As part of its aim to create transparency in the trade finance marketplace, CMM publishes this report, prepared by CAROLINE MAGINN, Cash Management Matters, CMM trade partner. This research will be updated quarterly throughout the year and anticipates the full-year report for 2010, which will be released after annual reports are published by the banks in Saudi Arabia.

In the full quarterly reports, CMM analyses the relative importance of corporate banking and trends and market-shares of banks’ corporate assets, liabilities, income, expenses and trade contingent liabilities (some examples of which are included in this article). The report refers to supporting data and compares each quarter to its equivalent in the preceding year. It also analyses available data on import and export letters of credit both by geography and industry.

The objective of the report is to track overall banking sector performance in relation to corporate banking and trade. Currently, we track the performance of the 12 Saudi Banks that are licensed entities with the Saudi Arabian Monetary Agency (SAMA).

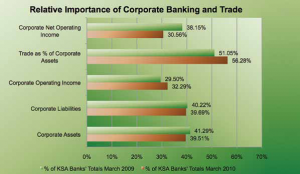

In broad terms, corporate banking remained a prime business segment to banks within Saudi Arabia; whether measured as a percentage of assets, liabilities, operating or net income. Trade continues to be a lead product to banks serving corporates, equating as it does to in excess of 50 per cent of total corporate assets. Overall, the banks’ commitment to trade increased in Q1 2010 over Q1 2009. Even during these times of credit tightening trade liquidity provided by banks grew. If trends prevailing during the first quarter continue over the rest of the year trade will have a robust year in 2010.

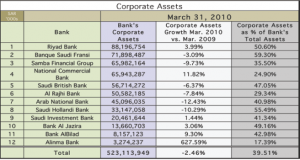

Assets

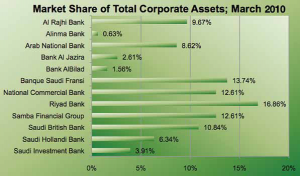

Corporate banking remains the No 1 business segment in terms of asset contribution, accounting for 40 per cent of total bank assets.

Overall corporate asset levels shrank from SARs 536bn in Q1 2009 to SARs 523bn this quarter but banks’ commitment to corporates remained strong and broadly resilient in spite of increased provisions for credit losses and impairments.

Under the prudent supervision of SAMA, banks remained well provisioned and capitalised against further credit deterioration. Total capital ratios ranged from 13.30 per cent for Saudi British Bank up to 151 per cent for Alinma Bank.

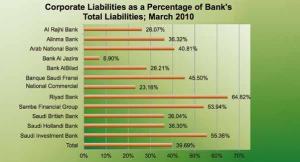

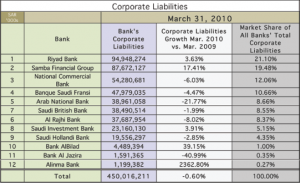

Liabilities

Overall corporate liabilities remained broadly constant at in excess of SARs 450bn.

Corporate banking’s contribution to liabilities matches almost exactly its contribution to assets, which accounts for 40 per cent of total liabilities. It is the No 2 business segment contributing to liabilities after retail.

Riyad Bank tops the league table for corporate liabilities as it does for assets showing the breadth and depth of its corporate offering. Banque Saudi Fransi, like the Saudi British Bank, built more corporate assets than liabilities over the period whilst SAMBA built more corporate liabilities.

The relative importance of the corporate segment to total liabilities varies substantially from bank to bank.

Operating income

Total operating income demonstrated growth of eight per cent for the corporate business segment although it declined for other segments.

Al Rajhi Bank, SAMBA, Riyad Bank, National Commercial Bank, Saudi British Bank and Banque Saudi Fransi all have market shares of above 10 per cent for corporate operating income.

It is worthy of note that, of the four banks recording the strongest growth in corporate operating income, three are purely Islamic Banks (Alinma Bank, Al Rajhi Bank and Al Jazira Bank) and only one of the four, Riyad Bank, covers conventional and Islamic banking.

The importance of the corporate business segment, as a percentage of total operating income, is highest for Saudi Hollandi Bank, Banque Saudi Fransi, Riyad Bank, Saudi British Bank and Bank Al Jazira, for which it is in excess of 40 per cent of total operating income.

Net operating income

Al Rajhi Bank tops the tables both for corporate operating income and net income notwithstanding the fact that with a share of 27 per cent of total income it represents its second most important business segment after retail.

Overall, corporate banking net income remained strong despite being reduced by 22 per cent in Q1 2010 over Q1 2009 and is the second most important contributor to bank profitability after retail.

The contraction in net income reflects higher but prudent provisions to counter any negative shocks. However, the positive growth in total operating income suggests a positive trajectory.

The relative importance of corporate net income to overall bank profitability is highest for Saudi Hollandi Bank, Bank AlBilad, Riyad Bank, Banque Saudi Fransi and Saudi British Bank, for which it makes up more than 50 per cent of total net income. It is the No 1 business segment for them by a significant margin.

Operating expenses

If we strip provision for impairments for credit losses/ other from total corporate operating expense, the general trend on expense was down for banks as a whole by three per cent.

For Saudi Hollandi Bank, Saudi Investment Bank, Bank AlBilad, SAMBA and Bank Al Jazira, non-credit- related corporate operating expenses were down by more than 10 per cent. If we take non-credit-related operating expense as an indicator of investment in a business, the increases in this expense line for Al Rajhi Bank, Saudi British Bank and the National Commercial Bank illustrate an increased commitment.

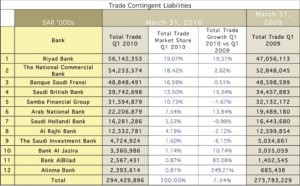

As a percentage of total bank operating expenses the corporate related expense grew from 20 per cent to 34 per cent in the first quarter 2010 on the back of increased impairment charges. At the same time, the return on expense ratio dropped from three to two, but remains more positive than, for example, for the retail segment. Against a backdrop of decline in total corporate assets, liabilities and net income, trade performed robustly and increased slightly in Q1 2010 vs. Q1 2009. This demonstrates the importance of, and general lack of volatility in, the provision of trade liquidity.

The increase in letters of credit to a total of SARs 71bn suggests an upturn in corporate purchasing and restocking, which is a positive leading indicator for overall corporate trading.

Riyad Bank tops the table reflecting that its commitment to trade is key to satisfying their corporate clients. National Commercial Bank, Banque Saudi Fransi and Saudi British Bank take up positions two, three and four respectively.

The top four report growth in total trade contingent liabilities year on year; most notably Riyad Bank and Saudi British Bank.

Letters of guarantee remain by far the most important trade instrument followed by letters of credit and acceptances.

Trade represents a significant contributor to banks’ overall portfolios equating as it does to 56 per cent of total corporate assets. This clearly shows the importance of trade instruments as liquidity tools for corporates.

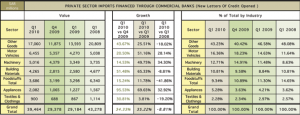

Overall, import LCs opened rebounded from Q4 2009 (+34 per cent) and Q1 2009 (35 per cent) to a total of SARs 39bn.

All sectors have improved on Q1 2009 and Q4 2009. The Other Goods broad category remained the most important section followed by Motor Vehicles and Machinery.

Appliances, Machinery and Motor Vehicles have also exceeded Q1 2008.

In terms of geography, imports on LC terms were most significant for Asia followed by the GCC and Europe.

The value of imports on LC terms from GCC countries has risen steadily since Q1 2008, thus illustrating the rising importance of these GCC flows.

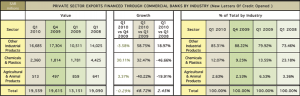

Private Sector Exports Financed by Through Commercial Banks

Overall, Q1 2010 exports on LC terms rose significantly compared with Q1 2009 and declined marginally over Q4 2009.

The broad category of Other Industrial Goods continues to dominate these flows followed by Chemicals and Plastics. The latter is up from both Q1 and Q4 2009 whilst Other Industrial Goods declined slightly over Q4 2009, although up from Q1 2009.

In terms of geography, Other Countries, which includes Asia, are the most significant contributor followed by the GCC. The lower proportion of LCs for exports to Europe and North America suggests a preference for open-account terms for these flows.

The full report is available by subscription and enquiries should be made to the Editor at editor@cashandtrademagazine.com

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East