There are a number of actions that can be taken in transaction banking to gain the edge in a highly competitive climate. Global experts NICLAS STORZ, GERO FREUDENSTEIN and STEFAN DAB explain what they are

The question of the moment is, “How can financial institutions gain a competitive advantage in transaction banking in a hyper-competitive climate?”

We believe the answer lies in sharpening both business and operating models, making them strong enough to withstand the volatility that is sure to continue or potentially worsen—in essence, making them “future proof”.

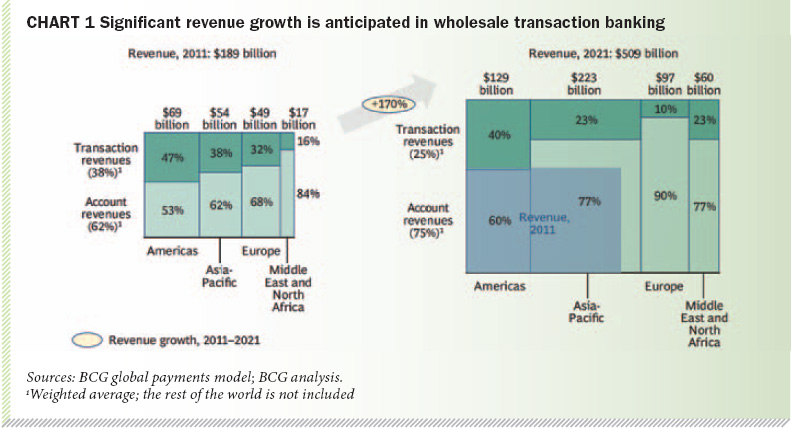

Of course, despite intensified competition and a generally troubled global-banking environment, wholesale transaction banking continues to be a highly attractive business. Despite shrinking margins, significant revenue growth of approximately 170 per cent— or a compound annual growth rate of roughly 11 per cent—is anticipated between 2011 and 2021. (See chart 1 below)

Rapidly developing economies are expected to drive the bulk of this expansion, outperforming developed markets. This is especially the case in the Asia-Pacific region and in Latin America, where there is significant room for growth in terms of key indicators such as the value of wholesale payment transactions per GDP and the number of wholesale payment transactions per capita.

Why does the outlook for wholesale transaction banking seem relatively rosy when other segments of the banking industry seem so uncertain? There are several reasons. First, transaction banking activities are historically stable, with fairly predictable business-development and upward-revenue trends across all client segments. The business still offers attractive profit and contribution margins as well as low capital absorption compared with other banking activities—leading to superior returns on economic capital. Moreover, wholesale transaction banking represents an inexpensive source of funding and liquidity for banks, particularly in the current market environment.

But the market landscape has grown more competitive as many corporate banks across the globe pay more attention to transaction banking. For example, highly evolved players— many of which have combined their transaction-banking businesses into a distinct, organisational entity — are moving this segment to the forefront of their offerings, up to the same level as private banking, corporate banking, and other core market segments.

Such a shift gives more weight to the segment both externally and internally (where it also raises performance expectations). In addition, many emerging transaction-banking players—whose transaction banking activities are typically still fragmented throughout the organisation—are now beginning to follow suit.

The landscape has been further altered by mergers and acquisitions. Although the M&A activity has not necessarily been triggered by transaction banking concerns, multiple players have enhanced their transaction-banking presence in this fashion.

Strategic importance

Globally, it is clear that the wholesale transaction banking segment is gaining in strategic importance relative to other banking segments, especially in a time of tight credit markets. In several credit-crunch scenarios that we examined, banks that derived a large share of their revenues (50 per cent or more) from sources related to transaction banking—institutions that we refer to as “transaction champions”—were far less damaged in terms of economic profit than players whose revenues were derived largely from credit products.

Yet what exactly is the right way to “do” transaction banking? Many banks still struggle with this core question. In our view, the key lies in revisiting business and operating models at the same time.

To get back on the right track, banks need to take a fresh perspective on the business model (what to do) and the operating model (how to do it). But succeeding is not just a matter of defining and optimising each layer of these models separately. In fact, it is much more about developing a holistic business and operating model that works from an end-to-end perspective.

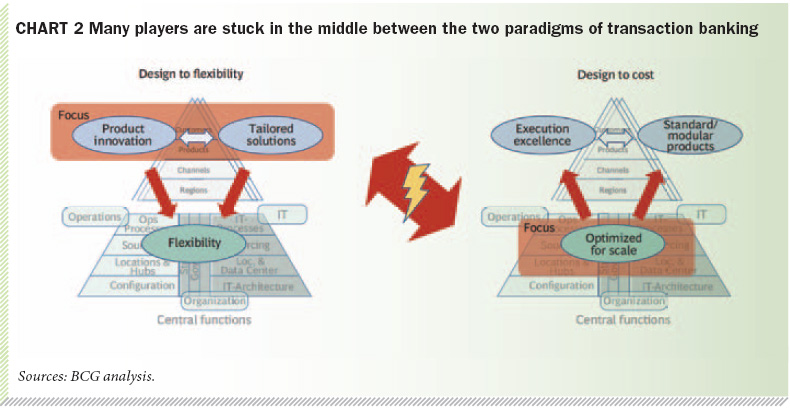

There are two fundamental design paradigms in play today: “design to flexibility” and “design to cost.” Although first-rate service levels and excellence in overall execution are obviously important to both, each paradigm has distinct characteristics that need to be examined from both the business-and-operating-model viewpoint.

- Design to flexibility This model enables the highly customised solutions required in wholesale transaction banking by many companies – particularly leading multinationals and large caps, as well as those in certain industries such as manufacturing and global trading. The model places a premium on product innovation. The emphasis is on meeting demands that are specific to highly sophisticated companies that are clear about the degree of customisation they need – in essence, tailoring solutions down to a segment of one. Banks that do this successfully can achieve true differentiation in the marketplace.

Such a business model has significant implications for the underlying operating model. Processes, IT and governance must be designed in a way that allows for close alignment between the front and back offices, for seamless transfer of client requirements, and for joint and realistic assessments of the bank’s ability to meet extremely specific client demands, often under considerable time pressure. Overall flexibility, rapid time to market, and effective bundling of solutions are key success factors. These elements all require cutting-edge skills in IT and operations.

Design to cost This model focuses on serving clients whose needs can be met sufficiently with standardised products. What matters most to these companies is cost efficiency, fast and flawless processing, and immediate rectification of errors. Highly engineered, complex products – which typically demand elevated levels of customer maintenance and onboarding time – are perceived as undesirable from a cost perspective.

Moreover, not all functionality that might be technically feasible – such as cash management solutions that enable pooling across different countries, banks, and currencies – is seen as required. An analogy can be found in the automotive industry: a car that is fast and extremely fuel efficient, and that never breaks down, but that has few, if any, sophisticated extras built in.

Of course, for a business model designed to achieve cost optimisation, the standardisation of products, services, and processes is mandatory. Ideally, all processing products should be standardised, while still allowing for some variation in sales products. Leveraging standardisation in order to achieve scale in the operating model is of course critical.

Process consolidation can help attain scale on platforms, and governance must push a disciplined cost agenda. Typical client segments for this paradigm include SMEs, mid-caps, and low-end large caps, as well as certain industries such as telcos, utilities, and retailers.

Clearly, the most suitable design paradigm greatly depends on the individual bank’s targeted clients, its own resources and capabilities, and the products that are most relevant from a revenue perspective. We have observed, however, that relatively few banks today are firmly committed to one model or the other in their transaction-banking businesses, instead remaining stuck in the middle, trying (and often failing) to maintain a primary focus on product innovation while also achieving significant scale effects. (See chart 2 below).

The problem with straddling both models is that true excellence is typically achieved in neither. For example, a bank focused mainly on the design-to-cost paradigm that also tries to customise products runs significant risks. Its investments in a highly efficient platform can be compromised both by a need for specialised IT (required to handle client-specific demands) and by insufficient volume in standardised products. Overall, optimal performance requires that business and operating models act in concert.

Three common pitfalls

Within this context, there are three common traps that many banks fall into when trying to improve their transaction-banking businesses:

n Undifferentiated coverage Many financial institutions active in transaction banking approach all clients as if they were complex multinationals, even though most of their revenues come from domestic products and from mid-to-large-cap companies – which have their own distinct needs. Even among multinationals, the transaction banking needs of telcos and utilities, for example, differ significantly from those of manufacturing and trading companies. Indeed, customer requirements in wholesale transaction banking are driven not only by company size but also by industry background. Banks should objectively consider who their target customers really are – and define their coverage models accordingly.

n Falling short on customer needs Interviews with transaction banking customers show that many value accurate execution of transactions and high service levels more than customised products. Indeed, many companies feel that standardised product portfolios meet their needs perfectly, but that basic service standards, such as “somebody picking up the phone,” are often not fulfilled to a satisfactory level. According to one interviewee, “All banks are frustrating for corporations from the standpoint of overselling and under-delivering.” Such comments are consistent with our observation that many transaction banks focus on adding new products to their portfolios, with improvements in customer service being a low priority. There appears to be a fairly frequent mismatch between customer requirements and banks’ strategic priorities.

n Failing to achieve scale advantages In examining cost and volume trends among the top transaction banks globally over the past five years, we have observed that these banks have not systematically managed to realise scale effects. For example, volume (indexed for payments, trade finance, and securities) has grown by roughly 24 per cent over this period, yet operational cost (non-interest expenses) has grown at nearly the same rate, clearly indicating that scale effects have been negligible. Moreover, expectations on cost savings should have been higher, as many players have carried out restructuring programmes that should have started to pay off.

Five steps to action

In our view, financial institutions wishing to shape future-proof business and operating models in their transaction-banking activities should take action in five specific areas. Improvement in these domains can go a long way toward building competitive advantage in an increasingly challenging marketplace.

1. Products: excel at standard solutions and be prudent about innovations. Realistically define target customer segments, as not every transaction bank can be a global player; understand true customer requirements instead of following common doctrine; ensure execution excellence in core products; if you innovate, make sure it pays off.

2. Coverage: enhance expertise at the frontline. Tailor your coverage model to the type of company you are serving; increase (industry) expertise at the frontline and weave product experts into the coverage model; make sales success in transaction banking relevant by developing incentives that have a clear impact on remuneration; be responsive to your customers in a way that drives loyalty. The broader goal is to generate holistic client coverage across transaction-banking, lending, and capital-markets offerings — in a way that enables transaction banking products to serve as cross-selling tools that facilitate deeper client relationships.

3. Footprint: organise around multi-local rather than global set-ups. Keep country-specific functions and infrastructure local, since globalisation is not a silver bullet; clearly distinguish among local, regional, and global functions and infrastructure, and eliminate overlaps and disconnects; ensure sufficient resources and talent at every layer of the organisation.

4. Platform: manage complexity before seeking scale. Strive for end-to-end process excellence; release frontline capacity for customer focus; (re)align the platform, providing a limited number of products but a large number of variations; distinguish between client-aligned and shareable activities, considering only the latter for outsourcing and offshoring.

5. Governance: bring business and operations/ IT closer together. Fix the governance model to stimulate cooperation between transaction banking businesses and operations/IT across countries; insist on a solid business case for all investments; increase financial transparency and performance management; do not allow regulatory compliance to determine your business or operating model.

Ultimately in the current hyper-competitive environment, only those banks that take bold steps and make tough trade-off choices on how to run their transaction-banking activities will be in a position to profit from the growth that is expected to come. Those that stick to the status quo may find themselves lingering behind more nimble rivals. n

Niclas Storz is a partner and managing director in the Munich office of The Boston Consulting Group (BCG)and the global leader of the firm’s wholesale transaction banking activities. Email storz.niclas@bcg.com

Gero Freudenstein is a partner and managing director in the firm’s Frankfurt office. Email freudenstein.gero@bcg.com

Stefan Dab is a senior partner and managing director in BCG’s Brussels office and the global leader of the firm’s overall transaction banking segment. Email dab.stefan@bcg.com

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East