across top performers was their ability to manage liquidity and capital successfully during the turbulent times.

Mr. Massi commented “These corporate banking divisions never let their loan-to-deposit ratios get out of hand. They were able to keep this ratio below 130 percent, effectively meaning that they were internally funding their liquidity to a large extent. At the same time, they were able to smartly deploy their capital to get optimal revenues for any given RWA by smartly managing cross-sell and optimizing pricing.”

Once again mid and small corporate segments were better able keep their loan-to-deposit ratio under control as compared to a large corporate segment that struggled to generate deposits to keep pace with their capacity to lend.

GCC corporate banking divisions saw both some of the highest and lowest loan-to-deposit ratios compared to their peers across the various regions. This again illustrates the divergence in GCC banks’ performance as compared to their counterparts elsewhere.

“While these three factors were common across top performers, corporate banking divisions need to continually work on upgrading their distribution model and staying aware of costs, while at the same time investing to improve their capabilities. In the turbulent years after the crisis, all banks were focusing on a few critical measures to stay afloat. Having overcome the challenging period to large extent, banks now need to chart their own customized course to further sustain their revenue growth and profitability. There are no common measures which are applicable to all corporate banking divisions across the board in the region,” concluded Mr. Turra.

The study was based on BCG’s corporate banking benchmarking performed with leading banks both in the region and globally, using non-published banks information in addition to the corporate banking segment data published in the annual reports of the banks.

* * *

About The Boston Consulting Group

The Boston Consulting Group (BCG) is a global management consulting firm and the world’s leading advisor on business strategy. We partner with clients from the private, public, and not-for-profit sectors in all regions to identify their highest-value opportunities, address their most critical challenges, and transform their enterprises. Our customized approach combines deep insight into the dynamics of companies and markets with close collaboration at all levels of the client organization. This ensures that our clients achieve sustainable competitive advantage, build more capable organizations, and secure lasting results. Founded in 1963, BCG is a private company with 78 offices in 43 countries.

BCG serves the Middle East from Abu Dhabi and Dubai. Our offices there, in conjunction with the BCG office in Casablanca, play a key role in serving clients in the rapidly developing Gulf region as well as Middle East North Africa (MENA). To date BCG has successfully conducted assignments in the Middle East serving clients across a wide range of sectors, including government, financial services, energy, industrial goods, telecommunications, real estate, healthcare and private equity. For more information, please visit bcg.com.

For more information, please visit http://www.bcg.com.

About bcgperspectives.com

Bcgperspectives.com is a new website—available on PC, mobile phone, and iPad—that features the latest thinking from BCG experts as well as from CEOs, academics, and other leaders. It covers issues at the top of senior management’s agenda. It also provides unprecedented access to BCG’s extensive archive of thought leadership stretching back almost 50 years to the days of Bruce Henderson, the firm’s founder and one of the architects of modern management consulting. All of our content—including videos, podcasts, commentaries, and reports—can be accessed via PC, mobile, iPad, Facebook, Twitter, and LinkedIn.

[1] BCG’s case work and benchmarking efforts identify core priorities for blue-chip corporate banks.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East