The effective mitigation of business risk needs treasurers to take an active role in Analysing Financial management andstrategy, as PETER MATZA heard when he attended the inaugural meeting of the Association of Corporate Treasurers Middle East (ACTME) in Oman and a breakfast meeting in Abu Dhabi

The fi rst meeting of the ACTME in Oman was the latest in a long series of fi rsts for the ACT Middle East. sponsored by the national Bank of Oman (NBO) and brought together by ravi narayanan, general manager of treasury for Omantel (and the regional representative of the ACTME committee), a diverse list of delegates representing the corporate, government and fi nancial sectors gathered for breakfast, two presentations and a panel discussion on the role of treasury and treasury management.

Tahir Bin salim Al amri, director general of treasury at the Ministry of Finance, presented the government perspective. The government of Oman has traditionally taken a conservative and prudent approach to fiscal and monetary policy, holding to a low debt-to-GDP policy even to the extent of being criticised for doing so during the Gulf Cooperation Council’s (GCC) boom years of the mid 2000s. While benefiting to a modest extent from oil and gas exports (mainly to China), the government has made considerable efforts to develop other, sustainable elements to the domestic economy – whether through agricultural modernisation or eco-tourism.

For its part, the Treasury has broadened its responsibilities in the economy, supporting the central bank and Finance Ministry (e.g. in efforts to develop a domestic capital market) on top of its traditional role as the government’s receipts and payments manager. The Treasury is also playing a role in a crucial element of the current fi ve-year plan: developing e-government (including e-finance). at a micro level, government treasury management is similar to corporate financial management; the differences emerge at the macro level.

Policy drivers

The Omani Treasury seeks to ensure a healthy government balance sheet through an appropriate level of expenditure and maintaining a low debt-to-GDP ratio, to promote economic diversifi cation and regional development, to explore and develop natural resources, to maintain a prudent level of external reserves, and to develop domestic infrastructure and industry.

Delegates at the event acknowledged and appreciated the willingness of the government to participate in the forum.

Humayun Kabir, general manager for wholesale banking at NBO, gave a punchy and humorous speech that nevertheless contained a serious message for treasurers. his view of the post-fi nancial crisis world is that treasurers must learn to live with risk and volatility (which are not necessarily the same things) and to use their developing skills to support business growth domestically and internationally for Omani companies. although the Omani banking sector has emerged relatively unscathed by regional and international credit difficulties, it too will have to learn to manage international risk and competition.

The two speakers were joined for the panel discussion by Narayanan and Abdul Razzaq Al-Belushi, acting CFO of Oman shipping. a lively debate between the panellists saw enthusiastic contributions from the fl oor. Th e corporate view seemed to suggest that, although financially sound, the Omani fi nancial services sector may lack the skills to meet some of the challenges as Omani business needs grow. The difficulties in creating a capital market were cited as an example. although part of the GCC (along with Bahrain, Kuwait, Qatar, saudi arabia and the Uae), Oman has often taken a financially non-aligned stance, which some delegates felt could be restrictive. Interestingly, Islamic fi nance was not necessarily viewed as a specialist market although it was seen as a way to harness capital market funds from a retail investor base.

Abu Dhabi breakfast review

The breakfast briefing held two days later in abudhabi attracted as knowledgeable and mixed a crowd as in Oman. This event, sponsored by Standard Chartered and hosted by Mubadala, was intended to focus on the evolving role of the treasurer and professional development.

Shady shaher, a UAE national and economist for the bank, gave an impressive and comprehensive tour d’horizon of the current state of the GCC and wider regional economy. Overall, 2011 and subsequent years look to be positive for the GCC. For shaher, three factors are most important for business in the region: domestic demand, intraregional trade and infrastructure investment.

Funding is clearly driven by oil/gas pricing but despite the current high oil price (which standard Chartered forecast would hold at $91 a barrel in 2011), regional capital markets will need to develop to fund large elements of the GCC’s development plans. Given figures of more than $400bn for saudi arabia and $80bn for the Uae, it seems clear that debt and equity (or perhaps shariah) investors will need to be nurtured. The intention is to drive non-carbon GdP growth up to a target of 64 per cent by 2030, so capital asset formation will play a critical role.

Regulators have some modest infl ation concerns but these should be overcome. Otherwise inflation is held back in dubai by a weak housing sector and in other GCC countries by currency strength. dubai has some refinancing worries to address, although a programme of asset sales and debt restructuring should soothe concerns.

Abu Dhabi will continue to drive UAE growth and dubai benefits from that and its position (still) as the regional financial and logistics hub.

Shaher was followed by andrew Foulkes, who gave a pithy and pointed presentation. Foulkes is a long-standing member and fellow of the ACT and runs the treasury at one of the world’s largest single-site industrial developments, the emirates aluminium plant. Over the past couple of years the project has spent nearly $7bn – part of the drive shaher described to develop non-oil business sectors.

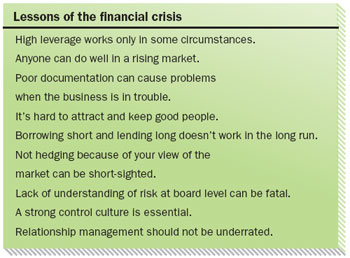

Foulkes focused his remarks on the treasurer’s role and the lessons he has learnt over his career and through the recent financial/credit crisis (see box). Foulkes took pains to stress that observation of events is not enough; treasurers must also analyse and dissect fi nancial management and strategy to ensure their organisations can at least mitigate the risk of business, which, aft er all, is about taking on risk for reward and value. In his own organisation, a move from project management to operational treasury means Foulkes and his team have had to introduce processes and systems to meet the changing demands of their operation in areas such as risk identifi cation and controls and insurance. In particular, treasury teams must keep their skills and knowledge up to date – an unashamed plug for the ACT and its qualifi cations! The panel discussion involved Paul Green, CFO of Union railway, which plans an estimated $11bn, 1,500km railway across the UAE. The first phase of the project will be a 270km freight line linking abu dhabi’s shah sour gas field to ruwais on the Gulf. Green has considerable experience of GCC business, which he shared with the audience. he reinforced the comments about the need for capital market development being crucial even for governmentsponsored investments such as rail infrastructure. he also supported the drive for transparency and enhanced corporate governance, which would help financial markets develop. The panel felt that the projected currency union across the GCC (except Oman and the UAE, for the time being) would be a while in appearing, although the principle that regional fi nancial institutions need to raise their game as though such competition was imminent was shared by the panel and the audience.

Both the Oman and Abu Dhabi events underline the tremendous progress the ACTME has made in creating a network that brings together treasury and fi nance professionals, government and regulators to drive standards in treasury management across the GCC.

Peter Matza is head of publishing at the ACT. pmatza@treasurers.org, www.actmiddleeast.org

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East