The notion of innovation in trade financing is explored by ALEXANDER R. MALAKET, president of OPUS Advisory Services International Inc. and author of Financing Trade and International Supply Chains

While the business of trade finance has a long history and functions on the basis of well-established principles and practices, it is apparent to industry observers that this esoteric discipline has undergone an unprecedented period of visibility, profile and even innovation.

But has the business of financing international commerce reached some form of “tipping point” in terms of its value proposition, innovation and the profile it now enjoys among business executives, political leadership and senior specialists in international institutions?

In my view, having had the privilege of interacting closely with many of the leaders of this industry, and having the luxury as a consultant to see numerous strategic perspectives, operating models and industry initiatives, the answer is a resounding “Yes!”

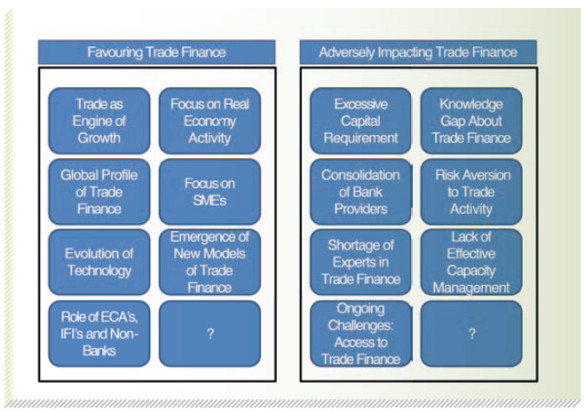

There are a variety of factors and dynamics at play that combine to create an environment highly conducive to innovation and transformational evolution in the financing of international commerce, including so-called “traditional” trade finance, and fast-emerging propositions in the realm of supply chain finance.

By some reckonings, even developments that ought to be seen as adverse to the health of global trade finance, such as regulatory pressures, might in the long run prove to be beneficial to the evolution of the sector.

Chains, Gower, 2014

There are several factors that set the stage for a transformational “tipping point” in the financing of international commerce. The eventual achievement of such transformation, and its translation to a set of commercially valuable and viable propositions depends on a recognition of shifting context, and purposeful action in support of such transformation.

The recognition is more easily spotted these days, but the purposeful action and market uptake remains a systemic challenge, though it, too, shows signs of momentum.

Profile and visibility

I have argued for several years, particularly since the peak of the global financial crisis, that the unprecedented visibility and profile of trade finance as an enabler of trade, economic recovery and growth, as well as trade-based international development, will ultimately serve the industry well.

The historical practice of maintaining optics of complexity and mystery around trade financing (either consciously or by default) is no longer viable: it is, in fact, damaging to the extent that it prevents industry leaders from shining a light on the value and importance of trade finance, and thus competing effectively for limited resources, be they human or capital.

The notion of profile is not a theoretical dynamic with only “strategic” implications, which could be viewed with some suspicion by fundamentally practical trade practitioners – especially those with an operations background who are historically very transactionally oriented.

Profile translates directly into the ability of trade finance executives to make compelling business cases in favour of various forms of investment, from technology to staff to extensions of operational footprint. That same visibility facilitates greater attention in policy and political circles, leading directly to the extension of capacity in support of trade through financing.

Leading initiatives in the UK around public policy-driven supply chain finance, or a market-based restructuring of ECGD into UK Export Finance, as well as a more recent initiative in the US related to supplier finance as a means of injecting liquidity into the economy, are clear illustrations.

The limitations of profile in the absence of sustained, effective championing and advocacy can be seen in numerous markets around the globe, and in the ongoing gap around SME and emerging markets trade finance.

Profile and visibility around trade finance have indeed reached unprecedented levels, to the extent that numerous non-banks have sought, with varying degrees of success, to create a proposition in this space, but it is clear that there is more work to be done, to raise the profile of this industry, to communicate its value and to advocate for its appropriate support, including adequate global capacity around risk appetite and liquidity, to facilitate the conduct of international trade and related investment flows.

Evolving technology and business models

One area where trade (and supply chain) finance seems clearly to be at a “tipping point” is around the effective application of technology and the related development of innovative business models.

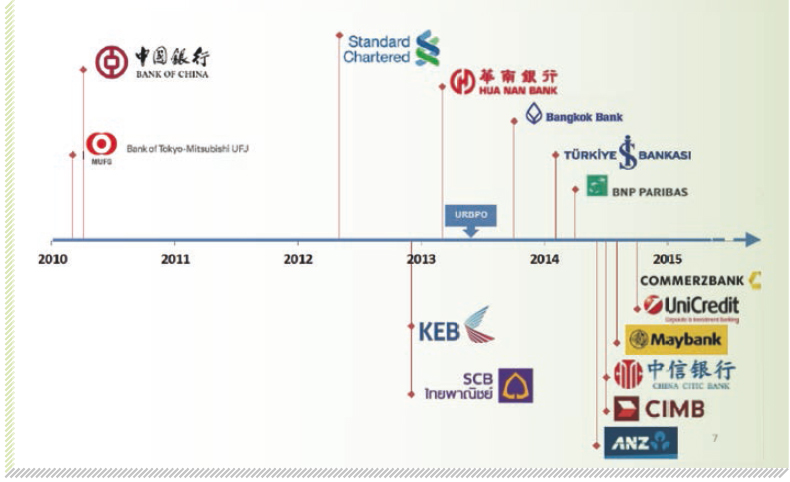

The “textbook” illustration at the moment on this is the accelerating interest in and uptake of the SWIFT/ICC Bank Payment Obligation seen over some months now in Japan, Germany, Turkey and Taiwan among other markets.

The pursuit of data-based payment and financing decisioning in trade has been out of meaningful reach since it was explored through the UN system and through several pre-dot-com startups that aspired to transform the conduct of trade.

It appears now that the capabilities in the technical environment have finally married with the expectations and acceptance of market players (particularly importers and exporters) to create meaningful momentum behind the transformation of the industry.

The Bank Payment Obligation is now being presented as more than a concept or a framework, with significantly more focus on transactional considerations, practical implications around implementation and operational issues, on the basis of numerous case studies now available in the market.

The BPO solution, now coupled with a timely and robust proposition around dematerialisation of transport and other documentation, through essDOCS, is increasingly powerful and compelling. This development also illustrates the importance and effectiveness of a genuinely collaborative approach to the conduct of business between influential innovators.

The pace of adoption and the scope of application of the Bank Payment Obligation are clearly in acceleration mode, with progress now measured in terms of banks not just signing on in principle, but “live” with BPO transactions.

Trade financiers, industry bodies and regulators will inevitably engage in discussion around the extension of scope of the BPO as a transformational solution, with favourable global impact in terms of injections of liquidity through accelerated settlement times, as well as through shortened “blockage” of credit facilities.

The BPO may also prove increasingly attractive as a framework for the delivery of trade finance capacity into emerging and developing markets, coupling the advantages of affordability in deployment costs, together with the absence of expensive, hard-to-decommission legacy systems in these economies, many of which are placing increasing emphasis and policy priority on trade as an engine of growth, international engagement and economic value-creation.

Trade finance is no longer completely in the shadows, and while external understanding about its nature remains limited, this, too, is changing inexorably, to the extent that evolutions and developments in non-bank and non-trade areas of activity will become increasingly influential in driving the evolution of trade and supply chain finance.

The increasingly strategic view around liquidity management and working capital which underpins growing analysis on settlement timeframes, and drives governments to accelerate their settlement of monies due to suppliers as a means of creating liquidity, and even supporting cash-starved SMEs, leads to the trade finance discussion being placed in a much broader context than has historically been the case.

In that environment, developments in electronic invoicing, presentment and payment become directly relevant to trade settlement and financing; and evolutions in the context of global payments become relevant and influential in cross-border trade finance.

Trade finance will no longer have the luxury – more accurately the impediment – of existing in a context of long-term status quo, where business can be conducted with limited innovation due to the robustness of the model, and the static expectations of end-clients and stakeholders.

With industry innovators such as PayPal now developing their SME-focused proposition around working capital financing, and disruptors like Facebook securing a banking licence, while specialist industry-focused trading platforms in China integrate payment and financing solutions into their business model, it is clear that competitive propositions will inevitably become a growing part of the trade financing landscape, and that complacency is no longer an option.

The global payments business in the commercial and corporate sphere is being increasingly influenced by developments (and expectations) in the personal and retail environment, and by propositions such as the very successful, Kenya-based M-Pesa mobile payments solution.

Likewise, the trade business will be increasingly shaped by developments, expectations and innovations outside of the immediate sphere of trade, or trade financing.

Emerging markets and new sectors

It has been suggested on the basis of some preliminary analysis by the Asian Development Bank, the IFC and others, that there is likely a significant gap between the demand for and the availability of trade finance globally.

A “trade finance gap” of $1.2 to $2 trillion annually is estimated to exist today, with about 40 per cent of that gap in key markets in Asia, and, anecdotally at least, a significant portion of the gap impacting small-and-medium-sized enterprises, often based in developing and emerging markets.

Additionally, the focus of trade finance is largely in supporting merchandise trade flows, though service sector flows are extremely important and increasingly in need of some form of financing and/or risk mitigation support.

Each of these realities presents both a significant challenge for trade financiers – certainly bankers operating with a commercial mandate, as opposed to ECAs or IFIs operating on the basis of a policy imperative or a development objective. Each also represents, however, a compelling opportunity and the potential to extend the value proposition of a trade finance business to new client segments and to new realms of trade activity.

Many developing and emerging markets are on a clear growth trajectory, with young and growing populations, expanding middle classes, or, at minimum, increasing levels of income to finance the purchase of a wider range of goods and services, including imports.

Such economies increasingly look to trade as a means of increasing wealth and raising the standard of living of communities, families and individuals, and the political leadership of these economies has clearly appreciated the importance of trade – and the critical role of SMEs – in economic growth.

Domestic policy priorities align well today with the focus of international financial institutions and development entities, also actively supporting trade as a driver for poverty reduction and growth.

Financial inclusion focuses on reaching large “unbanked” populations, increasingly through mobile solutions, and it is inevitable that such a focus will lead to the development of propositions aimed at enabling micro and small businesses in developing markets to engage in international commerce.

There is a clear global need and demand for trade financing, and while automation and technology can and will address parts of the business model, the underlying expertise – both in terms of international commerce and still-specialised financing and risk mitigation structures – will remain fundamental to the value proposition of trade finance.

Additional capacity in trade finance is a critical priority for the industry, demanding traditional providers to help attract the necessary capacity through creative partnerships and access channels, while concurrently championing their business internally to encourage allocation of capital and risk appetite to the trade business.

It has been stated explicitly on many occasions and in many ways since late 2009, but it bears repeating: trade (despite the numerous imperfections of the system) is critical to the health and growth of the global economy, to the quality of life of families and individuals and to development and poverty alleviation around the world.

Trade does not and cannot meaningfully take place without some form of trade financing.

There is still work to be done, to convey this message, champion the industry effectively, and appropriately leverage the importance and value of this business to ensure that the industry is adequately resourced on all fronts. n

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East