This article, by DILRUKSHAN ABEYSINGHE, senior sales manager, payments and cash management HSBC Middle East,

United Arab Emirates, provides an overview of current approaches and issues relating to cash management, specifically the management of working capital. Among the points it makes are the following:

• Using supplier credit as a source of capital may seem cost-efficient but carries potential risks

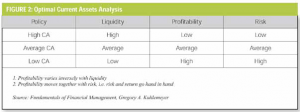

• Deciding the optimal level of working capital can be difficult as the level of current assets held affects a company’s liquidity, profitability and risk

• Channel financing provides a useful funding solution for small and medium-sized partners in the value chain and helps to reduce counterparty risk

Cash management has never been as important to a company as in today’s challenging environment. The cornerstone of successful cash management is effective management of working capital. No matter how big the organisation and how strong its ability to source external financing, whether through capital/equity markets or banking channels, working capital is the on-going source of funds that a company uses to service those financing avenues and repay its loans.

Prior to the global financial crisis, many companies took it for granted that banks would always be willing and able to provide additional funding as and when it was required. This has proved not to be the case.

However, the crisis showed that companies using internal sources of funding have been able to face challenges more confidently than those that relied on banks. Companies that are successful managers of liquidity, working capital and risk are largely financially self-reliant, do not extend beyond their debt-servicing capabilities and are prepared for any changes in the market.

Traditionally, a prescriptive approach was used in cash management, but now treasurers need to be more creative in their thinking to anticipate contingencies. To achieve this, treasurers need to integrate their traditional duties with new techniques made available through technology. This enables them to have a wider reach across the organisation and better control and visibility over cash flows.

Safeguarding working capital

Companies should aim to maintain sufficient readily cashable resources not only to ensure payment obligations are met as and when they fall due, but also to ensure that these obligations are met at a reasonable cost. This is primarily achieved by maintaining a broad base of funding sources and a well-diversified portfolio of highly liquid assets. As the best source of liquidity is from within an organisation, the treasurer should look at solutions to liberate cash through optimum working capital management.

When a company’s current liabilities exceed its non-cash current assets, it has negative working capital. This may be a result of the company using supplier credit as a source of capital. This strategy is commonly employed by the supermarket industry, and has been used effectively to support growth.

While seemingly cost-efficient, there are potential risks to this strategy. First, supplier credit is not really “free” as any delay in supplier bill payment may lead to loss of cash discounts and other price reductions. Therefore, a company that is considering supplier credit as a source of capital needs to bear this in mind when comparing it to traditional forms of borrowing.

Secondly, negative non-cash working capital is generally viewed as a source of default risk. This may result in a downgrading of the company’s external ratings and an increase in the interest rates paid by the company to its financiers. On a more practical note, there can be challenges in forecasting working capital requirements.

However, there is no reason why a company cannot use supplier credit as a source of capital in the short term, nor should it be assumed that non-cash working capital will become more negative over time. In the longer term, it is likely that positive working capital will be necessary as the company’s requirements or market conditions change.

Thus, while negative working capital may be a sign of managerial efficiency in businesses operating on a mostly cash basis, in other types of businesses it is a sign that a company may be facing bankruptcy or is in serious financial trouble.

A major part of working capital management is the financing of assets and other payables/accruals that arise in the firm’s day-to-day operations. For this, treasurers need to decide the combination of shortand- long-term financing to use to support the company’s current assets. Outlined below are the three main approaches.

The hedging (or maturity matching) approach. A company can hedge risks by offsetting each asset with a financing instrument of the same approximate maturity.

– Fixed assets and the non-seasonal portion of current assets are financed with long-term debt and equity (long-term profitability of assets to cover the long-term financing costs of the firm).

– Seasonal needs are financed with short-term loans (under normal operations sufficient cash flow is expected to cover the short-term financing cost). This approach does not take into account spontaneous financing.

The Conservative approach. A company can reduce risks associated with short-term borrowing by using a larger proportion of long-term financing.

The aggressive approach. A company increases risks associated with short-term borrowing by using a larger proportion of short-term financing.

The benefits, risks and results associated with the conservative and aggressive approaches are shown in Figure 1.

Industry trends

Different industries tend to adopt particular approaches to working capital management. Cash businesses such as the supermarket, food and beverage and hotel industries have fewer trade receivables and lower levels of current assets. They tend to adopt an aggressive approach to working capital management, borrowing short term to reduce interest charges.

In an environment of reducing bank financing lines, these industries tend to turn towards extended supplier credit to finance short-term capital requirements and are more likely to experience negative working capital.

On the other hand, capital-intensive businesses such as the construction and engineering industries tend to be more conservative in their working capital management and carry more long-term debts. Short-term working capital requirements are usually met via progressive cash payments by project developers.

In a tight liquidity environment, progressive payments may be delayed and bank lines withdrawn, which may result in some construction companies negotiating longer credit terms with their suppliers as well as drawing down from long-term funding lines to support their day-to-day operating requirements.

Interdependency

Deciding the optimal level of working capital can be a challenge for treasurers. As Figure 2 illustrates, working capital (ie profitability), liquidity and risk are interdependent: A higher level of current assets generates greater liquidity, but a lower level of current assets allows for a higher return on investment.

A declining level of current assets induces risks such as:

Decreasing cash, which will reduce the company’s ability to meet financial obligations Loss in sales, as a result of stricter credit policies reducing receivables Lower inventory levels relating to increased stockouts and lost sales

Risk and financing for SMEs

Traditionally, treasurers focused on business and operational risk, and risks relating to interest rates, foreign exchange and credit. However, with increasing globalisation, several new areas of “non-traditional” risk, such as counterparty risk, have become of interest.

With companies now extending their operations beyond their domestic market, visibility of finances and investments across local and international geographies has become a necessary requirement. However, with many global banks offering electronic banking platforms with international coverage, treasurers can access their bank accounts and make transactional decisions online. As well as mitigating operational risk, such platforms also allow faster implementation of treasury decisions and internal cost savings through better allocation of resources.

As a result of today’s extended value chains, companies face greater risks when collecting sales receivable from customers. With lenders scrutinising a company’s repayment capability more than before, some small and medium-sized enterprises (SMEs) transacting with multinational corporations (MNCs) and large local corporations (LLCs) are finding it difficult to source a credit line from their banks. And even if they are able to source a credit line, the risk premium factored into the interest rate will be comparatively high.

The same issue is attributable to an SME supplying raw material to an established corporate entity. These buyers and suppliers form an integral part of the value chain to a company. Hence, managing the risk of default and the long-term sustainability of these SMEs’ business is indirectly managing the long-term profitability of the MNC or LLC. This is also because finding alternate channels of supply and demand is a financial cost to the company, and such delays may lead to competitors taking advantage to capitalise.

Channel financing

MNCs and LLCs can support their SME business partners by introducing them to their own banking partners. The bank will view the SME’s long-standing relationship with the MNC or LLC positively and may extend a credit line to the SME based on the volume and value of the SME’s business transactions with the MNC or LLC.

With the bank evaluating the financials of the SME and advising it on how to manage its business prudently, the MNC or LLC will be assured of the long-term sustainability of its partner and may benefit from a reduction in the costs previously incurred in monitoring the SME.

Known as “channel financing”, this solution reduces counterparty risk, creates more loyalty within the value chain and helps to consolidate the ongoing business relationship without the reliance for extended credit and trade discounts – a win-win situation for all the parties concerned. It is similar to factoring, but differs to the extent that the bank has a closer relationship with the channel partner and financing costs can be cheaper.

Conclusion

Managing liquidity, working capital, risk and profitability go hand in hand. Deciding the optimum level of working capital is not easy and due consideration should be given to the entire value chain. Operating expenses are a crucial element in managing dayto- day cash requirements and can be controlled through automation and outsourcing of non-value adding activities.

Treasurers and finance managers need to be aware of the indirect expenses incurred by a company in initiating, recording and reconciling transactions, and they need to implement effective strategies to reduce these costs where possible.

This article appeared in HSBC’s Guide to Cash, Supply Chain and Treasury Management in the Middle East 2010.

References: Fundamentals of Financial Management, Gregory A. Kuhlemeyer, 2004

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East