The greatest demand for MENA exports is going to continue to come from Asia, according to HSBC Commercial Banking’s Trade Forecast.

The greatest demand for MENA exports is going to continue to come from Asia, according to HSBC Commercial Banking’s Trade Forecast.

Tim Reid, regional head of commercial banking for HSBC Middle East and North Africa, said, “Looking at the latest data, we see two key themes emerging at a regional level. First, Asia continues to be of increasing importance in terms of exports and imports for MENA due to its growing energy demands.

“Secondly, developing infrastructure within the region is enabling a long-term shift away from exporting petroleum to petroleum products, chemicals, textiles, transport equipment and industrial machinery. Continued political upheavals and dependence on oil prices dictates that headwinds remain, but long-term prospects for the region remain promising.”

HSBC believes that the UAE’s exports will remain dominated by oil and related products with its top markets being India, China and Vietnam, right up to 2030. “The composition of UAE’s imports will continue to diversify in the years ahead – dominated by industrial machinery contributing 15 per cent to total imports and transport equipment contributing 10 per cent over the forecasted period. Mineral manufactures will also become increasingly important – contributing up to 21 per cent in the long term.”

Commenting on the Emirates section of the report, Nicholas Levitt, head of commercial banking for HSBC Bank Middle East, UAE, added, “These trends very much reflect what we have been seeing on the ground – with exports and imports to the more traditional large markets in Europe growing much more slowly as growth in industrialised countries lags well behind the emerging markets.

“In addition to China, India and Vietnam, the UAE is seeing increasing energy demand from countries such as South Korea and Singapore. Exports to Latin America are also expected to accelerate significantly in the long term. Within the UAE, we expect continued heavy state spending on construction and property, while Dubai will continue to develop its trade and tourism sectors as well.”

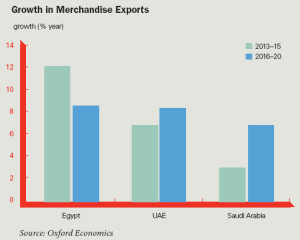

Turning to Saudi Arabia, the report says that the kingdom’s exports will continue to be dominated by petroleum and petroleum products. As with the UAE, the Asian economies will remain key to Saudi’s in the long term growth. But exports will also rise strongly to those markets that have large populations and an associated heavy demand for energy. These include Poland, Turkey, Brazil and, when its economy starts to recover, Egypt.

Mentioning Egypt, the report says that petroleum products and natural gas have traditionally comprised a large share of total exports, “but the country is forecast to steadily diversify out of these resource-based sectors as production slows down. Its rapidly developing chemicals industry is expected to become the primary export sector, with 18 per cent annual growth forecast for the next few years, slowing only slightly to around 13-14 per cent for the remainder of the forecast horizon to 2030. Textile, wood and mineral manufactures will also see double digit growth over the forecasted period”.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

One comment