The annual growth rate for supply chain services averaged between 30 per cent and 40 per cent for global banking institutions in 2011-2013, according to a survey by international consultants Demica.

In the atmosphere of tight corporate credit over the past few years, Supply Chain Finance (SCF) has become an increasingly attractive and important working capital management tool, according to London-based Demica, which provides consulting, advisory and technology services to the world’s leading banks and a diverse range of multi-national clients.

It says, “As the optimisation of cashflow now occupies a top position on the business agenda, corporates are examining their cash-to-cash cycle with greater attention and are exploring ways to extend their Days Payable Outstanding (DPO). This, however, should not come at the expense of supplier companies, particularly SMEs, which have been hit the hardest in terms of credit availability and price.”

According to the most recent six-month survey from the European Central Bank on SMEs’ access to finance in the euro area, the net percentage of SMEs in the region reporting a deterioration in the availability of bank loans increased marginally, from -10 per cent in the previous survey to -11 per cent.

While “finding customers” remained their dominant concern, “access to finance” was mentioned by the second largest percentage. The figures also showed that often SME suppliers’ need for cash was even more urgent than their buying customers.

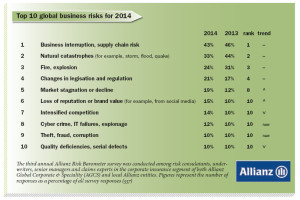

Demica said, “Despite buyers’ desire to explore new ways in which to generate cash, they also recognise the need to ensure the integrity of their supply chains. According to the Allianz Risk Barometer 2013, business interruption and supply chain risks are the top risk concerns of businesses globally – and rightly so. The 17th Annual Logistics Study estimated that economic losses from supply chain disruptions increased 465 per cent between 2009 and 2011.

“While some disruptions to the value chain, such as economic disruption or adverse weather, are beyond businesses’ control, organisations can help minimise supply chain risks posed by cashflow issues of their suppliers by leveraging their credit-worthiness to extend financing to their suppliers in a SCF arrangement.”

As purchasing organisations with access to more liquidity than they need increasingly seek to pass on that benefit to their smaller suppliers, the market is seeing an increasing number of SCF programmes.

These financial arrangements allow corporate buyers to provide much-needed liquidity to suppliers in order to avoid supply chain disruption; improve working capital efficiency; and enable payment discounts/cheaper financing costs for suppliers. Organisations are also placing growing emphasis on developing closer working relationships with supplier firms in order to alleviate competitive tension.

This surging interest in supply chain finance is equally reflected in the growth of SCF as a line of business for banks. According to Demica’s most recent report, annual growth rate of SCF services averaged between 30 per cent and 40 per cent for global banking institutions in 2011-2013.

By 2015 this should edge down to between 20 per cent and 30 per cent. Though the pace of growth is expected to slow down towards the end of the decade, it is still estimated to be more than 10 per cent by 2020. This research also showed that SCF is increasingly seen as a must-have for corporate buyers, according to almost 90 per cent of bank respondents. Equally, the added-value for clients provided by SCF is acknowledged by more than three-quarters of bank financiers.

In view of stringent banking regulations and an unlikely return to cheap (and relatively indiscriminate) liquidity, the value of SCF for the corporate community is expected to increase further, particularly as effective working capital management requires a best- practice approach to account payables (AP) and account receivables (AR).

“Companies that understand the critical role of AP and AR in the bigger financial picture and command the tools to optimise their management will be able to enjoy significant savings and much-improved cycle times,” says Demica.

Banks’ commitment to SCF

Market demand for SCF seems to be charting an upward trend since the crisis, as evidenced by other surveys as well as Demica’s own series of research. However, whether or not this growth momentum can be sustained in the long run will, in part, depend on the importance that banks put on SCF as a line of business. So how serious is the banking community about SCF?

As a starting point, one indicator considered is to what extent bank organisations have created positions specifically dedicated to the area of SCF. Within a bank’s business, SCF may simply be a small component part of trade finance, commercial/corporate finance or global transaction services.

“However,” says Demica, “as SCF takes increasing prominence in the broader scope of supply chains and continues to establish itself as a core banking facility within a wide spectrum of trade finance products, a mounting number of banks are seeing SCF as a distinct and full-fledged product in its own right. As a result, they are creating more strategic roles whose functions are to promote the development of SCF business within client organisations.”

Looking at the European banking community, the Demica study found the following:

- Close to 45 per cent of top banks have created SCF-specific roles/job titles

- 30 per cent have created SCF-specific roles with directorial status

- 18 per cent have sales functions specifically related to SCF

- 16 per cent have SCF-specific product managers

- 10 per cent have job titles focused on nurturing SCF client relationships.

These figures can be seen as a broad indication of the growing level of importance banks allocate to SCF. There are numerous driving forces behind this – “most notably the heightened interest originating directly from the corporate space. Banks generally aim to have a holistic, multi-product relationship with their business customers, so their ability to provide a wider package of financial products serving the diverse needs of the clients is, therefore, crucial”.

These figures can be seen as a broad indication of the growing level of importance banks allocate to SCF. There are numerous driving forces behind this – “most notably the heightened interest originating directly from the corporate space. Banks generally aim to have a holistic, multi-product relationship with their business customers, so their ability to provide a wider package of financial products serving the diverse needs of the clients is, therefore, crucial”.

The changing nature of trade is another driver. As trade business increasingly takes place via open accounts instead of letters of credit, banks have adapted to the phenomenon and developed new products that meet the requirements of evolving trading dynamics.

The comparatively low risk nature of SCF has also encouraged banks to develop this area of business further. Since buyer companies in an SCF arrangement are more often than not mid-to-large investment-grade corporates, the underlying risks associated with SCF tend to align well with the post-crisis regulatory regime.

Even though banks can earn more revenue in providing credit facilities to non-investment grade companies, the higher risks involved also require considerably higher capital adequacy. From this perspective, SCF is particularly appealing because of its short tenure, self-liquidating nature and low cost of opportunity. Banks are now jockeying to gain SCF businesses because of their strong appetites to use their balance sheet in support of short-term commercial trade-related transactions.

Development trends in SCF

Increasing market demand for SCF is likely to lead to the emergence of new players, a process that is already being accelerated with available technology. The increasing number of platform providers for supplier financing programmes has helped reduce initial investment into systems and resources, lowering market entry barriers for smaller banks.

“While SCF might just be a nice-to-have for smaller banks, it is a must-have for global banks since they are looking for smarter solutions than straight forward balance sheet lending. Because of their ubiquity across the globe large banks also believe that SCF allows them to better serve their clients than does balance sheet lending,” opined one international financier.

Another said, “We have given a big push into SCF as a growing number of our clients, regardless of blue chip or medium-sized companies, are demanding this solution. SCF is about integrating different banking products. At the same time, SCF solutions are also customised products. Internal co-operation across different bank departments is, therefore, essential in driving growth of SCF.”

The SCF market may also see more syndication in the future due to the increasing scope of the schemes demanded by corporates. As the purchasing volumes of goods by large corporations in emerging markets continue to rise, the magnitude of transactions involved in global programmes could prove so high that it would become difficult for a single bank to accommodate.

At the same time, given the heightened capital adequacy requirements and the resulting risk-averse stance of banks, SCF syndication markets where banks can sell or share risks on certain buyers will become necessary and, indeed, desirable.

Considering the current volume of global/pan-European SCF programmes at the moment, there is still significant potential to be exploited in the development of international SCF offerings. Global banking behemoths will have a crucial role to play in this context as local SCF programmes offered by domestic banks will not be able to meet the requirements of international trade business adequately.

Global banks, in contrast, with their enormous resources, networks, expertise and an international footprint, will be better placed to cope with the complexities involved with processing multiple large transactions on an on-going basis, as well as to create economies of scale for clients.

Until now, large corporates have been relying on banks to administer and take charge of their SCF programmes. However, businesses are increasingly keen to deploy their own cash reserves to set up SCF programmes on their own. A growing number are examining ways of leveraging their excess cash positions in jurisdictions where there is trapped cash. In fact, with the increasing availability of highly automated, bank-neutral platforms that are capable of accommodating different funding needs, companies are provided with more options than ever before.

As technology can determine the breadth and depth of a SCF offering, its significance for SCF implementation rates will only continue to rise. Businesses today are no longer just interested in achieving working capital benefits, but also operational efficiencies and cost reduction.

The combination of SCF and e-invoicing in particular is hailed as a huge step in helping improve process efficiency. On the other hand, efficiencies can be realised only if suppliers have access to the technology.

Successful SCF programmes should, therefore, have the ability to tailor to each supply chain’s specific needs without imposing a major IT or manual burden on submitting eligible invoices. Technology-based solutions or outsourced services that can deliver tried-and-tested secure capabilities in a way that is accessible for both buyers and suppliers without the need for major IT developments will prove instrumental in this regard.

Technological innovations will also help tighten the link between the financing of working capital and the actual flow of goods, receivables and payables along the value chain. With the increasing sophistication of Enterprise Resource Planning (ERP) and e-invoicing systems, real-time information on the actual inventory flow, for example, can be harnessed by banks to provide swift inventory financing according to changing requirements. This is a welcome development as companies increasingly seek integrated SCF solutions across their entire supply chains to achieve greater efficiency in working capital management.

The financiers’ conclusion on SCF

The financiers’ conclusion on SCF

The last few years have seen SCF advance rapidly as an important working capital tool. However, this rapid growth should be seen in the context of the product still in the early stages of establishing itself as a widespread and standard banking offering.

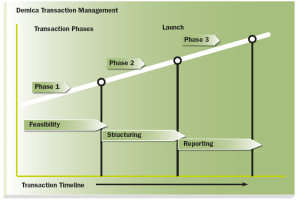

Nevertheless, banks (and in particular major players) are intensifying their efforts into marketing and creating SCF products. At the same time, financial institutions are becoming more efficient at structuring the product, on-boarding suppliers and delivering the service with the help of modern technology platforms that minimise manual efforts in the supply chain.

As SCF continues to expand in scope and widen in appeal, banks that can help their clients integrate physical supply chain processes with the financial supply chain will not only seize new business opportunities, but also help organisations transform their supply chains into a true competitive advantage.

“SCF complements the payments and cash management services we offer,” said one financier at a global bank.

“When examining companies’ working capital, we look at the cash concentration, the payables and the receivables, where they come from and how companies should work with them. We then look at SCF within this context. We also look at investment vehicles for the deployment of any excess cash. So our bank’s approach is a collaborative one that involves people from trade finance, cash management and asset management, working alongside each other to provide our clients an integrated service.”

Another said, “SCF will become an increasingly important product offering for us by 2015. We have made a considerable investment into the platform and the system in the beginning because we want to have the full capability to match the requirements necessary for running a SCF programme on day one instead of having those capabilities developed gradually.” n

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East