UAE banks aid smaller firms

Bid to bolster growth for SMEs

Many of the Gulf’s banks are renewing their focus on small-and-medium-sized enterprises and believe that this often-neglected sector could provide a good vehicle for growth. MELANIE LOVATT looks at its prospects

Many of the Gulf’s banks are renewing their focus on small-and-medium-sized enterprises and believe that this often-neglected sector could provide a good vehicle for growth. MELANIE LOVATT looks at its prospects

Studies show that SMEs in MENA have continued to lack access to financing but that is changing. A growing number of programmes – especially on the cash and trade side of the business – are being set up by banks to help the sector. At the same time, state measures to provide support are gaining traction.

Governments across MENA have started to catch on to the fact that SMEs are not only an engine for economic growth, but a good provider of jobs. As they expand their business they can help populous countries, such as Saudi Arabia, tackle unemployment. In the Kingdom while SMEs contribute 30 per cent to gross domestic product, bank lending to the sector is under five per cent. The story is similar in the UAE, where SME lending is around five per cent, despite the fact that this sector accounts for more than 50 per cent of GDP and provides more than 90 per cent of employment.

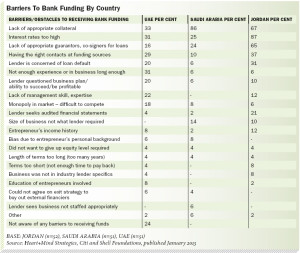

While the MENA region has a large and well capitalised banking sector, lending to SMEs is on average about two per cent in the GCC and 13 per cent in non-GCC countries. This is the lowest global level and only 20 per cent of SMEs in the region have a loan or line of credit, said a research paper by independent consultancy Heart+Mind Strategies.

Commissioned by the Citi and Shell foundations and published last year, the paper identified what they called the “missing middle”, which are companies past initial start up with revenues of $100,000 to $5m and between six to 150 employees. The paper said that they are a significantly large sector in MENA, yet underserved, with loan denial rates particularly high in Jordan and Saudi Arabia.

For sustainable success the report said these businesses need flexible capital structured to their needs, customised business development assistance, market linkages to supply chains to ensure new opportunities for growth, and an enabling business environment to address barriers to their development.

Banks are hearing the call and are increasingly tailoring programmes to foster development of SMEs. The UAE’s second largest bank, National Bank of Abu Dhabi (NBAD), for example, has staffed up to provide an increased level of support to the sector. The SME group is headed up by Tahany Taher, who reports to the head of commercial banking–Gulf, Nilanjan Ray, who was appointed in August last year because of his track record in SME product innovation.

He is tasked with making NBAD the bank of choice for SMEs. This year Shayan Hazir joined the team as executive director, commercial global transaction banking, to cement NBAD’s SME proposition. He came from HSBC’s Asia Pacific operations, covering SMEs and large corporates.

Need to educate customers

On the cash side, NBAD offers SMEs all of the standard products expected from a commercial bank. “There’s nothing that is not available to an SME customer,” emphasises Hazir.

One important tool for the SME customer is a simple one – an internet banking channel. Use of the internet can keep down administrative costs for small businesses, allowing them to make cross-border payments, local payments and payroll from anywhere in the world. “We also tell them the best way to structure payment in order to enhance cash flow,” says Hazir.

Moving away from manual to automated systems is an easy way to free up cashflow. But the UAE’s SMEs have not embraced internet banking as thoroughly as those in Asia-Pacific countries, he says, noting that he and his team see educating customers on the tools available to them as part of their support role.

Even if SME customers are using the internet for many of their banking transactions, they will still need to meet on occasion with their relationship manager at the bank. Having a large network helps NBAD and other large domestic players such as Emirates NBD service SME business more easily than their foreign counterparts whose branch offerings are more limited. NBAD has 127 branches and more than 585 ATMs and cash/cheque collection systems spread across the UAE.

Some international banks are finding it hard to service SMEs due to the need to maintain branches, which is seen as labour and capital intensive if it is not deemed a core business area. Three large international banks decided last year to close the accounts of some SMEs in the UAE. The move was made in line with the companies’ reviews of business in order to streamline operations and improve capital returns. Hazir says a branch network provides advantages through structuring customised solutions for SMEs when needed.

On the trade side, NBAD’s offerings are similar to other institutions, and all services available to larger businesses are offered to SMEs, such as documentary collections and discount for letters of credit (LCs). The bank can issue LCs on the back of both cash collateralisation and balance sheet lending. The collateralisation will be tied to the amount of cash that the business has on hand at the bank, and then, on that basis, a guarantee can be issued, such a performance assurance for a specific project.

LCs can be offered via the balance sheet on a term basis or overdraft, with sub-limits made for trade. NBAD assesses each client’s ability to repay the amounts extended. Once the facility is provided the client has the flexibility to access it and only need secure additional approval if the limits need changing. NBAD has a dedicated team of trade specialists that deal only with SMEs, allowing each business to have one-on-one discussions with their bankers. Trade finance is especially important, given that many of the UAE’s SMEs tend to be active in this sector.

If an LC is received by an SME from a customer via a bona fide institution, NBAD can provide the funds to the SME, discounted on bank risk. Otherwise the SME would have to wait 180 days before payment. In order to offer support to customers for this type of business, NBAD nurtures relationships with other banks – it has an international network of 60 branches and offices in 18 countries. Helping SME customers manage cashflows is extremely important, notes Hazir. Many businesses and especially start-ups can fail as a result of a cash crunch and cashflow management.

Source: Heart+Mind Strategies, Citi and Shell Foundations, published January 2013

Holistic approach

While some banks deal with the cash and trade components of transaction banking separately, Hazir prefers NBAD’s holistic approach. “If I go to see customers and I’m trying to understand their trade cycle coupled with their internal domestic or international cash remittance requirements, or repayments and receivables, I won’t be able to piece those two together unless I can understand the trade and cash side,” he says.

Banks such as NBAD also work with government-supported programmes, which can offer incentives to SMEs. This includes the Khalifa Fund for Enterprise Development, which was launched in June 2007 with capital of AED2bn to help develop SMEs in Abu Dhabi.

Financing can be offered for projects that are seen as helping feed the national economy through the Khutwa, Bedaya and Zeyada programmes. Khutwa is microfinance, providing loans of up to AED250,000 to create income streams for divorced women, widows and retirees; Bedaya is directed at new SMES and makes available loans of up to AED3m; and Zeyada can offer up to AED5 million for expansion and development purposes. The Khalifa Fund hosted the 10th Annual Forum and Meeting of the International Network for SMEs in Abu Dhabi’s Yas Marina Circuit in March.

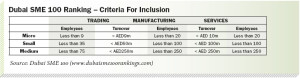

The Dubai SME 100, launched under the patronage of Sheikh Hamdan Bin Mohammed Bin Rashid Al Maktoum, Crown Prince of Dubai and chairman of Dubai Executive Council, identifies Dubai’s top-performing SMEs to help mould them into larger sustainable internationally oriented enterprises (see table for ranking criteria). Government partners in Dubai SME 100 include banks such as Abu Dhabi Commercial Bank, Emirates NBD, HSBC, Shuaa Capital, and other institutions, such as Nasdaq Dubai, Visa, law firm DLA Piper and accountant Deloitte.

In April this year the UAE’s President, Sheikh Khalifa bin Zayed Al Nahyan, approved a law that will provide support for SMEs. This puts measures agreed by the Federal National Council in June last year into effect. It stipulates that ministries and federal authorities must contract at least 10 per cent of their budget for services, purchasing and consulting to Emirati-owned SMEs. Government-related firms are directed to offer five per cent of those contracts to SMEs. The law also gives SMEs some exemptions from customs tax for equipment, raw materials, and certain goods used in production.

Other initiatives

In May last year Emirates NBD introduced schemes for SMEs that include a credit guarantee system being provided in conjunction with Dubai SME.

A privileges programme called “Rewards & Beyond” will give business owners product and service

discount and there will also be a support system for information exchange to help business growth. With Dubai SME, it is making up to AED50m in loans to be made available to the SME sector.

Emirates NBD has also improved its internet banking services to small businesses. “Over the past few years, the platform has been further developed to serve the needs of SMEs as we would like SMEs to benefit from what is available to corporates,” said Samir Sahu, deputy general manager, transaction banking services. “We have seen SMEs adopt the online experience as a preferred channel for transactions,” he added.

Dubai’s Noor Bank said in March that it was planning to launch an online commodity Murabaha financing platform targeting SMEs as well as other corporate clients. The bank says it has more than doubled financing to SMEs since it launched its Noor Trade initiative in May last year. This targets AED5bn of lending over the next five year to SMEs that contribute significantly to expansion in UAE trade. It also provides a Shari’a compliant banking service.

In support, Noor opened its first dedicated trade branch in Almas Tower, home of the Dubai Multi Commodities Centre, in July last year. It followed this up by opening a second trade branch for SMEs in Dubai’s traditional business district of Deira.

Earlier this year, United Arab Bank launched a facility to allow its customers, including SMEs, to complete trade finance transactions online, including standby letters of credit.

In the wider region, development institutions are trying to nurture growth in the SME sector. In May last year the IFC, the European Investment Bank (EIB), Agence Française de Développement (AFD), European Union and World Bank established the MENA SME facility, which will provide an initial $380m to improve access to finance for SMEs. Small businesses often complain that even if they can secure loans and other types of credit facilities, they are priced much higher than for large companies. They are hoping that development bank initiatives and government support will possibly help to address this pricing differential.

These initiatives are laudable, and will help foster growth. But the SME sector is expanding from a very low base in terms of its share of banking transactions and it will take some time before the sector is fully supported. The sector itself is poised for more growth, as more businesses start to discover the internet as a low-cost tool for marketing services and products to customers both domestically and abroad.

Banks are becoming increasingly savvy about how much business these SMEs can bring collectively. And, of course, singularly once they grow. Multi-billion dollar global juggernauts such as Google and Microsoft were once SMEs. Banks have the upper hand in securing this business and they will only have themselves to blame if they lose it to other methods of raising finance that have recently gained international popularity with small and start-up businesses, such as crowd funding.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East