NBAD’s bond issue was an expression of its desire to set a standard for the Gulf region, explains Mahmood Al-Aradi (pictured), the bank’s head of financial markets.

The National Bank of Abu Dhabi (NBAD) wanted to set a benchmark for the region and the UAE in returning to the funding markets with a $750m bond issue this spring, according to Mahmood Al-Aradi, the bank’s head of financial markets. “

A fter a period of economic difficulty, including last November’s crisis in dubai, we wanted to restablish local borrowers’ capacity to raise money from international investors. We have set a precedent that other bond issuers can now follow,” he explains. “We have a commitment to set the lead in this way, just as we did with our $850m bond issue last year, after the global financial crisis. On that occasion we felt we were equipped to test the stormy waters and set a benchmark for others.”

NBAD is in close touch with the international investment community and it moved rapidly when market sentiment became sufficiently positive to merit the launch of a new bond.

“We have been engaged in a lot of discussions with Japanese, asian, Malaysian investors; we were also in touch with the increasingly positive sentiment in the euro market and among sterling investors. We saw an improving appetite for Middle Eastern

risk,” says al-aradi.

However, he argues, this is not just a case of a recovery in confidence in the Gulf. The recent upheavals in the regional economy have highlighted the importance of transparency and good corporate governance, and the need for investors to look at individual credit risks on their own merits.

The lesson is that within the now recovering Middle East there are a number of borrowers that represent good risk opportunities for international investors.

“The market is itself beginning to become more mature, distinguishing between good credit and bad credit stories

You’ll find there’s plenty of scope for investments that add value – if you do your homework,” argues Al-Aradi.

You’ll find there’s plenty of scope for investments that add value – if you do your homework,” argues Al-Aradi.

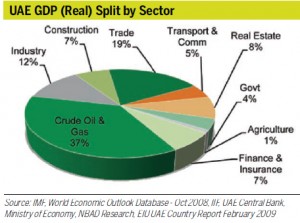

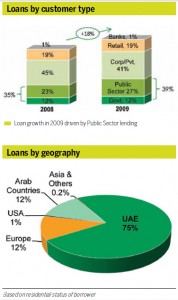

And the case for using NBAD is a strong one, he maintains: “We are more than 70 per cent owned by one of the richest emirates in the world. We have 21.4 per cent capital adequacy. If you look at 2009, when many local banks cut back on lending, NBAD expanded its lending by almost 20 per cent – but 75 per cent of that was to government-linked projects. some 40 per

cent of our assets are government of Abu Dhabi assets; and 55 per cent of our liabilities are government ones. This is a government bank that happens to compete commercially.”

At the same time, says al-aradi, “None of the bond issues that we’ve done have any kind of guarantee, explicit or implicit, from the government. We have never wanted or

needed them. The international ratings agencies assess us as a stand-alone institution.”

In other words, NBAD raises funds and maintains its financial status on an independent basis. But, behind this, is the strength of its ownership and its business franchise, both closely linked to the solidity of the oil-rich Abu Dhabi government.

In funding terms, the recent bond issue marks the next stage in a long-term strategy of diversifying the maturity profile and investor base of NBAD financing. But when it comes to lending on the money that it has now mobilised from the markets, the bank will largely target the economy of Abu Dhabi itself.

The emirate has an ambitious plan – Abu Dhabi 2030 – to transform itself into an energy-efficient, competitive and green urban and industrial hub in the Gulf. This entails massive project investment, not just by the government itself but also by state entities such as the project developer and investment vehicle Mubadala; private sector investments will be closely linked to this plan, explains Al-Aradi.

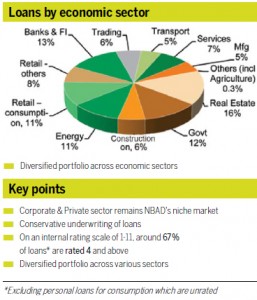

So NBAD faces a wide range of lending opportunities that benefit from the underlying security of its position within this widergovernment development strategy. even so, he says, the bank will look at each candidate’s case for funding on its own merits.

“We don’t lend to names. We don’t lend to families as a family. We look at the projects,” Al-Aradi says. “We need to understand the cashflow of the project itself. We need to be 100 per cent confident.”

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East