Our exlusive ranking reveals the full impact of the global economic crisis upon the region’s biggest companies. although the value of many stock exchanges actually increased during the course of the calendar year, the lion’s share of Middle Eastern firms suffered a fall in market capitalisation over the last 12 months. With oil prices again buoyant, the situation now looks relatively stable, but there is no forgetting the fear that ran through the markets most of 2009.

Saudi Basic Industries Corporation (SABIC) remains the region’s largest company with market capitalisation of $65.9bn, although this is a substantial fall from a market cap of $84.1bn at the same time last year. similarly,another two saudi firms, saudi Telecom and Al Rajhi banking & Investment Corporation, retain the next two spots, although their positions have reversed on the situation twelve months earlier. While the capitalisation of the former has fallen from $34.2bn to $23.5bn, the latter has fared somewhat better, with a valuation of $28.4bn in comparison with $31.7bn.

The rise of Qatari firms in this table is particularly interesting. although the number of companies from the emirate within the region’s Top 100 has actually fallen from 14 to 13, they are making their presence felt in the upper echelons of the table. Industries Qatar moves up from sixth to fifth, while Qatar national bank rose from 14th to 10th with market capitalisation of $12.3bn, just slightly down on last year’s performance. While most of the rest of the region has suffered from slow economic growth or even recession, Qatari GdP increased 11% last year on the back of relentless gas industry expansion and this is reflected in the strength of the country’s listed companies. Given the number of projects due to come on stream in the emirate over the next year, it would be no surprise to see more Qatari firms listed in the Top 100 ranking next year. Most of the companies listed specialise in one of four sectors: financial services, construction, telecoms and petrochemicals.despite Saudi Telecom’s decline in value, the telecoms sector as a whole has taken an even tighter grip on the table. saudi Telecom, emirates Telecommunications Corporation, Itissalat al Maghreb, Orascom Telecom and Zain secure five out of the top eight positions, although four out of the five have suffered sizeable falls in market value. The exception is Orascom Telecom, which moves up from 11th with $15.1bn to seventh with market capitalisation of $15.2bn; an outstanding achievement given the falls recorded elsewhere.

A breakdown of the Top 100 companies by country underlines the economic domination of the Gul Cooperation Council (GCC) states in the MENA region. as expected Saudi Arabia is the best-represented country with 30 firms in the Top 100.

The bigger picture

Over the course of 2009, the worst falls in stock values were seen in January and February but these forced governments across the Gulf to draw up a succession of investment packages to try to stimulate their respective economies. a series of more localised crises, including dubai World’s ongoing debt problems, continued to shake confidence during the rest of the year.

however, forecasts of low oil prices proved to be wide of the mark, as the barrel price rose sharply from $40 in april to $70 by july, boosting the fortunes of oil producers in the Gulf and north africa. Most forecasters, including the World bank and the IMF, have published far more optimistic oil price predictions for 2010 than they did at the start of last year.

Over the course of the calendar year, saudi arabia’s Tadawul all share Index performed best, rising 27.46% to reach 6,121 points by the end of december. Oman’s MSM-30 Index increased 17.05% and the United Arab Emirates 11.88% over the same period. however, Bahrain’s Global Index fell 17.94% and Kuwait’s Global share Index down 9.78%. a combination of aggressive selling and periodic buying helped boost trade volumes across the GCC region by 16.5% during 2009.

As ever, the economic fortunes of the Gulf states in particular rest on global demand for oil and gas. The IMF now forecasts that growth in the GCC states taken as a whole will increase by a healthy 5.2% in 2010 but the pace of the recovery across the wider region remains uncertain, especially with some predictions of a double dip recession. Perhaps the most interesting feature to watch out for in next year’s Top 100 Arab Companies is hether the non-GCC states continue to make headway against a backdrop of more buoyant oil and gas prices. Only then will the region really begin to move beyond its hydrocarbon dependency.

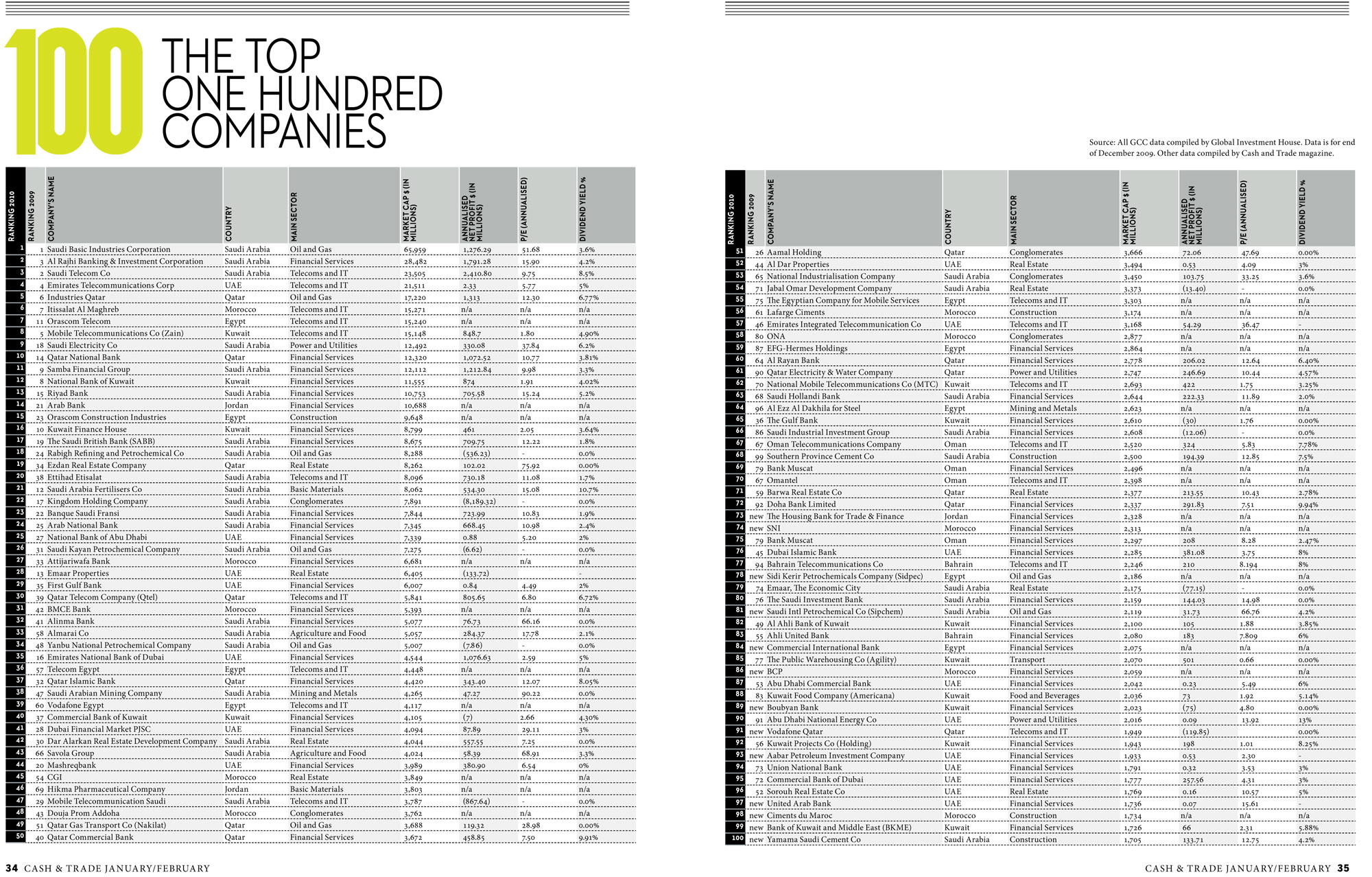

RANKING 2010 | RANKING 2009 | COMPANY’S NAME | COUNTRY | MAIN SECTOR | MARKET CAP $ (IN MILLIONS) | ANNUALISED NET PROFIT $ (IN MILLIONS) | P/E (ANNUALISED) | DIVIDEND YIELD %

1 1 saudi basic Industries Corporation saudi arabia Oil and Gas 65,959 1,276.29 51.68 3.6%

2 3 al rajhi banking & Investment Corporation saudi arabia financial services 28,482 1,791.28 15.90 4.2%

3 2 saudi Telecom Co saudi arabia Telecoms and IT 23,505 2,410.80 9.75 8.5%

4 4 emirates Telecommunications Corp uae Telecoms and IT 21,511 2.33 5.77 5%

5 6 Industries Qatar Qatar Oil and Gas 17,220 1,313 12.30 6.77%

6 7 Itissalat al Maghreb Morocco Telecoms and IT 15,271 n/a n/a n/a

7 11 Orascom Telecom egypt Telecoms and IT 15,240 n/a n/a n/a

8 5 Mobile Telecommunications Co (Zain) Kuwait Telecoms and IT 15,148 848.7 1.80 4.90%

9 18 saudi electricity Co saudi arabia Power and utilities 12,492 330.08 37.84 6.2%

10 14 Qatar national bank Qatar financial services 12,320 1,072.52 10.77 3.81%

11 9 samba financial Group saudi arabia financial services 12,112 1,212.84 9.98 3.3%

12 8 national bank of Kuwait Kuwait financial services 11,555 874 1.91 4.02%

13 15 riyad bank saudi arabia financial services 10,753 705.58 15.24 5.2%

14 21 arab bank jordan financial services 10,688 n/a n/a n/a

15 23 Orascom Construction Industries egypt Construction 9,648 n/a n/a n/a

16 10 Kuwait finance house Kuwait financial services 8,799 461 2.05 3.64%

17 19 The saudi british bank (sabb) saudi arabia financial services 8,675 709.75 12.22 1.8%

18 24 rabigh refining and Petrochemical Co saudi arabia Oil and Gas 8,288 (536.23) – 0.0%

19 34 ezdan real estate Company Qatar real estate 8,262 102.02 75.92 0.00%

20 38 ettihad etisalat saudi arabia Telecoms and IT 8,096 730.18 11.08 1.7%

21 12 saudi arabia fertilisers Co saudi arabia basic Materials 8,062 534.30 15.08 10.7%

22 17 Kingdom holding Company saudi arabia Conglomerates 7,891 (8,189.32) – 0.0%

23 22 banque saudi fransi saudi arabia financial services 7,844 723.99 10.83 1.9%

24 25 arab national bank saudi arabia financial services 7,345 668.45 10.98 2.4%

25 27 national bank of abu dhabi uae financial services 7,339 0.88 5.20 2%

26 31 saudi Kayan Petrochemical Company saudi arabia Oil and Gas 7,275 (6.62) – 0.0%

27 33 attijariwafa bank Morocco financial services 6,681 n/a n/a n/a

28 13 emaar Properties uae real estate 6,405 (133.72) –

29 35 first Gulf bank uae financial services 6,007 0.84 4.49 2%

30 39 Qatar Telecom Company (Qtel) Qatar Telecoms and IT 5,841 805.65 6.80 6.72%

31 42 bMCe bank Morocco financial services 5,393 n/a n/a n/a

32 41 alinma bank saudi arabia financial services 5,077 76.73 66.16 0.0%

33 58 almarai Co saudi arabia agriculture and food 5,057 284.37 17.78 2.1%

34 48 yanbu national Petrochemical Company saudi arabia Oil and Gas 5,007 (7.86) – 0.0%

35 16 emirates national bank of dubai uae financial services 4,544 1,076.63 2.59 5%

36 57 Telecom egypt egypt Telecoms and IT 4,448 n/a n/a n/a

37 32 Qatar Islamic bank Qatar financial services 4,420 343.40 12.07 8.05%

38 47 saudi arabian Mining Company saudi arabia Mining and Metals 4,265 47.27 90.22 0.0%

39 60 Vodafone egypt egypt Telecoms and IT 4,117 n/a n/a n/a

40 37 Commercial bank of Kuwait Kuwait financial services 4,105 (7) 2.66 4.30%

41 28 dubai financial Market PjsC uae financial services 4,094 87.89 29.11 3%

42 30 dar alarkan real estate development Company saudi arabia real estate 4,044 557.55 7.25 0.0%

43 66 savola Group saudi arabia agriculture and food 4,024 58.39 68.91 3.3%

44 20 Mashreqbank uae financial services 3,989 380.90 6.54 0%

45 54 CGI Morocco real estate 3,849 n/a n/a n/a

46 69 hikma Pharmaceutical Company jordan basic Materials 3,803 n/a n/a n/a

47 29 Mobile Telecommunication saudi saudi arabia Telecoms and IT 3,787 (867.64) – 0.0%

48 43 douja Prom addoha Morocco Conglomerates 3,762 n/a n/a n/a

49 51 Qatar Gas Transport Co (nakilat) Qatar Oil and Gas 3,688 119.32 28.98 0.00%

50 40 Qatar Commercial bank Qatar financial services 3,672 458.85 7.50 9.91%

51 26 aamal holding Qatar Conglomerates 3,666 72.06 47.69 0.00%

52 44 al dar Properties uae real estate 3,494 0.53 4.09 3%

53 65 national Industrialisation Company saudi arabia Conglomerates 3,450 103.75 33.25 3.6%

54 71 jabal Omar development Company saudi arabia real estate 3,373 (13.40) – 0.0

55 75 The egyptian Company for Mobile services egypt Telecoms and IT 3,303 n/a n/a n/a

56 61 Lafarge Ciments Morocco Construction 3,174 n/a n/a n/a

57 46 emirates Integrated Telecommunication Co uae Telecoms and IT 3,168 54.29 36.47 –

58 80 Ona Morocco Conglomerates 2,877 n/a n/a n/a

59 87 efG-hermes holdings egypt financial services 2,864 n/a n/a n/a

60 64 al rayan bank Qatar financial services 2,778 206.02 12.64 6.40%

61 90 Qatar electricity & Water Company Qatar Power and utilities 2,747 246.69 10.44 4.57%

62 70 national Mobile Telecommunications Co (MTC) Kuwait Telecoms and IT 2,693 422 1.75 3.25%

63 68 saudi hollandi bank saudi arabia financial services 2,644 222.33 11.89 2.0%

64 96 al ezz al dakhila for steel egypt Mining and Metals 2,623 n/a n/a n/a

65 36 The Gulf bank Kuwait financial services 2,610 (30) 1.76 0.00%

66 86 saudi Industrial Investment Group saudi arabia financial services 2,608 (12.06) – 0.0%

67 67 Oman Telecommunications Company Oman Telecoms and IT 2,520 324 5.83 7.78%

68 99 southern Province Cement Co saudi arabia Construction 2,500 194.39 12.85 7.5%

69 79 bank Muscat Oman financial services 2,496 n/a n/a n/a

70 67 Omantel Oman Telecoms and IT 2,398 n/a n/a n/a

71 59 barwa real estate Co Qatar real estate 2,377 213.55 10.43 2.78%

72 92 doha bank Limited Qatar financial services 2,337 291.83 7.51 9.94%

73 new The housing bank for Trade & finance jordan financial services 2,328 n/a n/a n/a

74 new snI Morocco financial services 2,313 n/a n/a n/a

75 79 bank Muscat Oman financial services 2,297 208 8.28 2.47%

76 45 dubai Islamic bank uae financial services 2,285 381.08 3.75 8%

77 94 bahrain Telecommunications Co bahrain Telecoms and IT 2,246 210 8.194 8%

78 new sidi Kerir Petrochemicals Company (sidpec) egypt Oil and Gas 2,186 n/a n/a n/a

79 74 emaar, The economic City saudi arabia real estate 2,175 (77.15) – 0.0%

80 76 The saudi Investment bank saudi arabia financial services 2,159 144.03 14.98 0.0%

81 new saudi Intl Petrochemical Co (sipchem) saudi arabia Oil and Gas 2,119 31.73 66.76 4.2%

82 49 al ahli bank of Kuwait Kuwait financial services 2,100 105 1.88 3.85%

83 55 ahli united bank bahrain financial services 2,080 183 7.809 6%

84 new Commercial International bank egypt financial services 2,075 n/a n/a n/a

85 77 The Public Warehousing Co (agility) Kuwait Transport 2,070 501 0.66 0.00%

86 new bCP Morocco financial services 2,059 n/a n/a n/a

87 53 abu dhabi Commercial bank uae financial services 2,042 0.23 5.49 6%

88 83 Kuwait food Company (americana) Kuwait food and beverages 2,036 73 1.92 5.14%

89 new boubyan bank Kuwait financial services 2,023 (75) 4.80 0.00%

90 91 abu dhabi national energy Co uae Power and utilities 2,016 0.09 13.92 13%

91 new Vodafone Qatar Qatar Telecoms and IT 1,949 (119.85) 0.00%

92 56 Kuwait Projects Co (holding) Kuwait financial services 1,943 198 1.01 8.25%

93 new aabar Petroleum Investment Company uae financial services 1,933 0.53 2.30 –

94 73 union national bank uae financial services 1,791 0.32 3.53 3%

95 72 Commercial bank of dubai uae financial services 1,777 257.56 4.31 3%

96 52 sorouh real estate Co uae real estate 1,769 0.16 10.57 5%

97 new united arab bank uae financial services 1,736 0.07 15.61 –

98 new Ciments du Maroc Morocco Construction 1,734 n/a n/a n/a

99 new bank of Kuwait and Middle east (bKMe) Kuwait financial services 1,726 66 2.31 5.88%

100 new yamama saudi Cement Co saudi arabia Construction 1,705 133.71 12.75 4.2%

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East