Th e Middle East has experienced a rapid transformation over the last few years, and corporates are now looking for a range of innovative transaction banking products and services from their banks as well as support to grow their businesses – both locally and internationally. Steve Donovan, Middle East and Pakistan head of global transaction services, Citi, together with his colleagues Sanjay Sethi, head of treasury and trade solutions, Middle East, and Faraz Haider, head of trade, Middle East, treasury and trade solutions, tell LIZ SALECKA why Citi is so well placed to meet Middle Eastern corporates’ growing and changing needs

For how long has Citi had a major presence in the Middle East, and how important is this region from a transaction banking services perspective today?

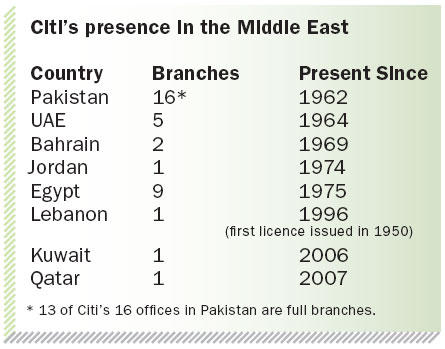

Steve Donovan: Citi’s presence in the Middle East dates back to the 1950’s, and today we have a physical presence in eight countries. Over the years, we have invested heavily in infrastructure, architecture and intellectual capital and now offer clients the full suite of transaction banking products and services including cash management, trade, and securities and funds services. These services are available both regionally and globally through connectivity to our global network, which spans more than 100 countries. Today, transaction banking represents a mainstream business in the Middle East for Citi.

How has Citi built up its operations in the Middle East?

Sanjay Sethi: Citi has a presence in every key country in the Middle East, including the United Arab Emirates (UAE), Qatar, Kuwait, Bahrain, Jordan and Lebanon as well as Egypt and Pakistan. We cover countries in which we do not have a branch presence, such as Iraq, by entering into partnerships with local banks and this has enabled us to grow our Middle Eastern footprint. Citi has developed seamless solutions with its key partner banks to ensure that our clients can achieve connectivity automatically via the Citi network in those countries where we are not present. If our clients require domestic services such as money collection points, or greater clearing participation, in these countries, we off er these services through our partner bank network.

Which countries do you believe represent strong growth markets?

Sanjay Sethi: We have seen strong growth in demand for transaction banking services across all major UAE cities, such as Abu Dhabi, as well as in Qatar, which are currently experiencing rapid growth in GDP, in addition to countries such as Saudi Arabia. Egypt is another fast-developing country and, as many of its local companies are now investing in advanced cash and trade solutions, we anticipate strong growth for our transaction banking services.

Which sectors do you believe will drive growth in the Middle East in 2011?

Sanjay Sethi: Foreign investment is increasing, and we also recognise growth opportunities for multiple sectors as well as growth driven by local public sector investment. Steve Donovan: Growth in the GCC in 2011 will be driven by hydrocarbons, infrastructure investment and private sector activity. We have seen a push by GCC authorities to diversify their economies away from oil in line with their long-term ambitions and most GCC countries have published formal development plans and budgets linked to several infrastructure projects, which include roads and railways. Increasingly manufacturing and tourism will also be high on the agenda as will telecoms and logistics. Citi is also helping local companies to expand their reach and grow their businesses internationally, which is facilitated by connecting them to the global Citi network.

What special benefits can working with Citi bring to Middle Eastern corporates?

Steve Donovan: Middle Eastern corporates are looking for two key features from their banking partners – a strong local presence and coverage, as well as an international footprint so that they can expand with ease into new markets. We are well-networked across the Middle East, and also offer companies access to a single global transaction banking platform, which enables them to view and transact on all their accounts in a uniform way across multiple countries in the region or globally. We use uniform platforms for our customer front-end solutions, enabling our clients to benefit from a similar “look and feel” wherever they are in the world. We also have direct interfaces into clearing systems in countries where we have a presence, and are, therefore, strong local players as well.

Faraz Haider: From a trade perspective, many of our corporate customers are expanding rapidly and dealing with new suppliers, and they require services that encompass both standard letters of credit as well as more sophisticated trade financing. We off er a wide range of structured fi nance solutions, including short-term to long-term Export Credit Agency-type of off erings. Solutions-based off erings and product innovations are always at the centre of our business approach in trade. Sanjay Sethi: Citi has also met new demand for services such as corporate payment cards, which have already been rolled out across the UAE. Th ese provide company employees, who are frequent travellers, with an easy and uniform way of making payments, and enable corporate treasurers to track spending while providing them with greater control over business expenses. Th ey can also be used by corporates’ procurement departments to make regular purchases, while providing treasurers with a better overview of where money is being spent so that they can secure volume discounts from suppliers. Citi also off ers prepaid cards, which act as prefunded wallets, and can be used to make salary payments to blue collar workers. Th e latter can use the cards to withdraw funds via an ATM or make purchases at a store via point-of-sale terminals.

Have you experienced increased interest in your transaction banking services over the last three years?

Steve Donovan: Th e market has undergone significant transformation, which has resulted in tougher regulation, changes in taxation and the adoption of technology-led innovation. Th ese challenges are spurring companies on to analyse, explore and execute strategies to make their cash work in a smarter way – not just a harder way – for their organisations. Many companies are responding to the upstream and downstream needs of their own customers and vendors, and are actively employing strategies to optimise working capital and inject liquidity into their supply chains, while simultaneously seeking to enhance their own competitiveness and profi tability. This agenda has become a priority for companies and is increasingly being executed at CFO-level. Sanjay Sethi: Achieving eff ective cash management and improved working capital efficiency, centralising liquidity and streamlining payments have all come to the fore, as has the need for new services such as corporate payment cards. Cash and trade are coming much closer together, and many companies are now also looking for ways to support both their suppliers and their distributors with supply chainfi nancing products.

How can Citi meet these growing requirements?

Sanjay Sethi: Citi has continued to expand and grow by connecting clients to its vast network and providing the tools and techniques required to achieve greater automation. The key issue for most corporate treasurers with a multi-country mandate is to ensure that liquidity is managed efficiently across all these countries. Citi can provide them with access to a global platform, which ensures that they benefi t from the same user experience when managing cash globally. We provide corporate customers with access to uniform banking platforms across all countries via CitiDirect/Citi® File Xchange or SWIFT as channels. Our core customer platform – CitiDirect® Online Banking – can be used for a wide range of transaction banking services, such as viewing accounts across multiple geographies and making multiple payments to multiple suppliers in diff erent countries, as well as off ering trade-related services. Corporate customers looking for more technical solutions can move towards fi le-based interfaces that provide higher levels of integration. Faraz Haider: We are also rolling out world-class products and solutions such as commercial cards, prepaid cards and both buyer and seller-centric trade and supply chain-fi nancing solutions across these markets, and off er scalable solutions for payments/collections.

How does Citi work with local banks, and is there a degree of competition?

Steve Donovan: Citi has forged long-standing relationships with key fi nancial institutions across all of the markets we serve. We provide world-class products and services to them and enable them to access our infrastructure and network so that they can provide their own clients with a better service. We also work closely with key partner banks to connect our clients in markets where we are not present by leveraging on these partners’ products, services and networks.

Sanjay Sethi: Citi, using its own network, allows customers to bridge countries, and uses its own infrastructure and clearing capabilities to provide most solutions. however, we network with local banks within a country to simplify the provision of services such as cash collections, and, in this way, we provide our clients with a seamless, complete service, eliminating the need for them to deal with several banks at a time.

Many local banks are still only just discovering how large banks manage cash for large corporates, and, having recognised the advantages of using one technical platform, are building local platforms themselves. however, they are at a disadvantage when it comes to building truly global platforms.

Faraz Haider: Also, within the trade space, their off ering continues to remain plain vanilla in outlook, and their needs for greater product sophistication are, by and large, being met by foreign banks.

How has Citi managed to establish good relationships with local corporates?

Sanjay Sethi: We currently have around 3000 Middle Eastern corporates and locally-based multinational companies as customers, although when SMEs are added to the equation, these numbers are much higher. Citi has been very successful in building relationships directly with local corporates and subsidiaries of multinational companies as well as local governments. We also act as an international banker to local banks that need multicurrency clearing and payments solutions overseas. Being able to understand our clients’ needs and our value-added product off ering generally put us ahead of the competition when it comes to customer relationships.

What do you believe will be the main themes of 2011?

Faraz Haider: 2011 will continue to be the year of “embracing change” given recent fi nancial and economic events. Treasurers will be looking to more actively manage their working capital, and will be relying more on their own internal sources, despite access to fi nance becoming easier. Both their cash and trade processes will increasingly come under scrutiny as companies look to squeeze more money from within their own working capital cycles, and seek to off er supply chain fi nance facilities to both their suppliers and their distributors. Th ere is likely to be increased demand for more sophisticated trade fi nance solutions as well as cash and trade solutions. Citi’s product sets are being continuously evolved and expanded to cater for these needs.

Steve Donovan: We are also seeing increased demand for technology-led innovation and more sophisticated products, tools and techniques, as well as demand for our services as a trusted adviser when it comes to both helping corporates see beyond the many challenges that the markets have presented, and to grow their businesses.

Does Citi plan to expand its activities in the Middle East?

Sanjay Sethi: One of our key aims is to expand the number of countries in which we can do business – even if we do not have a branch presence – to meet our clients’ needs. For example, there are a number of companies in Dubai that are looking to expand their services into Iraq, and they want to be led in by an international banking partner that can help them understand the rules.

Steve Donovan: We currently have direct custody and clearing capabilities in a number of countries, having added the UAE and Bahrain in 2010 and, most recently, Kuwait. Th is expansion eff ort is a core strategy for 2011.

We have also continued to invest in expanding our infrastructure and bringing innovation and new products to the region. We plan to expand our provision of corporate cards and pre-paid cards to other countries outside the UAE, and are also looking to extend the capabilities of pre-paid cards to include, for example, other types of commercial payments as well as insurance payments.

In 2011, we anticipate that treasurers will also be placing a much greater focus on managing liquidity and excess cash in other countries, and that they will be looking to centralise their cash management. We are placing an increased focus on helping them to move money around, and make their centralisation efforts easier.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East