Energy companies in the Middle east have been hit hard by the global economic downturn, but a revival is underway. This is putting pressure on treasury departments to improve their operational efficiency and enhance working capital, writes LANCE T. KAWAGUCHI of CITI.

In the Middle East have had to cope with a significant fall in demand for their products. This has led in turn to considerable price uncertainty, as a result of the global economic downturn. Investment in new projects has been reduced, or completely shelved, pending an upturn.

Government-owned national oil companies (NOCs) and international oil companies (IOCs) have all felt the impact of reduced demand, and all sectors of the industry have been affected – upstream, midstream and downstream.

Crude oil spot prices averaged $78 a barrel in november 2009, more than $2 above the October average. but the us energy Information administration predicts prices will weaken, falling to about $75 a barrel in february, before rising again to about $82 by the end of 2010.

As for capital spending, World Energy Outlook 2009, published by the International energy association (Iea) in november 2009, notes that “energy investment worldwide has plunged over the past year in the face of a tougher financing environment, weakening final demand for energy and lower cash flow”. It says that energy companies are drilling fewer oil and gas wells, while cutting back spending on refineries, pipelines and power stations. What all this means is that conditions have been increasingly tough for treasury departments in Middle East energy companies. They have been under more pressure from business line management, executive management and boards to improve operational efficiency across the entire treasury function and enhance performance of much-needed working capital. With revenues falling, margins contracting and credit becoming harder and more expensive to access, treasury departments have been under unprecedented pressure to unlock trapped capital.

Better times on the way

Thankfully it’s not all bad news. as the world economy recovers in 2010, demand for energy will increase, and with it prices, albeit slowly. The Iea’s World Energy Outlook 2009 warns that the speed at which energy demand will rebound in the short term is uncertain and depends on the pace of global economic growth.

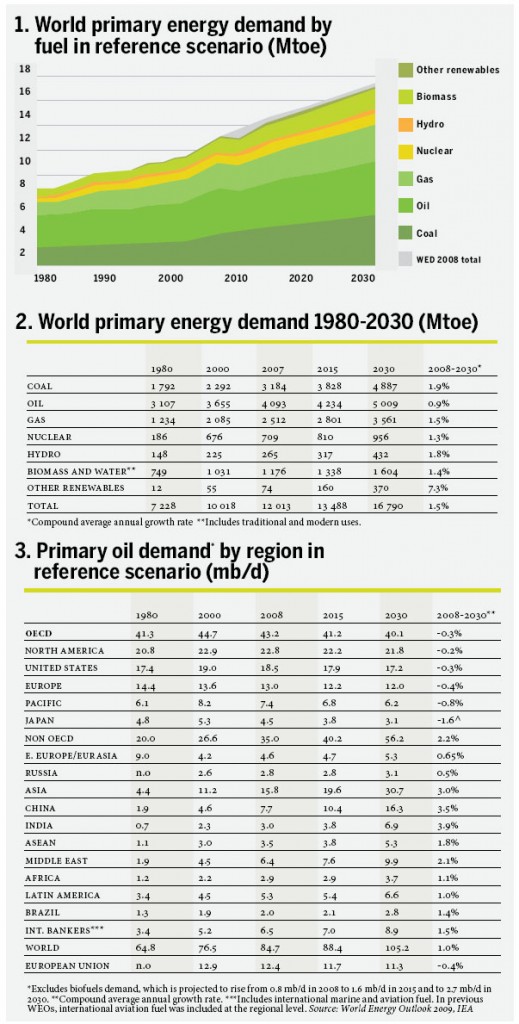

In the long term, however, the outlook is good. according to the Iea’s ‘reference scenario’ – a baseline picture of how global energy markets would evolve if governments make no changes to their existing policies – world primary energy demand is projected to increase by 1.5% a year between 2007 and 2030, from just over 12,000 million tonnes of oil equivalent (Mtoe) to 16, 800 Mtoe, an overall increase of 40% (see Tables 1 and 2).

Fossil fuels will continue to dominate the energy mix, accounting for more than three-quarters of incremental demand between now and 2030, estimates the Iea. non-OeCd countries will account for over 90% of this increase, and China and India alone for over half.

In the reference scenario, oil demand will recover in 2010, reaching 88m barrels a day (mb/d) in 2015 and then 105 mb/d in 2030, a 23.5% increase on 2008 (see Table 3). natural gas demand will rise from 3.0 trillion cubic metres (tcm) in 2007 to 4.3 tcm in 2030, a 41% rise.

Increased demand will necessitate renewed investment. “The capital required to meet projected energy demand through to 2030 in the reference scenario is huge, amounting in cumulative terms to $26 trillion (in 2008 dollars), equal to $1.1 trillion or 1.4% of global gross domestic product per year on average,” predicts the Iea.

The challenges for corporate treasurers

Energy companies in the Middle East, and everywhere for that matter, are already preparing to meet this demand. for their treasury departments this is creating challenges in four distinct areas: capital expenditure, joint venture arrangements, mergers and acquisitions, and competition to purchase hydrocarbon assets; challenges which need to be met by improving treasury management efficiency and optimising working capital.

Greater capital expenditure will be necessary to ensure the oil and gas keep flowing. Many of the oldest and biggest fields in the Middle East are past their most productive phases and require more expensive methods of extraction. new fields need to be developed, and undiscovered fields discovered. downstream facilities for refining and marketing the oil and gas will have to be built.

When an energy corporation increases its capital spending, working capital can become scarce. extra investment and activity creates greater cash flows which, if not managed carefully by the treasury department, can lead to working capital shortages. The result of this is that treasurers may find it necessary to arrange complex financing to align project completion dates with debt maturities, and if schedules are not met cash outflows may exceed cash inflows.

A second challenge is that posed by joint venture projects, which are increasingly common. for example, in the second-round bidding for Iraqi oil and gas production contracts in December 2009, many of the bids came from joint ventures: royal dutch shell (60%) and Petronas (40%) teamed up to win the bid for the Majnoon field; Lukoil (85%) and StatoilHydro (15%) were awarded the contract for West Qurna 2; Petronas (60%) and Japex (40%) won the bid for Gharraf; and Gazprom (40%), KOGAS (30%), Petronas (20%) and TPAO (10%) got Badra.

A company entering into a joint venture faces considerable counterparty risks. The role of the corporate treasurer in such cases is to scrutinise the partners to understand what the financial dangers are, and then take appropriate steps to mitigate those risks and ensure the long-term security and viability of the project.

A third potential difficulty is mergers and acquisitions. The $30bn acquisition by exxonMobil of XTO energy, the Texasbased oil and gas producer, in december 2009 could signal more acquisitions in the sector, with a trend developing for major oil companies to buy up smaller, independent producers around the world.

Acquisitions, whether financed by stock or cash, or a combination of the two, will deplete balance sheets at a time when credit and capital markets are hard to access. In such a dynamic environment, corporate treasurers need full visibility across the enterprise to understand where internal cash is located and how to unlock it. ensuring systems are fit for purpose in order to achieve this must now be at the top of any energy business’s agenda.

Finally, competition for hydrocarbon assets is getting fiercer. The tendency for NOCs aggressively to acquire hydrocarbon assets outside their own countries and pay significant premiums to do so, is making it harder and more expensive for IOCs to compete for these assets. The list of NOCs owning oil and gas fields in other countries is a long one. It includes CNOOC (China National Offshore Oil Corporation), CNPC (China National Petroleum Corporation), ONGC (India’s Oil and Natural Gas Corporation), PDVSA (Petróleos de Venezuela sa), Petrobras (Brazil), Petronas (Malaysia), and Statoil (Norway).

With so much money being channelled into this scramble for assets, companies are depleting their balance sheets and stretching their credit lines. Treasurers in both types of companies, but especially in IOCs, are therefore under pressure to operate as efficiently as possible, to ensure they are making use of all available cash, and to use supplier finance and export agency finance where appropriate.

The solutions

Those are the pressures facing treasurers in energy companies. how should they deal with them? The solutions fall into five broad categories. In each case, the company’s bankers have a role to play. The first solution is to optimise visibility and control over global cash. Companies frequently have cash distributed across many countries, and across many banks and accounts, with a consequent loss of visibility and cash flow leakage. To remedy this, the treasury department should work with its bank to take a number of steps, including some or all of the following:

■ Set up a web-based system to allow global visibility of cash balances and real-time balance sheet management

■ Initiate end-to-end processes for collections, payables and investments to increase the velocity of cash flow and the ability to net surpluses and deficits across regions

■ Deploy tools to bring all countries within a global cash structure, including target balancing and notional pooling appropriate for each country

■ Use integrated trapped-cash solutions to optimise liquidity and cash returns in regulated markets

■ Use efficient follow-and against-thesun sweeps to reduce the need for local cash build-up

■ Consider investment options that mitigate counterparty risk and facilitate optimisation of investment return against risk.

A second solution is to enhance operational efficiency and productivity. Manual intervention, spreadsheets and diverse processes in different regions often inhibit straight-through processing, resulting in longer processing cycles, increased settlement risk and higher operating costs. steps should therefore be taken to streamline key financial processes; this can include expanding the scope of shared service centres, rationalising banking relationships and using cross-border payment solutions to make foreign currency payments without the need to maintain local currency accounts.

Another solution is to extract liquidity from the financial supply chain. enhancing the order-to-cash and purchase-to-pay cycles delivers substantial improvements in working capital and considerable costsavings.

receivables are often the largestasset on a company’s balance sheet, so there can be considerable value in speeding up collections and reducing days sales outstanding (DSO) by automating receivables processing with solutions such as electronic invoice presentment and payment.

Making payments efficiently, cost-effectively and securely is pivotal to every wellmanaged finance function. Manual payments processing should be replaced by automated methods, and if days purchases outstanding (DPO) can be extended without compromising supplier relationships, it should be attempted.

Trade finance, in its many forms, is a fourth solution. supplier finance can be used to pay suppliers in a timely fashion, perhaps even earlier than usual, yet at the same time allow energy companies to extend their dPO; export agency finance diversifies funding sources and preserves bank lines, because the agency- guaranteed part of a loan (typically between 50% and 95%) does not count against bank credit; and project finance allows energy companies to match financing payments with the revenues generated by a project.

finally, next-generation banking platforms should be put to work to improve operational efficiency and produce tangible cost savings. The best global banks can provide electronic bank account management (EBAM) that allows corporate clients to manage hundreds of accounts around the world.

Opening, maintaining and closing accounts is a significant administrative overhead and closely scrutinised by auditors. EBAM allows treasurers to standardise and simplify processes globally and improve controls. EBAM is also being developed to incorporate electronic documents and automated bank account action messaging, signed with digital certificates.

Working in partnership

as the global economy recovers in 2010, energy companies in the Middle East are gearing up for better times and a rebound in demand. This will create pressure in a number of areas, especially in relation to capital expenditure, joint ventures, mergers and acquisitions, and competition for hydrocarbon assets – pressure that corporate treasurers can help relieve by improving the efficiency of their operations and enhancing working capital. In setting out to achieve these goals, treasurers will not be working alone. They will be enlisting the services of their bankers to deploy solutions that work to best effect and drive operational excellence. ■

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East