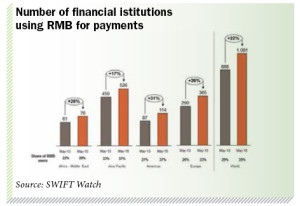

Recent SWIFT data shows that the growth in RMB payments is supported by an increasing number of banks. In May 2015, 1,081 financial institutions used the RMB for payments with China and Hong Kong, representing 35 per cent of all institutions exchanging payments with the latter across all currencies.

Recent SWIFT data shows that the growth in RMB payments is supported by an increasing number of banks. In May 2015, 1,081 financial institutions used the RMB for payments with China and Hong Kong, representing 35 per cent of all institutions exchanging payments with the latter across all currencies.

This is a 22 per cent increase in the number of institutions using the RMB and a six per cent increase in adoption, up from 29 per cent two years ago.

In May 2015, RMB adoption for payments by financial institutions in Asia Pacific increased to 37 per cent from 33 per cent in May 2013. During the same time period, the Americas experienced even stronger growth with financial institutions increasing their use of the RMB for payments by 10 per cent, leading, again, to 37 per cent adoption.

Europe follows closely with 33 per cent adoption, while for Africa and the Middle East the figure is 28 per cent.

“Every month we witness new proof of global RMB adoption,” says Michael Moon, head of payments, Asia Pacific, SWIFT. “The number of banks that use RMB for payments with China and Hong Kong is a key internationalisation indicator. This large number also shows that many banks, across the globe may have an interest in connectivity to the China International Payment System that China will launch end of the year.”

Overall, the RMB strengthened its position as the fifth most active currency for global payments in value and accounted for 2.18 per cent of payments worldwide in May 2015. Although in a comparison made in April 2015 all currencies overall decreased in value by 3.1 per cent, RMB payments increased in worth by 1.99 per cent, which helped lead to its record high share in global payments.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East