In Q3 2013 the corporate banking and trade finance segment in the KSA continued its strong performance against the key measures, with total trade-related contingent liabilities setting record levels. CAROLINE MAGINN reports

Riyad Bank retained its lead in the overall CMM Corporate Banking and Trade Finance League Table but lost its number one position in the trade-related contingent liability table to SABB, whose total of SAR 78bn continued its strong upward momentum.

Total trade-related contingent liabilities, after easing in Q2 from the record highs set in Q1 2013 were resurgent in Q3 and set a new peak of SAR 425bn. The strength was due to the five per cent quarterly increase in letters of guarantee which, at SAR 305bn, breached the SAR 300bn mark for the first time. Ten banks increased their overall portfolios with notable increases at the top of the table with SABB (SAR 78bn, +5.24 per cent) regaining the number one position they achieved for the first time in Q1.

Letters of guarantee made up 72 per cent of trade-related contingent liabilities in Q3 2013, a rise of two per cent on the previous quarter and all 12 banks increased their levels on their books. Eight of the 12 banks reported record figures for the quarter. Double-digit increases were reported by SABB (SAR 58bn, +10 per cent), who took over the lead position from Riyad Bank for the first time, Banque Saudi Fransi (SAR 46bn, +11 per cent) and Bank AlJazira (SAR 3bn, +11 per cent).

In contrast, letters of credit eased very slightly on the quarter (SAR 95.7bn, -0.26 per cent), NCB, which regained top position, and Banque Saudi Fransi (fourth) were the only banks in the dominant top four to increase levels on the quarter. Acceptances, which reached their highest level of SAR 23bn in Q2 2013, were also lower (-14 per cent)

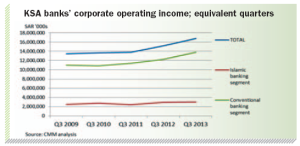

Corporate operating income rose 10 per cent on the equivalent Q3 2012 with the top three banks, National Commercial Bank, Riyad Bank and SABB, each posting in excess of SAR 2bn. Samba and Banque Saudi Fransi reported just under the SAR 2bn figure and Al Rajhi Bank, Arab National Bank and Saudi Hollandi all showing well in excess of SAR 1bn in operating revenues for the first nine months of 2013. Six of the 12 banks reported double digit year-on-year growth.

Total corporate net income showed a 31 per cent increase on Q3 2012 to SAR 11.1bn. Six banks reported corporate net income above SAR 1bn for the period, with NCB and Riyad Bank approaching SAR 2bn. NCB continued its recovery from impairment charges (as did the majority of the other banks), taking over the top position from Riyad Bank and eleven of the 12 banks showed positive momentum year-on-year.

Total KSA banks’ corporate assets rose strongly again in Q3 2013 by 2.5 per cent to SAR 726bn. Eleven of the twelve banks increased their corporate assets robustly; National Commercial Bank, Banque Saudi Fransi, Riyad Bank, Samba and SABB between them, again, account for more than 64 per cent of the total market. All 12 banks posted gains on the equivalent quarter (Q3 2012) with eight posting double-digit gains year-on-year (NCB, Riyad Bank, Samba, Saudi Hollandi Bank, Alinma Bank, Saudi Investment Bank, Bank AlJazira and Bank AlBilad).

Corporate liabilities rose to SAR 624bn with National Commercial Bank, again, a clear market leader with 20.5 per cent of the overall total, at SAR 128bn. This continues a trend for NCB and compares to Q3 2009 when it represented just 11 per cent of the total. Eight banks made double digit percentage point gains in this area on the equivalent Q3 of 2012; NCB +17 per cent). Riyad Bank (SAR 97bn, +10 per cent), SABB (SAR 66bn, +11 per cent), Al Rajhi Bank (SAR 56bn, +31 per cent), Saudi Hollandi Bank (SAR 32bn, +18 per cent), Bank AlJazira (SAR 27bn, +18 per cent), Bank AlBilad (SAR 8.7bn, +15 per cent) and Alinma Bank (SAR 7bn, +17 per cent).

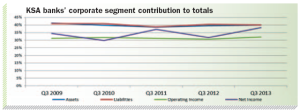

In terms of contribution to totals, corporate banking has continued to be a cornerstone contributing between 30-40 per cent. In terms of assets, total operating income and net income the segment increased its contribution to the total figures. Trade finance, in the form of the trade-related contingent liabilities at the heart of corporates’ needs increased from the record figures set in the first quarter, as mentioned above. As suggested in the previous quarterly reports, this is expected to translate into robust earnings for full-year 2013 and continues the trajectory for the seventh consecutive year. This would appear to be the ideal time for banks to invest to improve their trade finance offerings and there should be no complacency after such a long period of growth as corporates still see a lot of scope for improvement.

SABB still leads in terms of the relative importance of trade-related contingent liabilities whose value rose to the equivalent of 99 per cent of its corporate assets book. The relative importance of corporate assets to total assets is most notable at Banque Saudi Fransi (59 per cent), Alinma Bank and Saudi Hollandi Bank where they represent more than 50 per cent of their respective totals. Corporate liabilities remain the most important segment for Riyad Bank with 58 per cent of total, for Bank AlJazira at 53 per cent and at Banque Saudi Fransi, where the ratio rose two points to 49 per cent. Saudi Hollandi Bank’s corporate segment is responsible for more than 67 per cent of its total operating income for Q3 2013; for both Banque Saudi Fransi (50.5 per cent) and Alinma Bank (49.49 per cent) it contributes around half.

For nine of the 12 banks corporate operating income, the best available indicator for earnings power and customer relationships and origination power in the corporate segment, accounts for more than 30 per cent of actual income generated. The importance of the segment is even more evident in terms of net income; four banks (Saudi Hollandi Bank, Banque Saudi Fransi, Alinma Bank and Riyad Bank) each showing the corporate segment as responsible for more than 60 per cent of their net income. Ten of the 12 banks record corporate segment net income at more than 30 per cent of total, which further testifies to the core importance of the segment.

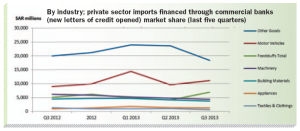

Figures for imports financed by commercial banks by (new letters of credit opened) show a continued fall from the Q1 2013 and the equivalent Q3 2012. This is mainly accounted for, in industry terms, by the dominant Other Goods category (SAR 18bn) dropping by 22 per cent from Q2 2013, which was only partially compensated for by quarterly increases in Motor Vehicles and Foodstuffs.

Exports financed by commercial banks (new letters of credit opened by importing countries) were flat on the quarter at SAR 38bn. The dominant Other Counties category, which includes Asia, was, in fact, stronger at SAR 25bn but there was a lower figures for GCC Countries, which dipped back to levels seen in the equivalent quarter in 2011. Chemicals and plastics dipped slightly whilst the broad other category covering the export success of many individual corporates and SMEs grew as increasingly KSA strong brands gained ground on the back of long planned investment in diversification. n

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East