The Bank Payment Obligation (BPO) continues to build on the pace and substance evidenced by its market debut earlier this year. CAROLINE MAGINN looks at its progress

The Bank Payment Obligation (BPO) continues to build on the pace and substance evidenced by its market debut earlier this year. CAROLINE MAGINN looks at its progress

Having undergone extensive comparisons to letters of credit and many discussions about what it is not, the BPO now has its own affirmative definition. It is expected to sit comfortably alongside documentary letters of credit, guarantees and collections as a new trade finance instrument for the 21st century with a unique set of attributes that can facilitate greater speed, certainty and discrepancy resolution in designated trade transactions.

As only three drafts of the International Chamber of Commerce Banking Commission’s Uniform Rules for Bank Payment Obligations (URBPO) are expected, this will make it the fastest fully fledged trade instrument to the market in the long history of trade finance.

The effort deployed by the ICC’s Banking Commission, SWIFT and their constituent bank and corporate communities signals their collective belief in the future potential of the BPO.

The benefit of strong advocacy and support from the market-infrastructure facilitators cannot be underestimated. Lead by the ICC’s Banking Commission and SWIFT, those working on the URBPO have benefitted from the financial community’s past experience in other market evolutions, where practical matters lagged the market demand creating needless constraints and growing pains, or in the case of eUCP, the right idea at the wrong time.

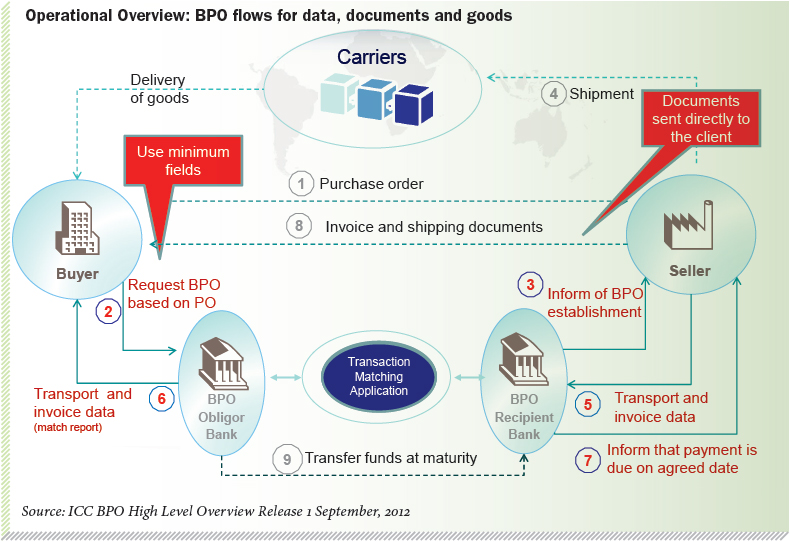

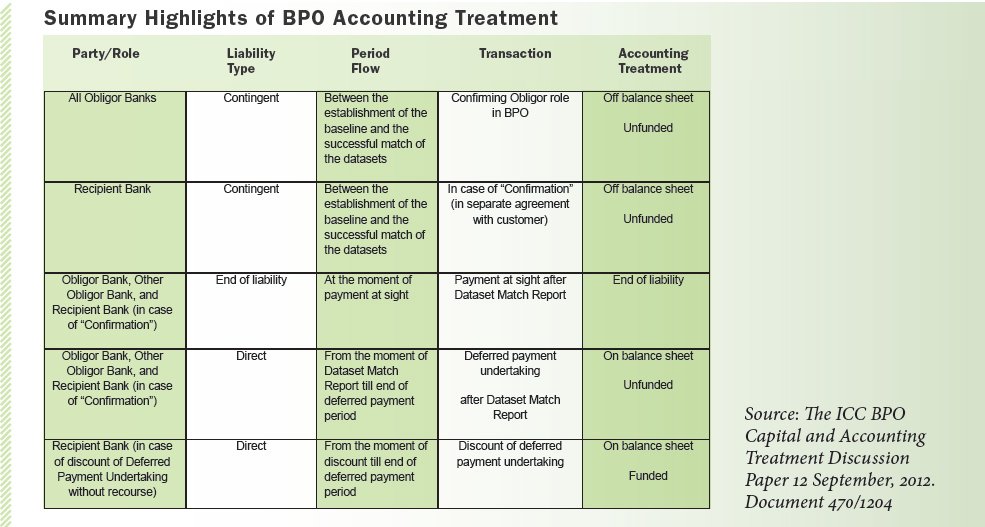

On the BPO project ICC and SWIFT are engaging fully with as many trade finance experts as possible so that all material aspects of the new instrument are fully considered and worked out. Accordingly, there are several key documents prepared by the ICC Banking Commission’s BPO education group currently in circulation. These consider and set out the best international market thinking on the different dimensions to BPO. The documents set out the operational, legal, accounting and technological environments for the new instrument.

Having informed market practitioners ready on the ground will be crucial both to the early success and adoption of the instrument and to its longevity. The awareness raising is crucial for all parties to engage with the new instrument in a fully transparent manner and play their respective roles in approving, issuing, booking and ensuring the overall orderly processing and product management of the same. Harnessing the collective wisdom of the senior trade operations managers who have made the documentary letters of credit a success since UCP was introduced in 1933 together with the new generation of banking technological experts will be key for the BPO to establish the trust critical to its longevity.

The alacrity of the BPO to the market is borne-out by the speed with which Standard Chartered Bank issued the first GCC BPO. It started the process of talking to clients about the product and putting in place the necessary infrastructure and capability in February 2012. It then issued the first BPO for OCTAL Petrochemicals Oman, in May 2012, giving the instrument a short season to fledge.

The number of corporates in the preparation stage to issue BPOs is growing, with approximately 40 corporates globally reported to be currently engaged with banks on this matter. The latter are preparing to join the ranks of OCTAL Petrochemicals Oman and BP Chemicals, which were among the first users of this new instrument in the region earlier this year.

The BPO has become a new option in the ICC Model International Sale Contract (Article 5.5. Version of September, 2012). This facilitates the BPO as a contractual term between buyer and seller making it a readily accessible option for corporates defining their terms of trade. As a result, it is expected that corporates will be choosing this term of trade and expecting banks to support them in this new way of doing trade business.

Forty four banks have confirmed their current or future adoption of the presently available SWIFT Trade Services Utility (TSU) BPO Rules as of 22 October. It is expected that they will also adopt the URBPO when published by the ICC.

Additionally, more than 100 banks are registered to SWIFT’s TSU to support BPO transaction using Transaction Matching (TMA) ISO 20022 messaging standards, which include provision for the BPO. Section 8 of SWIFT’s TSU Service Description provides guidelines for the Customer Terms of Financial Institutions.

These groups of banks include several indigenous banks from the MENA region, including Al Khaliji Bank, Bank Al Etihad, Byblos Bank, Commercial Bank of Dubai and Qatar National Bank as well as global players active in the region such as BNY Mellon, BNP Paribas, Citibank, Deutsche Bank, HSBC, JP Morgan and Standard Chartered.

As discussed at the ICC Supply-Chain Financing Conference on the 4-5 October, 2012, in Paris, the second draft of the URBPO has been released as of 18 September this year. This is being actively debated and commented on by the working groups involved. It is expected that the current industry-wide efforts on the URPBO will be rewarded at the ICC Banking Commission meeting scheduled to take place in Mexico on 12-15 November, 2012. At that meeting, comments on the current second draft are scheduled to be finalised leading to the third and final draft for review and adoption.

This project is on track and the final URBPO are still targeted for release in Q2 2013, expected to be announced at the ICC Banking Commission meeting in Lisbon between 15-19 April, 2013.

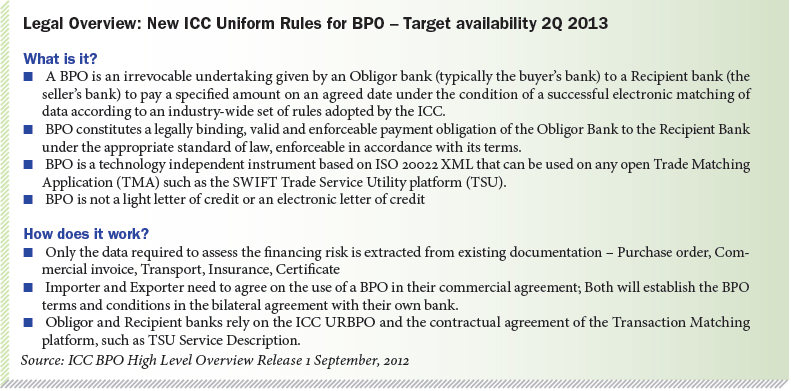

Legal Overview: New ICC Uniform Rules for BPO – Target availability 2Q 2013

What is it?

- A BPO is an irrevocable undertaking given by an Obligor bank (typically the buyer’s bank) to a Recipient bank (the seller’s bank) to pay a specified amount on an agreed date under the condition of a successful electronic matching of data according to an industry-wide set of rules adopted by the ICC.

- BPO constitutes a legally binding, valid and enforceable payment obligation of the Obligor Bank to the Recipient Bank under the appropriate standard of law, enforceable in accordance with its terms.

- BPO is a technology independent instrument based on ISO 20022 XML that can be used on any open Trade Matching Application (TMA) such as the SWIFT Trade Service Utility platform (TSU).

- BPO is not a light letter of credit or an electronic letter of credit

How does it work?

- Only the data required to assess the financing risk is extracted from existing documentation – Purchase order, Commercial invoice, Transport, Insurance, Certificate

- Importer and Exporter need to agree on the use of a BPO in their commercial agreement; Both will establish the BPO terms and conditions in the bilateral agreement with their own bank.

- Obligor and Recipient banks rely on the ICC URBPO and the contractual agreement of the Transaction Matching platform, such as TSU Service Description.

Conclusion: Given the lack of historical data and commercial experience around a new instrument such as the BPO, the current discussion related to capital adequacy is framed almost entirely with reference to recent experience around traditional trade products. Early engagement of the Basel Committee and national regulators, as well as other parties in a position to influence the application of capital rules to the BPO will be a key element of the ICC’s and the industry’s approach going forward.

The BPO can, according to corporates with a track record of issuance, add trade terms flexibility, reduce costs and free up usage of bank credit lines. While the take-up is initially likely to be among larger importers and exporters, this will help to build a critical mass and a track record for smaller companies to follow. Key users are expected to include corporates engaged in repeat annuity petro and non-petro-chemical flows engaged in primary trading and re-export activity.

Given that the BPO can remove some of the expensive and painful delays and inefficiencies inherent in trade finance – loudly talked about by corporates to their bankers – there is likely to be a good take-up of the instrument in the GCC, and it is believed that the BPO will support improved trade finance liquidity during a continued period of economic and political uncertainty.

Local regulators in the GCC are urged to give their full support to the URBPO as part of the ICC Banking Commission’s wider efforts on trade finance.

For our part, Cash Management Matters and Cash and Trade Magazine will be partnering with the ICC Banking Commission, and with ECAs banks and their corporate clients in the GCC, to gear up for the issuance and product management of this new instrument. n

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East