Representatives of 18 Middle Eastern banks, from the UAE, Jordan, Saudi Arabia and Qatar, recently discussed the outlook for transaction banking in the region, and how they can grow their share of global revenues by at least 25 per cent

Sixty-eight senior bankers from across the Middle East gathered at iGTB’s client advisory event at the Park Hyatt in Dubai to explore the challenges and opportunities presented to transaction banking in the region.

The interactive forum – designed to encourage peer-to-peer dialogue – set out to explore how Middle Eastern banks could increase their share of global transaction banking revenues (set to hit $509bn by 2021 1), and featured prominent guest speakers, including Mishal Kanoo, deputy chairman of the Kanoo Group, and Andrew England, senior adviser, transaction banking, McKinsey.

The event sought to address the region’s take on the fundamental question of “how do you help a corporation”? In the words of Phil Cantor, iGTB’s CMO and master of ceremonies for the day, “the corporate value chain is, at its core, about buying and selling, so banks must ensure their suite of offerings ultimately aligns with this basic underlying requirement. Only by helping corporations buy and sell both home or abroad can banks fuel corporate growth and, in turn, grow their own business”.

In order to elicit banks’ own views and encourage interactivity throughout the day, each participant was given an electronic voting button to participate in a rolling survey; a survey that immediately threw up some interesting results.

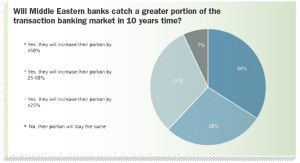

When asked what share of the $509bn market Middle Eastern banks would “catch” by 2025, 93 per cent of the 43 survey participants were optimistic that the region’s share would increase, with 34 per cent believing their portion would grow by 50 per cent or more.

A further 28 per cent of participants believed Middle Eastern banks’ share of global revenues would increase by between 25-50 per cent.

Such results set the tone for the forum – one of confidence and excitement, with subsequent discussions hinging on how best such rapid development can be achieved.

transaction banking market in 10 years time?

Seizing opportunity

Andrew England – a senior adviser at McKinsey and newly-appointed director and head of strategy, iGTB – provided a route-map to realising this potential.

He said that transaction banking is undoubtedly enjoying a “gold rush” era thanks to surging global payment flows (related revenues are due to reach $2.3 trillion by 2018), soaring inter and intra-emerging market trade, technological advancements and a renewed appreciation of the role of transaction banking in supporting the “real” economy.

But in order to seize this opportunity, banks must establish a clear framework of priorities and principles.

With this in mind, he defined the “Seven Cs” of transaction banking success. These were:

- Demonstrating a commitment to transaction banking, both through long-term investment and making sure the importance of transaction banking to the wider bank is understood

- prioritising core over non-core activities; that is, focusing on core cash and trade capabilities that directly help customers build their business – ensuring operational consistency, and avoiding trying to be all things to all people

- creating internal connectivity; organisational alignment that ensures the buy-in of bank stakeholders and integrates transaction banking into the bank sales process

- promoting co-operation through strategic partnership and network models, to penetrate new trade corridors, increase scale, pool expertise and extend product offerings

- ensuring domain competency, with regard to expertise, end-to-end process accountability, and customer and segment differentiation, with product managers “owning” their business case

- leveraging digital enablement for customer-centricity, creating a 360° view of the customer

- and demonstrating conviction through a track record of successful project execution and excellent performance.

success of MIddle Eastern banks in ten years time?

Of course, some of these factors may be easier to achieve than others. As Andrew pointed out, while the development of transaction banking skills and competencies in the Middle East has been first class, product management – an extremely important discipline to get right – is not always delivering what is needed.

Similarly, while there seems to be an industry consensus that cooperation models are the way forward, turning theory into practice may not be straightforward. For successful cooperation, banks must understand the culture of their prospective partners, establish a clear delineation of roles and share both processes and people in a true bilateral exchange of resources.

Finally, there is the need to remove any lingering bank confusion around what is meant by “digital enablement”; a must-do that is fundamentally about providing technology-supported functionality to clients in a rich and straightforward manner, creating transparency and enhancing the customer experience.

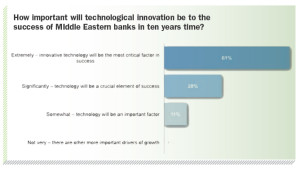

Opening this conversation to the floor revealed that delegates agreed that the need to innovate is a key concern. In fact, 61 per cent of attendees stated that innovative technology would be the most critical factor in the success of Middle East banks in 10 years’ time.

Harshit Jain – head of GTS product management, solutions structuring and delivery, Mashreq Bank – took up this theme in his subsequent exploration of innovation-driven growth, and the importance of leveraging advanced technology at a time when “growing is less risky than not growing”.

Harshit urged his banking peers to prioritise innovation if they’re to maintain their position despite the emergence of new market entrants such as non-bank payment providers.

He said Mashreq’s clearly successful approach was to focus on product leadership first and foremost, even above operational excellence and customer intimacy, using an integrated technology platform.

Navigating risk and regulation

source of banks’ risk concerns?

In answer to questions from the floor regarding regulation-related hurdles to innovation, Harshit pointed out that, in fact, some compliance demands give an advantage in that they can be utilised to move customers away from paper-based processes to full automation, thereby ensuring online banking channels gain traction.

The question of the difficult interplay between investing in innovation while ensuring compliance with regulatory demands tied in with the theme of the next discussion, where Phil Bethel – CMO of iRTM, Intellect – demonstrated that technology-enabled risk-visualisation can help banks and corporates alike to navigate the “regulatory maze”. In fact, with the right technology to hand, he stated, banks should be able to view new regulation as an opportunity rather than a risk.

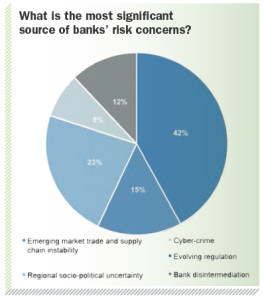

He also pointed out that “Basel now has teeth” (with Bahrain the regional leader in terms of implementation) and 42 per cent of the attendees agreed that evolving regulation was the most significant source of bank risk concerns.

The onslaught of risk and regulation means real-time visibility gained through the consolidation and translation of data is key. This coincides with the banking industry’s maturation to what’s sometimes referred to as “Treasury 3.0” or “One Treasury”: a centralised treasury able to identify and utilise information across numerous streams, from risk and trading to middle office and operations.

Certainly, banks’ C-suite executives must have real-time views over everything from exchange rates and volatility to interest rates and trade data, with the ability to overlay both industry regulations and their own controls for a truly 360° picture. This requires the integration of risk and treasury management onto a single platform with a real-time dashboard, enabling detailed analytics and the ability to conduct “what-if” simulations, the latter being vital for stress-testing.

With such tools, banks can not only navigate risk but better identify where investment should be directed to maximise opportunities and improve performance management. The adage “knowledge is power” still holds true – but today such knowledge is digital.

Despite this, Middle Eastern banks – according to 50 per cent of delegates – “significantly” lag behind other regions when it comes to implementing innovative technology; although one delegate was careful to point out that the Middle East is a diverse region, and solutions that may work in the UAE, for example might not enjoy the same success somewhere like Saudi Arabia, due to differences in customer behaviour.

Changing customer needs

Of course, while banks must continue to navigate evolving regulation, they are also faced with fast-changing customer needs and heightened expectations. One example raised by Mashreq Bank’s Harshit Jain is the rising popularity of ApplePay: a mobile payment and digital wallet service for users of Apple devices such as iPhones.

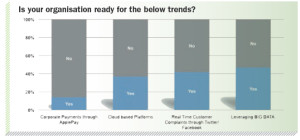

Despite the huge take-up of such payment methods (according to The New York Times2, 50 per cent of McDonalds transactions in the US are now conducted using ApplePay), 86 per cent of delegates claimed their organisations were not yet ready for corporate payments to be conducted in this manner.

The changing behaviour of customers is reflected not just in their use of solutions but also in the way in which they communicate with their banks. On-the-ground branches are becoming less popular in favour of “anytime, anywhere” digital interaction, and banks must ensure they’re equipped to communicate with customers in a way that suits the customer – yet 58 per cent of attendees said they weren’t prepared for dealing with real-time customer complaints through social media such as Twitter or Facebook.

What is clear is that good client service remains paramount; a fact underscored by Mishal Kanoo, deputy chairman of the Kanoo Group, during his chief guest address. For Mishal, drawing on his personal experience, consistency is key; maintaining great client service regardless of client size (“don’t discount small accounts”), geography or sector. Indeed, the SMEs of today are the MNCs of tomorrow, and such corporations will ultimately select their primary banking partner – the bank that will benefit from their business during their growth journey – on the basis of strong client service.

Intelligent innovation

While banks should already be leveraging such technology to the benefit of themselves and their clients, they should also be aware of more futuristic concepts and anticipating upcoming capabilities. This was the focus of Henry Gorbet – SVP, Payment Solutions, iGTB – who provided the clear highlight of the day; a walk-through demonstration of Onyx, iGTB’s conceptual software designed to spark conversation around the possibilities of “smart” technology.

Currently, the data provided by many bank dashboards still relies on (and informs) a human decision, which then leads to an technology-enabled action, often back on that platform – but is it possible to streamline processes by removing the need for the human intermediary? Indeed, is there a technology that actually understands what you’re trying to do?

This was the question asked by Gorbet to begin his session, and participants quickly learned that the answer is “yes”: in fact, such technology is more common that we think.

Henry cited non-banking examples such as “nest” – a widely popular self-adjusting home thermostat that seeks to understand your needs and preferences, learns these trends and makes decisions (ie, adjusts the home temperature accordingly) on its own without human intervention.

Henry advised that such examples of “intelligent decisioning” (not to be confused with intelligent advising, or artificial intelligence) are, in fact, fairly common, but have yet to be adopted by the banking industry.

New concepts such as Onyx are a call to arms to rectify this. Onyx, for example, can “proactively scan news sources for developments that could impact your organisation, distinguish between these impacts as either positive or negative, analyse what the potential effect would be and make a recommendation”.

This could be in the form of giving decision options to an accounts payable clerk, or interpreting news data regarding potential mergers for the benefit of a relationship manager. Such solutions present an opportunity for banks to provide enormous differentiation from their growing non-bank competition, to bring transaction banking firmly into the 21st century.

Next steps

Hani al Maskati – publisher of Cash&Trade – chaired the final group discussion of the day, based on the survey results. Insights of note included the view that many Middle Eastern banks are moving towards further or more effective integration of their cash and trade functions, although 61 per cent of delegates believed such functions currently remain “very distinct”, and not a single participant believed cash and trade to be fully integrated. While these figures suggest considerable room for improvement, delegates agreed with Hani’s view that local and regional banks have taken significant steps in offering more integrated solutions to their corporate clients, investing “serious money” into this area within the last five years.

A perhaps unsurprising result revealed that a third of the senior bankers present viewed regional socio-political uncertainty as the most significant source of their corporate clients’ risk concerns.

The ability of banks to help their clients address such upheavals will depend in part on the ability of transaction bankers to demonstrate their importance to stakeholders across the wider bank. In particular, Hani stated, “corporate relationship managers must view the transaction banking arm as a key influencer of corporate strategy, rather than misjudging it as a purely operational unit”. While the speakers and delegates continued to interact and debate the best route forward, one thing was clear: there is plenty to talk about, as transaction banks adapt to the “new normal” of the post-crisis environment, and seek to better-support their clients no matter what regulatory or economic challenges lie ahead. It was on this note that Manish Maakan, iGTB’s CEO, wrapped up the day, with the announcement that the event will be held again next year, on Wednesday 24th February, 2016. It will be interesting to monitor the sector’s progress in a year’s time.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East