The future of cash management points towards integrated management dashboards, says Maki Vekinis – Cash Management Matters (CMM) Managing Partner,

The advent of the sophisticated business performance monitoring tools, resulting from the adoption of sophisticated enterprise resource planning (ERP) platforms is slowly making its way into the corporate internet banking systems. The emerging trend, sometimes referred to as integrated cash management dashboards, represents the next generation of information and transaction management resources in the toolkit of the cash manager.

The duties and responsibilities of a cash manager can range from the basic form, which simply provides the service to the business by managing the flows and ensuring the smooth operation of the company’s accounts, to the more complex role of providing the above plus contributions to the bottom line by becoming a profit centre. In both cases the integrated dashboard is the necessary tool to achieve the results and deliver to management reliable updates or action plans. Through a purpose-built integrated cash management dashboard, a cash manager can understand precisely their financial position, thereby enabling them to anticipate and plan for future inflows and outflows whilst simultaneously maximising financial performance through a series of actions, such as timely replenishments and placements.

A simple illustration of an integrated dashboard (below) consists of two types of information components and a processing platform.

The information components are:

■ The current state of the accounts and the status of inflows and outflows, as these are made available by any and all sources of the information, preferably in real-time

■ The key performance indicators (KPI) that are set to track the above and provide recommendations for actionable items.

The processing platform is the mechanism by which the information provided is converted to a series of actions.

The appeal of the integrated dashboard stems from the fact that it not only provides the precise status of the financials as these relate to the performance criteria set for the business owners, but allows, through the exact same user interface (uI), execution, or submission to execution to the appropriate authoriser(s) as per company rules of financial transactions.

The simplicity of the definition hides tremendous complexity in how to orchestrate the actions from the various inputs. for example, if these actions can be predetermined based on a set of rules, can they be automatically submitted to execution? along the same lines, if a placement into the money market (MM) that arose from a gap between collection and payment obligation produces less than the early payment discount, shouldn’t the system provide the payment ready for approval with an explanation as to why it was automatically generated? Or, to extrapolate the above further, what if the charges associated with a series of payments can be minimised through bulking into a single transaction, with the associated information transmitted electronically for the recipient to reconcile their receivables?

There is ample evidence that the financial services industry is preparing to introduce the next generation of cash management tools. financial institutions are under considerable pressure from the corporate sector which has invested heavily in the last 10-15 years in ERPs, to also invest and thereby confirm their commitment to the business in equivalent terms.

From online electronic banking, to offline application-driven electronic banking, to internet-provided electronic banking, to today’s integration, we are hard pressed to find a single bank offering a cash management system as a corporate cash manager or a treasurer would define it. each bank concerns itself with offering information on accounts, executes requests for payments or collections and allows management of accounts for performance through sweeps or pooling mechanisms.

On the other hand, corporate customers are keenly aware of their business; they know when to expect a payment to come in from a sale, they know when an obligation to pay is due and they know what payments submitted are outstanding. With that information, starting from the actual accounts position they arrive at the complete picture, which, the longer it is pushed to the future the less reliable it becomes. for example, it is easy to predict the receipt of funds for a cheque deposited, as yet not cleared, to an invoice raised and due for payment at the end of the month. but as the corporate knows about the current and future payments and collections, so does its bank; with repayment schedule for loans, trade finance transactions outstanding, treasury deals outstanding, deposits awaiting clearing, incoming payments yet to be credited and, of course, account balances (cleared, uncleared, available, blocked, etc).

And here is the important question: Is this the problem or is it an opportunity for the banks to exhibit their commit- ment and understanding of corporate cash management? banks, introducing platforms that not only provide information, but integrated tools that evaluate alternative and undertake actions, will shape the future of online banking. With Web 2.0 around the corner, the cash manager or the corporate treasurer will see the account balances and future positions change in real-time (albeit with different levels of confidence), similar to a treasury workstation and will be able to drill-down to underlying transactions. all these will be coupled with immediate execution of appropriate transactions.

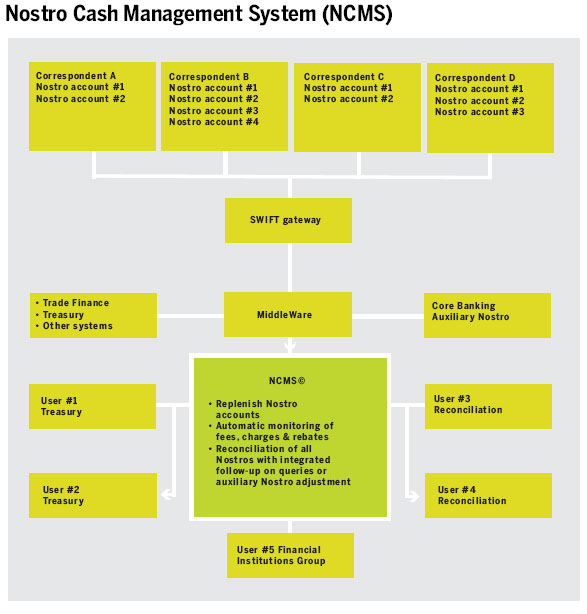

A fitting illustration of the above principles of cash management for performance is the aptly named nostro Cash Management system (NCMS) from Cash Management Matters. Taking advantage of the information available inside a bank’s operating environment for all payments and

collections, the NCMS platform, recently in production, exhibits all the above and more.

In order to understand the design philosophy of NCMS it is necessary to understand a bank’s operating environment. The most important aspect of a bank’s operating cycle is the management of its accounts with other banks. These accounts, named NOSTRO (Latin for ‘ours’), are the preferred means for a bank to transact on behalf of its customers or on its own account. The accounts are maintained to effect payments, manage trade or other financial transactions. Typically, acomprehensive agreement spelling out every single detail that determines the charges for a transaction, the penalties for a particular condition or the fees associated with the account status, is signed by both parties.

The NCMS platform is the implementation of a fully integrated cash management dashboard for NOSTRO account management. It not only presents up-tothe- minute information on all NOSTRO accounts but allows the authorised users to execute actual transactions to any or on all correspondent accounts. replenishments are effected based on projected requirements, which are fed directly from the core banking application and other areas where transactions are initiated, such as treasury, trade finance, etc. In addition, since the system is fed with all the account statements for all NOSTRO accounts from the correspondents, transactions are reconciled, with direct adjustment of the auxiliary NOSTRO

held in the bank’s core banking for approved differences, while charges, feeds and rebates are automatically verified for accuracy as per

agreements.

The diagram above provides a simplified view of the NCMS design that illustrates these principles.

In the context of the integrated dashboard, we can see that NCMS illustrates the definition and provides an important clue as to the future direction of cash management platforms from the corporate cash manager viewpoint. effective cash management requires accurate and up-to-the-minute information from all relevant sources, coupled with the ability to execute transactions and integrated with a complete decision-support platform with all the relevant KPIs to monitor performance and insert adjustments as necessary.

In other words, an effective solution to satisfy a cash manager or a treasurer requirement is a purpose-built integrated cash management dashboard.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East