The GCC bond and sukuk markets are now firmly on the radar screens of global investors, according to the National Bank of Abu Dhabi

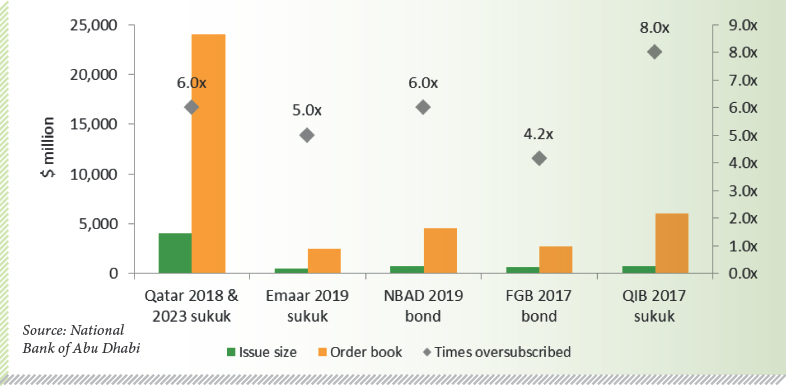

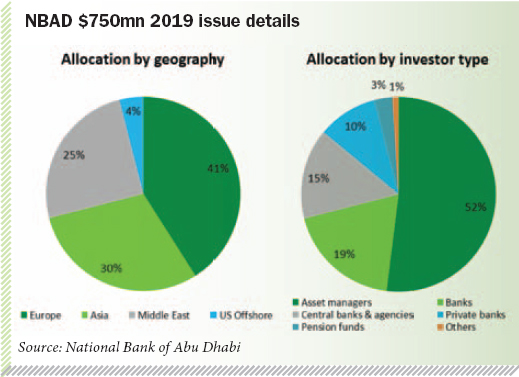

In the middle of Ramadan, when GCC markets are normally quiet, the National Bank of Abu Dhabi launched and concluded a $750m-bond issue, building an order book of circa $4.5bn in less than four hours. A few weeks earlier, the government of Qatar concluded a $4bn sukuk issue. These deals show clearly that the GCC fixed income markets – bonds and sukuk – are thriving.

Granted, these markets are still somewhat nascent relative to fixed income markets in more developed regions such as Asia, Europe and the US. Still, GCC bond markets figure firmly in the investment strategy of large institutional investors around the world. The largest and most prominent hedge funds, pension funds, and others, are actively investing in the region – and eager for further opportunities. An analysis of the market shows visibly that it is maturing faster than anticipated and opportunities in it continue to increase.

Current state of play

While the GCC bond and sukuk markets are clearly smaller and less developed than some others around the world, the growth has been significant to say the least. For example, we now have well over 120 bond and sukuk instruments that are actively traded in the secondary market (this number would be even larger if we included non-USD denominated transactions).

Issuance of new bonds and sukuk in the GCC during 2011 amounted to some $20bn, and thus far in 2012 we have already reached the $23bn mark, with some sizeable transactions yet to be printed before the end of the year. As more borrowers in the region begin to use the debt capital markets as a funding strategy, and as the investor base continue to gain greater confidence in the GCC markets, we see this positive momentum rising.

Misconceptions linger

We still have far too many conversations with people who have the misconception that there is no secondary market for GCC bonds and sukuk. These people, from both within the region and beyond, are under the impression that if you buy such GCC paper you are effectively stuck with it until maturity. However, this is not the case. There is an active and liquid secondary market for GCC bonds and sukuk, which provides very interesting opportunities for both investors and borrowers.

Of course there is a need for more investors, and, indeed, borrowers, to be made aware of this market, although to a certain extent this will happen over time as the market develops. Nevertheless, it is important to highlight that awareness and also appetite for this market has come a long way over the past two years or so.

We would go so far as to say that the investor base for GCC fixed income is now truly global. In fact ,we are seeing global institutional investors actively putting their money to work in this market with a wide range of interest – from investors that are primarily focused on the blue-chip credits in the region, such as Abu Dhabi sovereign or Qatar sovereign, to those that are looking for more “yieldy” assets such as some of the Dubai Inc credits.

Global awareness and appetite of the GCC fixed income market can be further illustrated by looking at some recent bond and sukuk issues that came to the market from this region.

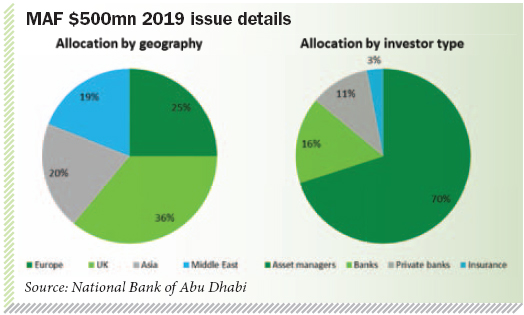

For example, in the latest bond offering from NBAD, circa 75 per cent was bought by investors from outside the MENA region (see chart below). Similarly, in the recent deals from Emaar and MAF, the proportion bought by international investors was 52 per cent and 81 per cent, respectively. Such data clearly demonstrates that international investors are comfortable with putting their money to work in this region, and, moreover, they see the value that some of the GCC bonds and sukuk offer.

Relative value

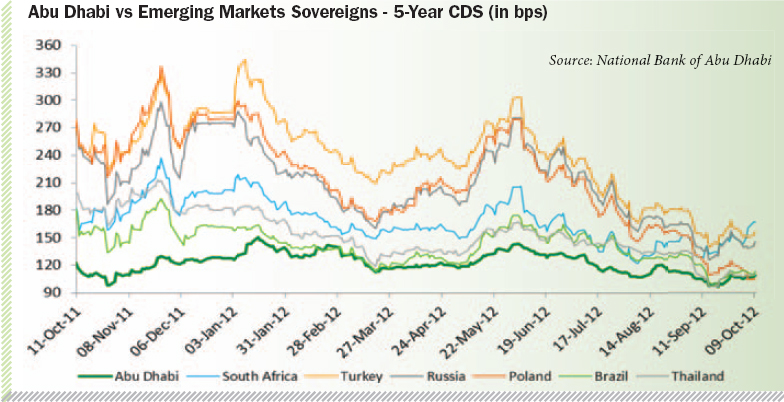

The challenges faced in other regions of the world has made the relative value and attractiveness of the GCC even more apparent. For instance, the Abu Dhabi sovereign, compared to other prominent emerging market peers such as, say, Turkey, South Africa, Russia, Poland, Brazil, and Thailand, is trading at the tightest spread of all of these credits – in other words, the markets (ie investors) regard Abu Dhabi as the highest credit quality compared to them (see chart below).

That says much, especially in view of the fact that the peers are pretty solid credits in their own right. A similar picture emerges if we compare some of the blue-chip banks and corporates in the region with their peers in the more developed regions of the world.

That says much, especially in view of the fact that the peers are pretty solid credits in their own right. A similar picture emerges if we compare some of the blue-chip banks and corporates in the region with their peers in the more developed regions of the world.

Equally, there are several examples of bonds from this region that trade at a “premium” (higher spread) comparable to the more developed countries, which presents investors a compelling proposition as they benefit from the solid credit quality that borrowers from this region often bring while still getting paid a higher return purely due to the region and geopolitical arena in which our credits are based. This makes it a win-win situation for the investors.

Hence, would an international investor buy a high single-A or double-A rated bond from this region versus a comparable bond from another part of the world and take advantage of the spread pick-up (“Middle East premium”) that they can get? For sure! In fact, this is precisely the kind of relative value trade that many international investors are putting on their books.

GCC corporates – access to debt capital markets

The GCC bond and sukuk issuance has been generally dominated by sovereigns or entities that are owned by the respective governments in the region; for example IPIC, TDIC, Mubadala, etc in Abu Dhabi, DEWA, etc in Dubai, QTel, etc in Qatar, and so on. Investors have taken comfort from the government ownership of these entities, despite the lack of any explicit guarantees from the government in respect of these entities and their liabilities, and hence there has been substantial investor demand for bonds and sukuk issued by these entities – in both the primary and secondary markets.

While this presents excellent funding opportunities for government-related entities (GRE) in the region, a key question that remains unanswered is whether non-GRE corporates – ie companies that don’t have the “halo” of government ownership – do in fact have access to the markets if they wish to raise finance via conventional bonds or sukuk.

To date, there haven’t been many such stand-alone corporates that have tried to access the debt capital markets. However, one example that is worth referring to is that of Majid Al Futtaim Group (MAF) in Dubai. The company successfully raised $400m from a sukuk deal in January 2012, and then a further $500m from a conventional bond transaction in June 2012.

Investor demand, from this region as well as internationally, for the two deals from MAF was very decent indeed. Based on our discussions with clients, it seems that institutional investors in the GCC and globally actually found it quite refreshing that they had the opportunity to invest in a stand-alone corporate that didn’t come with the usual concerns/questions that GREs often bring in terms of explicit versus implicit guarantees from the government and likelihood of external support in the event of any financial distress.

In the case of MAF, investors felt that it was more a case of “what you see is what you get” – in other words, investors simply examined the information that MAF provided in terms of financial and non-financial disclosures, track record, credit ratings, etc, and took a view on whether they were comfortable with the credit quality of the company and decided whether or not to buy the paper being offered.

Investors welcomed the “simplicity” of the investment proposal and also the fact that these deals from MAF brought some diversification to the market and provided broader choice to those looking to invest in GCC corporates.

Notwithstanding the positive response to the MAF deals, the question of whether such non-GRE corporates can access the debt capital markets still exists in the minds of potential borrowers.

Our view on the matter is that such funding opportunities do indeed exist, although there are certain key criteria that would better facilitate such access to funding (or conversely prohibit access), including among others:

1) credit ratings – non-GRE corporate borrowers from this region would find it much more difficult to access the capital markets if they didn’t have ratings from at least two of the main agencies (Standard and Poors’, Moody’s, Fitch)

2) good track record in terms of financial performance

3) transparency and corporate governance. We would expect that over time we should see more stand-alone corporates from the GCC access the debt capital markets, especially as they grow to a size where the need to diversify their funding sources away from relationship banks becomes significant.

Global cloud with silver lining for GCC

Many of us continue to spectate, analyse and sometimes even opine as the situation in the Eurozone continues to bubble away. Started initially by concerns over Ireland and Greece, the situation in Europe appears to become more complex, especially as we witness practically every day new headlines about the political and financial saga that is unfolding. Investor sentiment, globally, remains on a rollercoaster.

Non-experts on the situation rely on what is read and heard in the media and from the economists and political commentators that have the requisite expertise. Much of this leads us to believe that it is difficult to see any near-term solution to the current problems. This is why one of the only plausible conclusions that we can draw is that the Eurozone will continue to muddle along and apply short-term fixes to what seem like longer-term problems. Uncertainty is, therefore, here to stay for some time.

While all of this translates into a substantially grey cloud that hangs over investors around the world, there is, in our view, something of a silver lining for the GCC region. After all, despite the ongoing uncertainty in Europe, and indeed the US and parts of Asia, global investors still have to put their money to work. They can’t keep all their holdings in cash for an unlimited period of time, and, frankly speaking, these money managers continue to search for either (a) a safe place to park their cash, or (b) yield, or sometimes even both!

The fixed income opportunities in the GCC markets tick these boxes and hence we have seen substantial interest and inflows from international investors. Furthermore, given the protracted nature of the uncertainties on the global macro stage, we see this interest in GCC bonds and sukuk continuing or even increasing over the near to medium term. Good news for potential borrowers in this region.

The GCC bond and sukuk markets offer substantial potential to shift up a gear and take it to the next level. However, in our view, there are certain requirements that would have to be met in order for this to happen, which include the following:

- Better transparency and access to management teams for investors – while this has been spoken about for a long time, it remains a key issue with international investors in particular

- Improved (quality and frequency) financial and non-financial disclosure combined with enhanced investor relations and communication with investors globally – many entities in the region have made substantial progress on this, with some already achieving best international practice; nevertheless, more work is needed

- Regulatory environment needs to be further tightened and enhanced to generate greater credibility and comfort among investors – some encouraging progress on this from central banks and regulators in the GCC. However, we need further improvement

- Robust and more thorough legal framework and application thereof – the issue of creditor protection is never far from the minds of investors and recent debt restructurings in the region have further highlighted this point

- More comprehensive and liquid benchmark curves for dollar denominated sovereign bonds from governments in this region – for international investors, it becomes more difficult to evaluate new corporate bond issues if there are no government curves to benchmark against, hence more comprehensive sovereign curves would attract more investors and also improve pricing for the borrowers in the medium term

- Discount windows with central banks in the region – the UAE central bank recently announced the intention to open such a discount window, which should be very positive for GCC bond and sukuk markets as and when it opens

- Increased volumes, in terms of both primary market issuance and secondary market trading – this will, of course, happen over time as the market develops and more investors are engaged.

Taking the bull by the horns

Rather than shying away from the issues noted above, namely those factors that need to be addressed in order to take the GCC bond and sukuk markets to the next level, we should take the bull by the horns and tackle them. Doing so can result in a beneficial situation for the GCC borrowers, global investors, and Gulf economies alike.

After all, the issues discussed above aren’t insurmountable. Over time we can address them and thus move towards getting more global investors to put their money to work by investing in GCC bonds and sukuk. Surely this would bring more funding opportunities to GCC borrowers, broader investment opportunities for global investors, and deeper and more active capital markets for the GCC economies. Win-win-win.

Positive outlook

GCC bond and sukuk markets have come a long way, especially over the past five years or so. With the investor base now truly global, borrowers from this region have access to far greater liquidity if they choose to use bonds or sukuk as part of their funding strategies. Furthermore, now that we have the interests of international investors and have put the GCC markets firmly on their radar screens, the future prospects for these markets are very exciting indeed. Yes, we have some work to do, but, indeed, the potential for GCC bond and sukuk markets is huge. Although “watch this space” has become something of a cliché, in this particular case it is certainly true. More to follow. Much more indeed.

Written by: Chavan Bhogaita

Financial Markets Division

National Bank of Abu Dhabi

Email: Chavan.Bhogaita@nbad.com

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East