The Middle East has a population of more than 190 million people and a combined GDP of $1.6 trillion. Its aggregate economy is larger than Russia or Brazil and has impressive growth prospects. The most prominent economic powers are the members of the Gulf Cooperation Council (GCC): Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates. These six nations account for 20 percent of the region’s population, but more than 60 percent of its GDP

Despite an encouraging economic and demographic profile, the region’s payments industry is young and especially undeveloped outside the GCC. While there is plenty of opportunity for banks and payments providers to expand, they must first understand the region’s particular characteristics and challenges. A relatively basic payments infrastructure has led to high processing costs and limited access to electronic payments channels. Growth in payments is also hindered by the fact that many merchants and consumers do not understand how, where and why to move from cash to non-cash payments.

A six-billion dollar industry and growing

Over the past decade, the payments infrastructure in the GCC has become more sophisticated as financial markets have matured. Nevertheless, room for improvement remains. The precise level of development varies by country, but all continue to suffer from inefficient clearing and settlement systems, limited electronic channel access and a population wedded to cash.

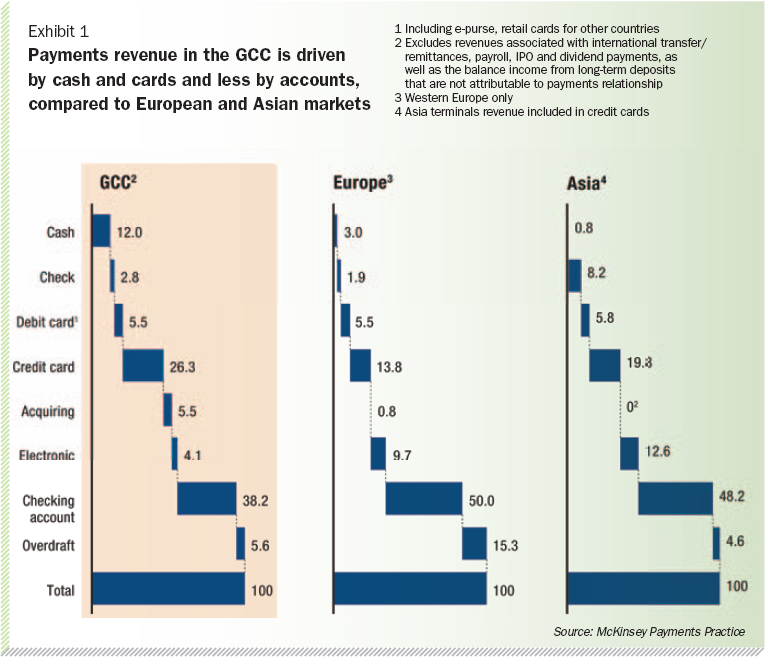

Banking within the GCC generates revenues of approximately $33 billion, but only $6 billion comes from payments. This 15-to- 20 percent share is well below the 25-to-30 percent typical of the North American, European and Asian markets. The most promising areas for growth in payments revenue in the GCC are card payments and acquiring, which, despite the low overall use of payment cards, already account for more than 37 percent of overall payments revenue (compared to 20 percent in Europe and 25 percent in Asia) (Exhibit 1).

Current accounts and overdraft revenues comprise just 44 percent of total revenues, compared to 55-to-65 percent in Asia and Europe. Electronic credit transfers and direct debit-based products contribute less than half of what they do in Europe and only one-third of the 12 percent share they represent in Asia.

These numbers show that a shift to more electronic payments in the GCC would increase payments’ contribution to total banking revenues by improving transaction fees and increasing transaction balances.

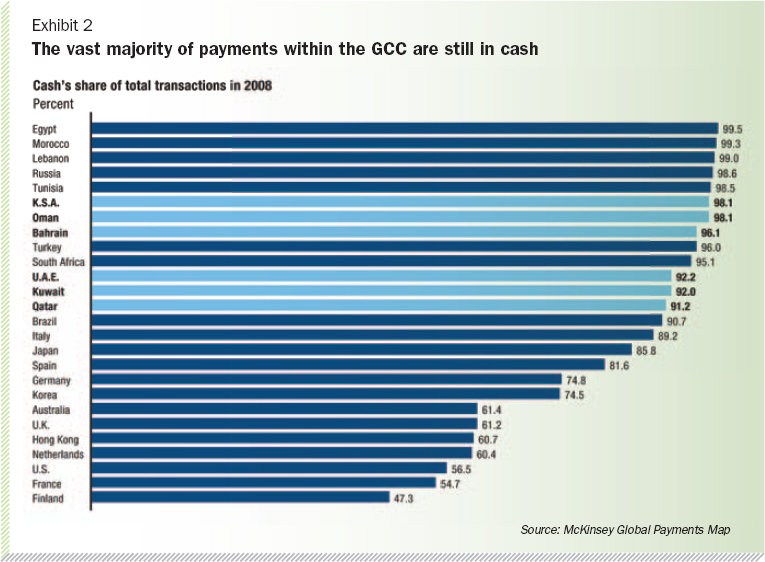

Cash is used in more than 90 percent of transactions in the GCC (Exhibit 2). The majority of non-cash payments are checks. The existing infrastructure in most countries can settle electronic transactions, but is modeled on a real-time settlement platform and lacks the efficiency of typical ACH and wire systems designed for clearing small value transactions. The cooperative processing entities that have driven payments efficiency elsewhere in the world have not evolved in the region, despite the close economic ties between GCC countries. There are few regional card processors and even national infrastructure solutions are fragmented. In total, this results in a high cost per transaction ($.15 to $.52 versus around $.03 for a typical ACH payment) and hinders the widespread adoption of electronic account-to-account payments.

The success of Saudi Arabia’s SADAD, an electronic bill presentment and payments system that utilizes the country’s real-time settlement platform with end-of-day settlement, has demonstrated the appetite to adopt electronic account-to-account payments.

Considering the time and cost of building payments infrastructure across the region, modernizing card payments and tapping into remittance opportunities offers the biggest immediate revenue gains for banks today.

Acquiring opportunities

The GCC is very stratified. There is a large underbanked population and an affluent upper class with high spending power. Non-cash payments instruments exist, but the infrastructure is incomplete and cash still dominates. These dichotomies present opportunities for players who can tailor their offerings to the local market. We suggest three areas of focus for banks and payments providers.

1. Push the debit card and acquiring opportunity

The use of debit cards at the point-of-sale (POS) is extremely low in the GCC, even though terminal penetration is comparable to eastern Europe – between three and eight terminals per thousand inhabitants. Saudi Arabia, Slovakia and Poland have a similar terminal penetration, for example, but spend per terminal is $1,600 in Saudi Arabia compared to $3,400 in Slovakia and $4,000 in Poland. Driving POS use and displacing cash transactions with debit cards will require governments and financial firms to do two things: educate merchants and existing cardholders and tap into the unbanked segment.

Most merchants in the region prefer cash and often lack information on card acceptance. They rarely distinguish between credit and debit cards, and not all realize that both can be used at their POS terminal. Exacerbating the problem, merchants rarely consider the cost of cash in terms of insurance, courier fees and the risk of theft or counterfeit bills. Even when acknowledging that theft alone can cost 1 to 3 percent of revenue, large retailers still resist the idea of paying the card fees.

Increasing POS terminal penetration and encouraging merchants to steer customers toward card payments will require concerted outreach, sales and education efforts by card issuers, acquirers and government agencies. Teaching merchants about the risk of fraud and theft and the benefits of card payments (higher spend per transaction, loyalty programs, increased transaction speed) may help significantly.

Access to cards is not an issue for middleand upper-class consumers. Banks in the UAE and Saudi Arabia issue a debit card with every new bank account, and debit card penetration ranges from 0.4 cards per capita in Saudi Arabia to 0.74 in Kuwait. These cards are, however, used almost exclusively for ATM withdrawals – nearly 90 percent of all card transactions in Saudi Arabia and Oman are made at ATMs (Exhibit 3).

The lack of interest in using cards at the POS stems from customers simply not realizing they can use debit cards this way – it is not unusual for consumers to pay a merchant with cash they have withdrawn from an ATM in the merchant’s lobby. Cards are saved for expensive purchases – the average debit card transaction is over $100 in Saudi Arabia compared to $40 in the United States – yet experience from Europe suggests that it is small-ticket daily purchases that drive card growth.

Cards could come into play more if wages were paid onto pre-paid cards, as advocated by the UAE’s e-Government program. Strong economic growth within the region will also boost consumer spending, creating another incentive to shift to cards. Thus, banks should explore increasing debit card penetration among people who are ineligible for credit cards but who are still important customers.

To get people to use these cards, financial institutions must develop a compelling mix of products and services tailored to this very particular market. Successful programs in other regions have included financial incentives (e.g., depositing $5 in customer accounts after the first debit POS transaction), installment programs or government intervention via payroll cards. In the GCC, cards now account for a significantly lower share of existing noncash payments than in countries at a similar stage of economic development. To bring this share up to the level of Brazil, for example, would create an additional 240 million card transactions and generate an additional $500 million in transactional revenues.

2. New horizons in credit card issuing

Debit cards are convenient for customers and create revenue for providers. They also help take inefficient cash out of the system. However, the real opportunity is in credit cards.

Overall credit card penetration is low within the GCC. Encouragingly, however, credit cards still contribute a significant part of overall payments profitability in Saudi Arabia, UAE and Kuwait, as a result of high interest revenues and substantial annual fees. Card revenues comprise 14.4 percent of total banking revenues in the UAE (compared to an average of 5.5 percent in Europe). Issuer margin in the UAE is also more than double that of Europe (at $59 per card versus $23).

In the GCC, cards account for 37 percent of total payments revenue, versus 19.2 percent in Western Europe and 25.6 percent in Asia. The majority of this larger share comes from credit cards, with debit cards contributing just 4 percent to total revenue. Credit card income is primarily balance-related (60 percent), with the remainder split evenly between annual fees and transaction revenues.

Increased credit card penetration will drive these numbers even higher. A sizeable segment of the region’s population does not have credit cards due to religious concerns or residency issues, so the available pool of credit card holders is lower than in markets of similar size. Greater penetration could be achieved, however, by deeper segmentation and marketing in the existing space. Issuers are still struggling to stimulate card penetration despite tailored efforts such as issuing cards that comply with Shariah (Islamic) law. Unfortunately, at the moment, most of these cards are poor replicas of conventional credit cards, with usage restrictions and operational challenges that limit consumer appetite.

The recent economic downturn has also hit some members of the GCC particularly hard. Combine this with the high number of “skips” (people who permanently leave the GCC having accrued large debts), and it is easy to see why banks’ appetite to issue credit cards has dropped in the past two years. As the crisis recedes, we expect growth to return, albeit sluggishly, as banks wind up existing losses.

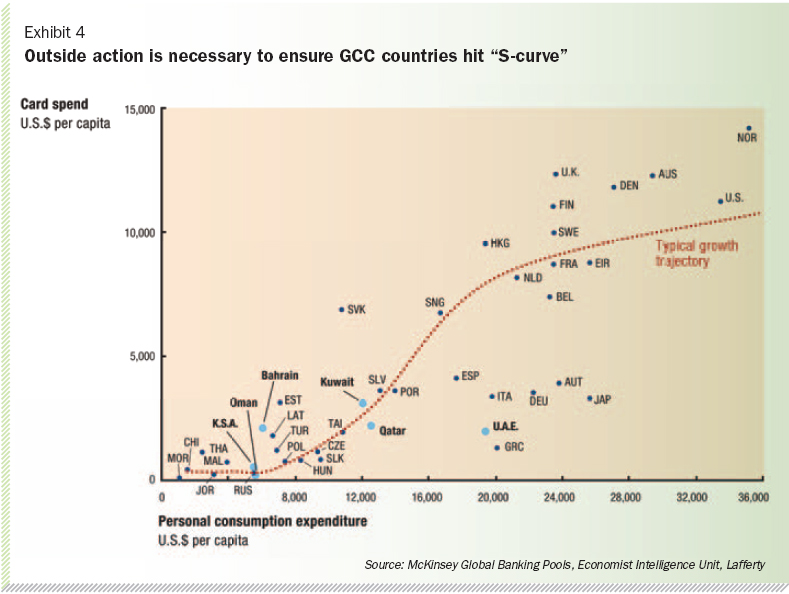

There are abundant growth opportunities in both debit and credit card payments in the region. The shift from cash to cards follows a similar trajectory in many countries: as personal consumption rises, card payments slowly increase. Once annual personal consumption reaches approximately $8,000 per capita, an inflection typically occurs. Provided the right infrastructure and incentives are in place, card spend rises rapidly then tapers as economies mature (Exhibit 4).

Benchmarking the GCC countries against this typical pattern suggests significant growth potential for card spend per capita in every market except Bahrain, where it is already relatively high. Kuwait and Qatar are on track with their transition to a cardbased payments economy and should grow strongly as personal consumption increases. Saudi Arabia and Oman are at an early stage of development in card spend. The UAE falls within a group of countries that lack the infrastructure or incentives to catalyze card growth, but could grow substantially if their potential is unlocked.

3. Remittances driving innovation

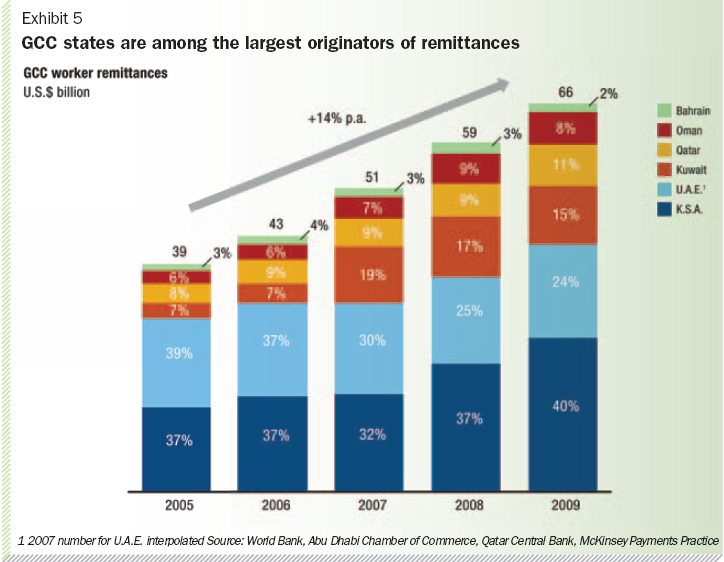

Remittance payments in the GCC account for a disproportionately large share of total payments transactions and revenues. GCC countries have traditionally relied heavily on expatriate workers from both south Asia and Southeast Asia for jobs, especially in construction and domestic service. Indeed, with approximately 15 million foreign workers sending a large share of their income home, the GCC states are among the largest originators of remittances. The World Bank estimates that the GCC accounts for two-thirds of all remittances to Bangladesh and Pakistan and 18 percent of flows to all developing markets. In total, more than $60 billion in remittances flow through the GCC each year, generating an estimated $1.8 billion in revenues (Exhibit 5).

In response to recent political developments in the Middle East and north Africa, GCC governments are increasingly using surpluses generated from high oil prices to stimulate their economies and create jobs for their citizens. Despite the efforts to curtail growth in migrant labor, the effect of stimulating the economy is likely to have positive effects on remittances. Saudi Arabia alone has an expected pipeline of infrastructure investments worth $300 billion to $400 billion, which will require more foreign labor. Estimates suggest remittances in Saudi Arabia could reach $30 billion to $35 billion by 2015, while total remittance payments in the GCC overall could reach $80 billion.

Money transfer specialists such as Western Union and local exchange houses have traditionally dominated this market. Mainstream banks are becoming increasingly active, however, some in partnership with specialists, others with a sub-brand (to differentiate from their mainstream banking models that focus on more affluent customers).

Players can differentiate themselves along five dimensions that drive success in remittances: reliability, cost, availability, transaction speed and convenience. Money transfer specialists and banks score well on reliability and speed, but the barriers to gain access to these channels are high. Those wishing to remit funds may need an existing account at the bank, which requires completing “Know- Your-Customer” forms. Non-banks typically provide over-the-counter service without the same level of scrutiny. Finally many migrant workers live in labor camps, not served by most banks, leaving them at the mercy of sometimes unscrupulous money changers and informal networks.

Remittance origination is mostly branch based with migrant workers spending hours in line to send funds. On the delivery front, most players have an equal footing with dense correspondent networks, while informal networks promise door-to-door delivery at a lower cost.

So convenience and speed are becoming powerful differentiators for banks, along with their scale and ability to invest capital and bundle products and services. Some GCC banks have already introduced sophisticated remittance solutions and are trying to capture share through innovation. One player has been offering money transfer to the Philippines via ATMs, for example. Recipients receive confirmation of the deposit on their mobile phone in the Philippines before the originating ATM prints a transaction receipt. New entrants and incumbents that can develop innovative solutions will continue to gain ground in remittances in the region.

The robust growth prospects for and favorable government attitudes toward payments modernization make the GCC markets distinct and accessible opportunities. Success, of course, is not assured. Government willingness to drive payments growth is favorable in theory, but must be implemented through improvements in infrastructure and regulations that promote electronic payments.

At the same time, payments players (mostly banks) must focus on developing payments as a business rather than a service for account holders and restructure their highly fragmented operations accordingly. Local banks can take their cues from institutions in Europe that have developed ways to overcome this fragmentation (e.g, establishing a head of payments or a payments council to break down silos and provide a clear view of the bank-wide payments opportunity.

Payments players should also focus on the needs of the end user. Initial steps should include developing an educated sales force to articulate the benefits of card acceptance to merchants, as well as marketing and customer segmentation initiatives to understand what account holders want from a card. As seen in other countries with low card use, such as Italy, Greece and Japan, economic development alone is not enough to ensure the payments prize is captured. Quick and decisive action by banks and government agents is required to ensure this multi-billion dollar opportunity is not missed. n

McKinsey on Payments, Number 12, September 2011, “A new dawn in Middle East payments,” by Nadir Akram, Mehmet Darendeli, Olivier Denecker, Michael Southwell. Copyright (c) 2011 McKinsey & Company. All rights reserved. Reprinted by permission. To send comments or request copies, email: paymentspractice@mckinsey.com .

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East